United Community Banks (UCB, Financial) has successfully completed its merger with ANB Holdings, effective May 1, 2025. This strategic move also includes the integration of ANB’s subsidiary, American National Bank, into UCB’s own bank subsidiary, United Community Bank. Following the merger, American National Bank will adopt the United Community brand identity, with all core systems, signage, and branding transitioning to United Community's during the weekend of July 11, 2025.

Lynn Harton, Chairman and CEO of United, expressed enthusiasm about the merger, highlighting the strong cultural alignment and community-focused approach shared between the teams. Harton emphasized the potential for growth and development that this partnership brings, particularly in the South Florida market, as UCB remains committed to enhancing customer service and community investment.

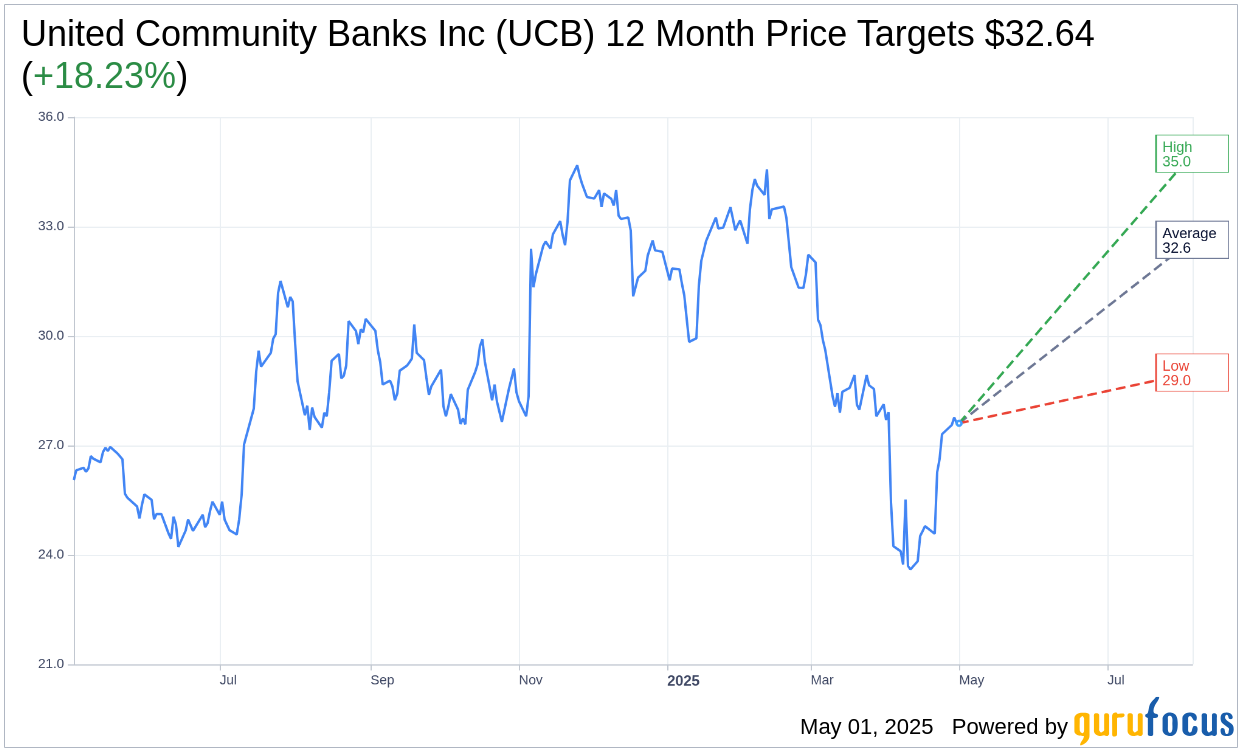

Wall Street Analysts Forecast

Based on the one-year price targets offered by 7 analysts, the average target price for United Community Banks Inc (UCB, Financial) is $32.64 with a high estimate of $35.00 and a low estimate of $29.00. The average target implies an upside of 18.23% from the current price of $27.61. More detailed estimate data can be found on the United Community Banks Inc (UCB) Forecast page.

Based on the consensus recommendation from 8 brokerage firms, United Community Banks Inc's (UCB, Financial) average brokerage recommendation is currently 2.6, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.