Purple Innovation (PRPL, Financial) announced its first-quarter revenue of $104.171 million, aligning closely with market expectations of $104.15 million. The company's performance in this period highlights its successful execution of strategic initiatives aimed at stabilizing and bolstering the business for future prosperity.

Positive trends in showroom sales contributed significantly to the expected revenue outcome. Additionally, enhancements in gross margin and effective cost management led to Adjusted EBITDA surpassing forecasts. These results underscore the company's focused efforts to drive sustained growth and profitability.

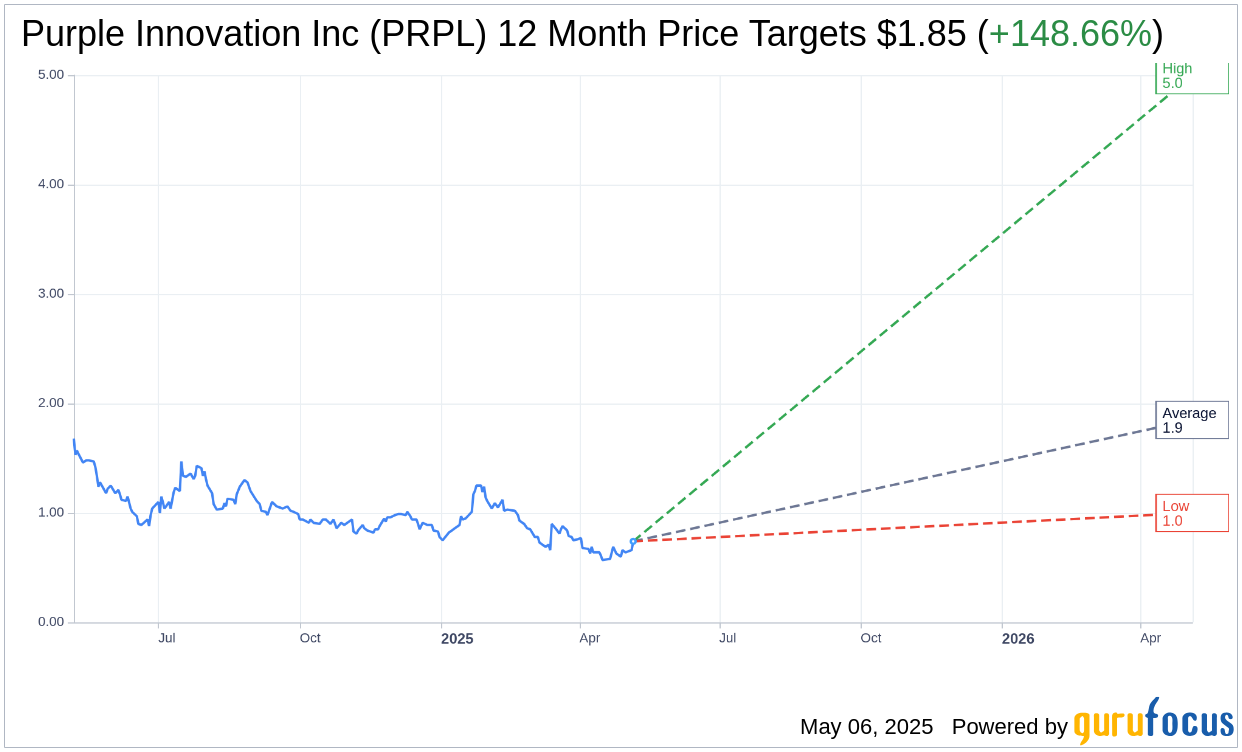

Wall Street Analysts Forecast

Based on the one-year price targets offered by 5 analysts, the average target price for Purple Innovation Inc (PRPL, Financial) is $1.85 with a high estimate of $5.00 and a low estimate of $1.00. The average target implies an upside of 148.66% from the current price of $0.74. More detailed estimate data can be found on the Purple Innovation Inc (PRPL) Forecast page.

Based on the consensus recommendation from 8 brokerage firms, Purple Innovation Inc's (PRPL, Financial) average brokerage recommendation is currently 2.8, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Purple Innovation Inc (PRPL, Financial) in one year is $1.53, suggesting a upside of 105.65% from the current price of $0.744. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Purple Innovation Inc (PRPL) Summary page.

PRPL Key Business Developments

Release Date: March 13, 2025

- Net Revenue: $129 million for Q4, down 11.6% from $145.9 million in the prior year.

- Gross Margin: 42.9% for Q4, an improvement of 970 basis points compared to last year.

- Adjusted Gross Margin: 44.9% for Q4, up 810 basis points year-over-year.

- Adjusted EBITDA: $2.9 million for Q4, improved from negative $9.8 million last year.

- Adjusted Net Loss: $8 million for Q4, improved from $15.8 million loss last year.

- Cash and Cash Equivalents: $29 million at year-end, up from $26.9 million the previous year.

- Net Inventories: $56.9 million at year-end, down 15% year-over-year.

- Full-Year Net Revenue: $487.9 million, down 4.4% from $510.5 million last year.

- Full-Year Gross Margin: 37.1%, up 350 basis points from last year.

- Full-Year Adjusted EBITDA: Negative $20.8 million, improved from a $54.7 million loss last year.

- 2025 Revenue Guidance: Expected to be in the range of $465 million to $485 million.

- 2025 Adjusted EBITDA Guidance: Expected to be flat to up $10 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Purple Innovation Inc (PRPL, Financial) achieved adjusted EBITDA profitability for the first time in eight quarters, indicating improved financial health.

- Gross margin improved significantly to 42.9%, up 970 basis points from the previous year, showcasing effective cost management.

- The successful launch of the PurpleRenew mattress in 170 Costco locations expanded market presence and complemented online sales.

- The Rejuvenate 2.0 mattress line and expanded pillow collection were well-received, securing new distribution points and generating excitement.

- Cost-saving initiatives, including manufacturing consolidation, are projected to yield annual EBITDA savings of $25 million to $30 million, enhancing operational efficiency.

Negative Points

- Net revenue for the fourth quarter decreased by 11.6% compared to the previous year, reflecting ongoing challenges in consumer demand.

- The wholesale segment experienced a 23% decline in net revenue for the fourth quarter, indicating difficulties in this sales channel.

- E-commerce revenue was down 5.3% for the quarter, highlighting challenges in online sales performance.

- The company anticipates a potential impact of $2 million to $5 million from recently announced US tariffs, which could affect profitability.

- The broader macroeconomic landscape remains challenging, with softening consumer demand impacting sales performance.