Aflac (AFL, Financial) is set to announce its earnings after the market closes, with analysts predicting earnings per share of $1.67. Investors and stakeholders are keenly anticipating the financial results, as they offer insights into the company's performance and future outlook. This expected figure will be closely watched to assess how Aflac is managing in the current economic environment. The results will provide further indication of the company's operational efficiency and market strategy. Stay tuned for the actual earnings announcement to see if Aflac meets, exceeds, or falls short of these expectations.

Wall Street Analysts Forecast

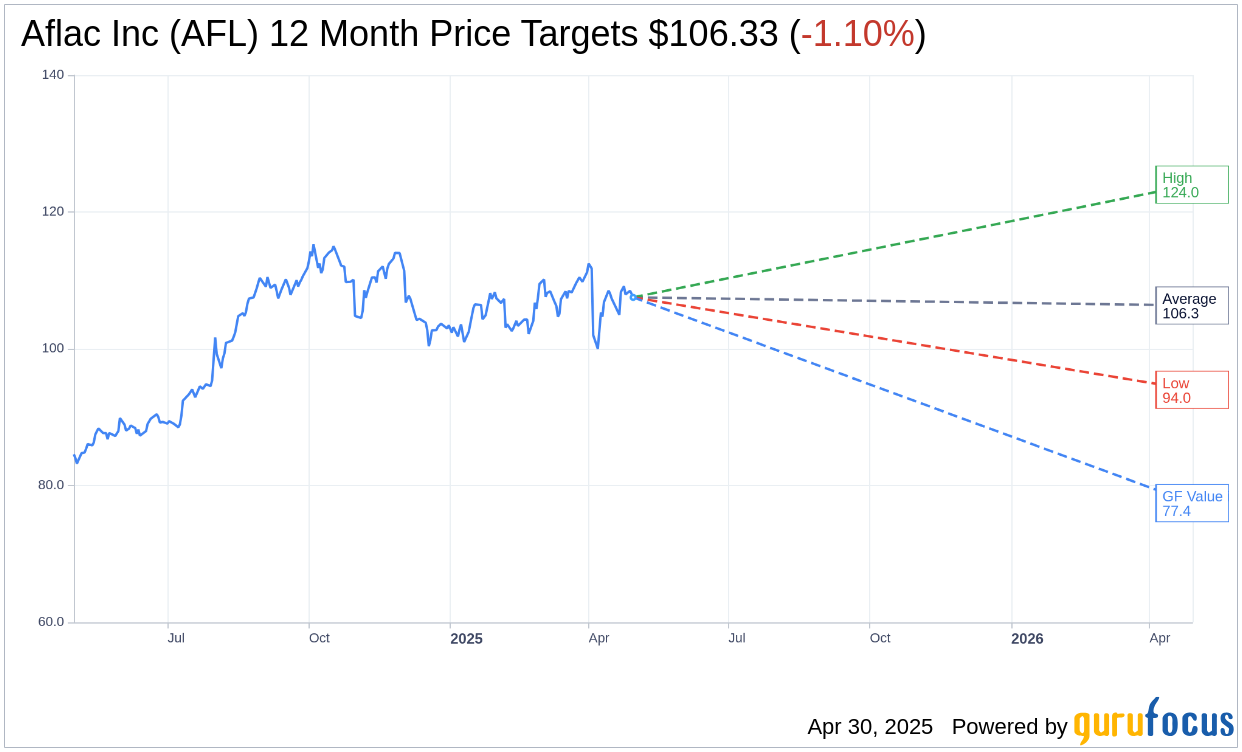

Based on the one-year price targets offered by 12 analysts, the average target price for Aflac Inc (AFL, Financial) is $106.33 with a high estimate of $124.00 and a low estimate of $94.00. The average target implies an downside of 1.10% from the current price of $107.52. More detailed estimate data can be found on the Aflac Inc (AFL) Forecast page.

Based on the consensus recommendation from 15 brokerage firms, Aflac Inc's (AFL, Financial) average brokerage recommendation is currently 2.9, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Aflac Inc (AFL, Financial) in one year is $77.43, suggesting a downside of 27.99% from the current price of $107.52. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Aflac Inc (AFL) Summary page.

AFL Key Business Developments

Release Date: February 06, 2025

- Net Earnings Per Diluted Share: Up 23.8% to $9.63.

- Adjusted Earnings Per Diluted Share: Up 15.7% to $7.21.

- Aflac Japan Pretax Adjusted Earnings: Increased 15.5% with a 36% pretax profit margin.

- Aflac Japan Premium Persistency: 93.4%.

- Aflac Japan Sales Increase: 5.6% year-over-year, including a 9% increase in Q4.

- Aflac US Premium Persistency: Improved by 70 basis points to 79.3%.

- Aflac US Net Earned Premiums: Increased by 2.7%.

- Aflac US Pretax Profit Margin: 21.1% for the year.

- Capital Deployment: $2.8 billion to repurchase over 30 million shares.

- Dividends to Shareholders: $3.9 billion returned in 2024.

- Adjusted Earnings Per Diluted Share (Q4): Increased 24.8% to $1.56.

- Japan Segment Net Premiums (Q4): Declined 5.4%.

- Japan Benefit Ratio (Q4): 66.5%, up 40 basis points year-over-year.

- Japan Expense Ratio (Q4): 20.8%, down 30 basis points year-over-year.

- US Total Benefit Ratio (Q4): 46.3%, up 170 basis points from Q4 2023.

- US Expense Ratio (Q4): 40.3%, down 310 basis points year-over-year.

- US Pretax Margin (Q4): 19.7%.

- Unencumbered Holding Company Liquidity: $4.1 billion.

- Stock Repurchase (Q4): $750 million.

- Dividends Paid (Q4): $277 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Aflac Inc (AFL, Financial) reported a strong increase in net earnings per diluted share, up 23.8% to $9.63, and adjusted earnings per diluted share, up 15.7% to $7.21 for 2024.

- Aflac Japan achieved a record 36% pretax profit margin in 2024, with a 15.5% increase in pretax adjusted earnings.

- The company maintained a strong capital position with an SMR above 1,150% and an estimated ESR about 270%, indicating robust financial health.

- Aflac Inc (AFL) returned $3.9 billion to shareholders in 2024, including $2.8 billion in share repurchases and 42 consecutive years of dividend growth.

- The US segment showed improvement with a 70-basis-point increase in premium persistency to 79.3% and a 2.7% increase in net earned premiums.

Negative Points

- Aflac Japan experienced a 5.4% decline in net premiums for the quarter, impacted by internal cancer reinsurance transactions and paid-up policies.

- US sales were lower than expected in the fourth quarter, leading to a 1% decline for the year, attributed to competitive pressures and challenges in the dental sales segment.

- The US total benefit ratio increased by 170 basis points year over year, driven by lower remeasurement gains compared to the previous year.

- The commercial real estate market remains challenging, with Aflac Inc (AFL) increasing its CECL reserves by $40 million due to distressed property valuations.

- The company anticipates a lower pretax profit margin for Aflac Japan in 2025, at the lower end of the 30% to 33% range, due to expected higher benefit ratios and lower net investment income.