Key Takeaways:

- EZCORP, Inc. (EZPW, Financial) reports a robust 12% increase in revenue for Q2 2025, driven by pawnbroker loans and cash solutions.

- Latin American markets show impressive growth with a 25% rise in revenue.

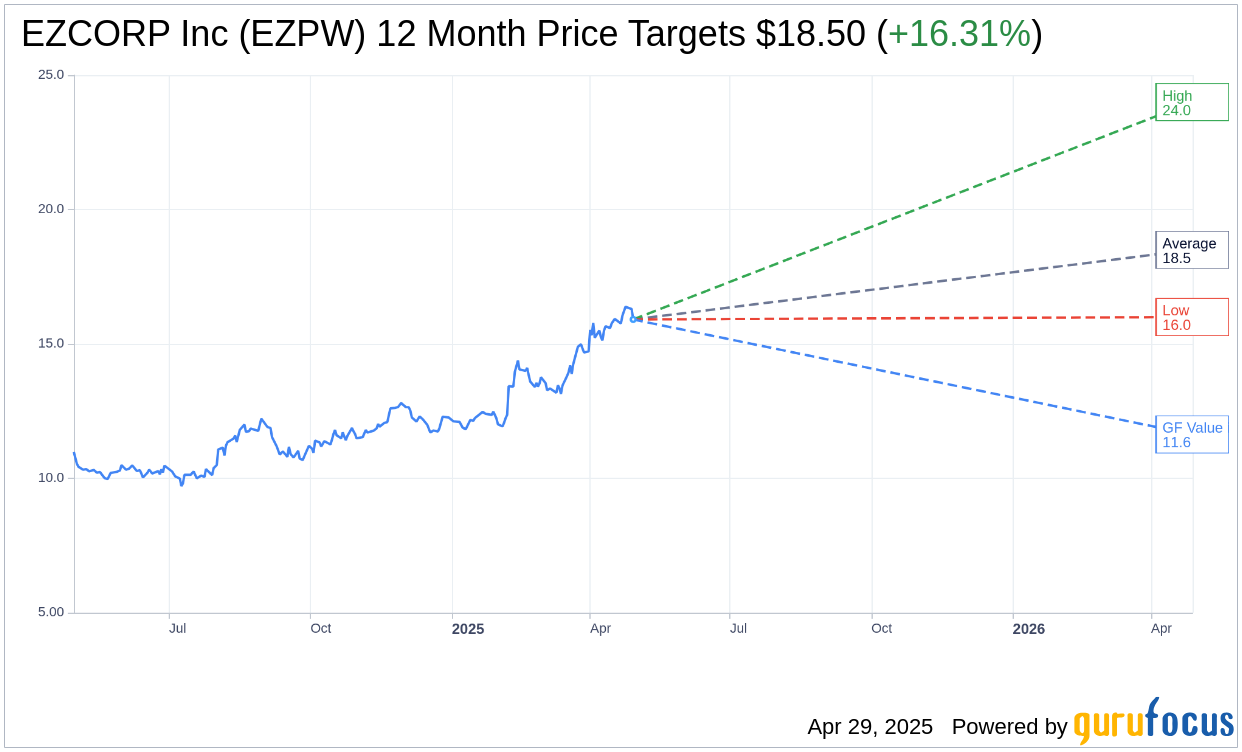

- Wall Street sets an average price target of $18.50, indicating a potential 16.31% upside from the current price.

EZCORP's Financial Performance in Q2 2025

EZCORP, Inc. (EZPW) has delivered a strong performance for the second quarter of 2025, showcasing a notable 12% year-over-year revenue increase, pushing total earnings to an impressive $318.9 million. This surge is attributed primarily to a heightened demand for their cash solutions and secondhand goods, indicating a healthy market appetite in these areas.

The company also reported a significant boost in pawnbroker loans, which escalated by 15% to reach $271.8 million. Additionally, EZCORP's cash reserve has surged to $505.2 million, a feat supported by a strategic $300 million debt financing initiative. Furthermore, the company's EBITDA witnessed a stellar 23% growth, reaching $45.1 million. Notably, the Latin American sector exhibited remarkable expansion, with a 25% increase in revenue and a 36% rise in EBITDA, underscoring EZCORP's successful international operations.

Analyst Insights and Price Targets

Wall Street analysts are maintaining an optimistic outlook on EZCORP Inc (EZPW, Financial), projecting an average one-year price target of $18.50. The range spans from a high of $24.00 to a low estimate of $16.00, which suggests a potential upside of 16.31% from the current share price of $15.91. For more in-depth analysis and projections, visit the EZCORP Inc (EZPW) Forecast page.

Brokerage firms have rated EZCORP with an average recommendation of 2.0 on a scale where 1 represents a Strong Buy and 5 a Sell. This "Outperform" rating reflects confidence in the company's ability to exceed market expectations.

Understanding GF Value Estimates

According to GuruFocus evaluations, the estimated GF Value for EZCORP Inc (EZPW, Financial) stands at $11.63 for the next year. This estimation indicates a potential downside of 26.88% from the current trading price of $15.9056. The GF Value is a proprietary metric designed to assess a stock's fair trading value, calculated from historical trading multiples, past growth, and future business performance forecasts. Investors interested in a comprehensive examination can visit the EZCORP Inc (EZPW) Summary page.