Canaccord has increased its price target for Ezcorp (EZPW, Financial) from $24 to $25, maintaining a Buy rating on the stock. This decision comes after the company reported another outstanding quarter, showing a 7% rise in sales for Q2—exceeding Canaccord's expectations by approximately 2%. A significant factor behind this growth is an 11% rise in pawn loans outstanding (PLO), which serves as a crucial business driver for EZPW.

The backdrop of persistent inflation and limited credit options for many consumers has led to heightened demand for pawnbroking services. Additionally, there is an increasing trend among consumers to opt for affordable and sustainable pre-owned goods, further boosting EZPW's business prospects.

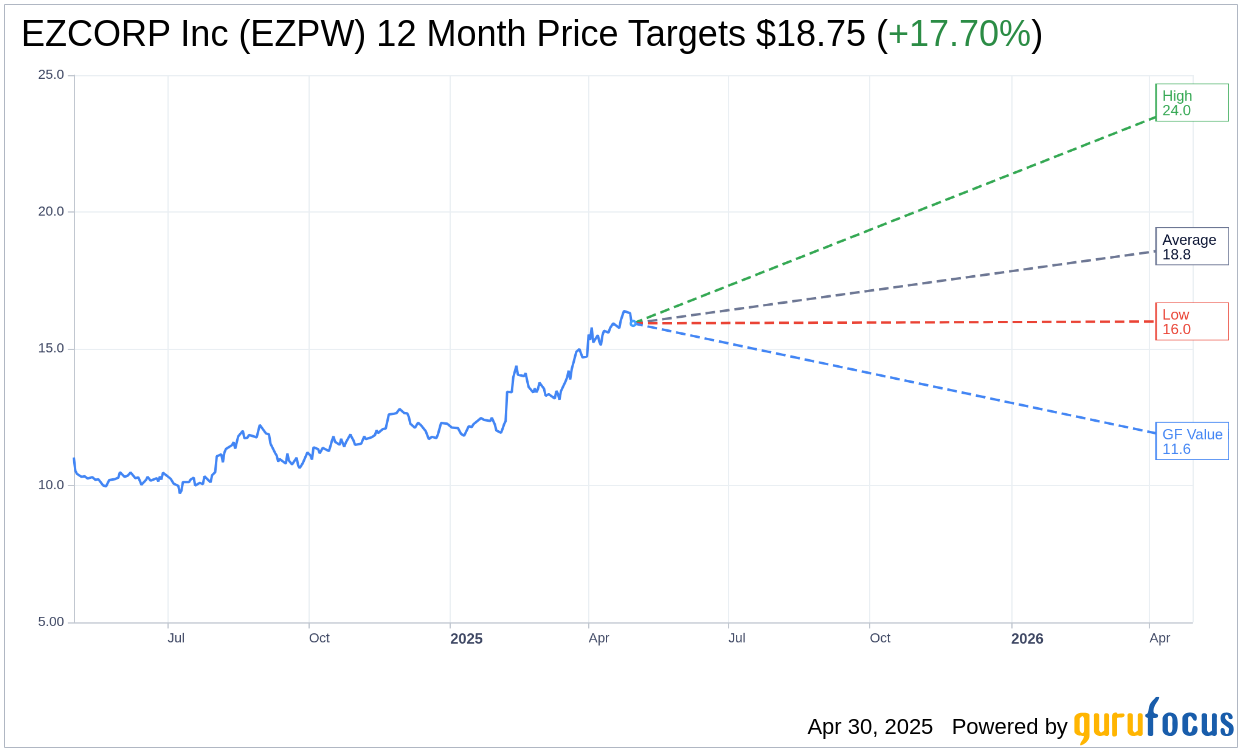

Wall Street Analysts Forecast

Based on the one-year price targets offered by 4 analysts, the average target price for EZCORP Inc (EZPW, Financial) is $18.75 with a high estimate of $24.00 and a low estimate of $16.00. The average target implies an upside of 17.70% from the current price of $15.93. More detailed estimate data can be found on the EZCORP Inc (EZPW) Forecast page.

Based on the consensus recommendation from 4 brokerage firms, EZCORP Inc's (EZPW, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for EZCORP Inc (EZPW, Financial) in one year is $11.63, suggesting a downside of 26.99% from the current price of $15.93. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the EZCORP Inc (EZPW) Summary page.

EZPW Key Business Developments

Release Date: April 29, 2025

- Revenue: Record Q2 revenue of $318.9 million, a 12% year-on-year increase.

- PLO (Pawn Loan Outstanding): Grew 15% to a Q2 record of $271.8 million.

- EBITDA: Increased 23% to $45.1 million.

- Diluted EPS: Grew 21% to $0.34.

- Store Locations: 1,284 stores across the US and Latin America; opened nine de novo stores in Latin America and acquired one store in Guatemala.

- Cash Balance: Increased to $505.2 million, up from $174.5 million last quarter.

- Merchandise Sales: Increased 8% to $177.4 million.

- Gross Profit: $185 million, reflecting a 10% increase.

- EBITDA Margin: Increased to 14.1%.

- Inventory: Increased 32% year-over-year.

- US Pawn Revenue: Up 7% to $221.4 million.

- Latin America Revenue: Increased 25% to $97.5 million.

- PSC Revenue: Rose 12% year-over-year.

- Average Loan Size: Increased 15% in the US.

- Online Payments: Increased by $7 million, reaching $29 million in the US.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- EZCORP Inc (EZPW, Financial) achieved record Q2 revenue of $318.9 million, marking a 12% year-on-year increase.

- The company reported a 23% increase in EBITDA to $45.1 million and diluted EPS growth of 21% to $0.34.

- EZCORP Inc (EZPW) opened nine new stores in Latin America and acquired one store in Guatemala, expanding its footprint.

- The EZ+ Rewards program saw a 34% increase in membership, now accounting for 77% of all transactions.

- The company's cash balance increased significantly to $505.2 million, providing a strong liquidity position for future growth opportunities.

Negative Points

- Merchandise margin contracted by 150 basis points due to increased price negotiations at the counter.

- Inventory turnover decreased to 2.5 times from 2.9 times, partially due to the expansion of the layaway program.

- The introduction of a long-term layaway option has shifted some sales to future quarters, impacting current revenue.

- Merchandise sales growth was modest at 8%, with a 2% increase in the US, indicating potential challenges in retail sales.

- The company faces macroeconomic pressures, including persistent inflation and economic uncertainty, impacting consumer behavior.