Key Takeaways:

- AppLovin Corporation reports significant increases in both revenue and net income for Q4 2024.

- Analysts see potential upside with an average price target well above current trading levels.

- GuruFocus metrics suggest a possible overvaluation compared to the calculated GF Value.

AppLovin Corporation (APP, Financial), known for its innovation in mobile technology, has reported impressive financial results for the fourth quarter of 2024. The company saw a remarkable revenue increase of 44% year-over-year, reaching $1.37 billion. Net income also surged by an astounding 248% to $599.2 million. In light of these strong numbers, Millennium Management has notably increased its stake in the company, highlighting AppLovin's promising growth trajectory and positioning it as a potentially lucrative investment opportunity.

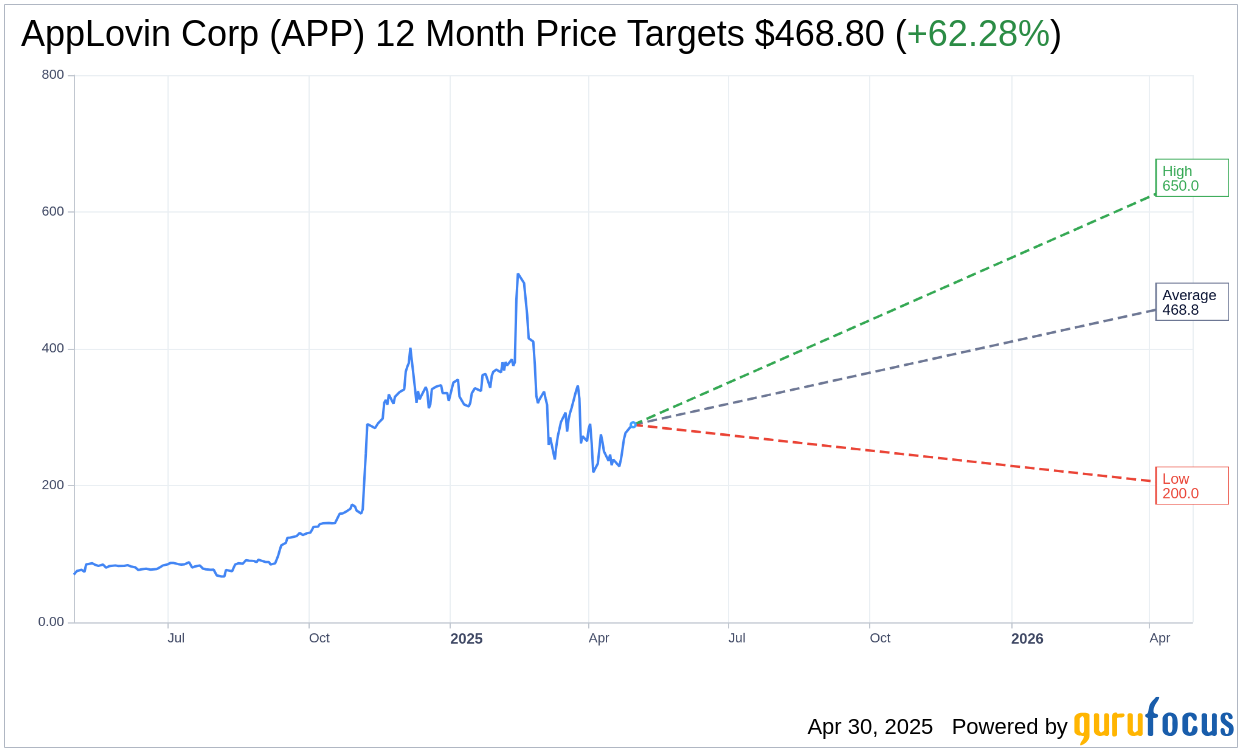

Wall Street Analysts Forecast

According to projections from 21 Wall Street analysts, the average one-year price target for AppLovin Corp (APP, Financial) stands at $468.80. This includes a high estimate of $650.00 and a low estimate of $200.00. When compared to the current trading price of $288.88, the average target price signifies a compelling upside potential of 62.28%. Investors can delve deeper into these estimates on the AppLovin Corp (APP) Forecast page.

The consensus recommendation across 27 brokerage firms for AppLovin Corp (APP, Financial) is currently an average of 1.9, which suggests an "Outperform" rating. This recommendation scale ranges from 1 (Strong Buy) to 5 (Sell), placing AppLovin in a favorable investment light.

GuruFocus Valuation Insights

Despite the optimistic projections from analysts, it's essential to consider the GF Value metric from GuruFocus. This valuation figure estimates AppLovin Corp's fair trading value at $88.99 over the next year, indicating a significant downside risk of 69.19% from its current market price of $288.88. The GF Value is calculated by analyzing the historical trading multiples alongside anticipated business growth and performance estimates. For more in-depth valuation data, investors should visit the AppLovin Corp (APP, Financial) Summary page.