- Upstart Holdings (UPST, Financial) achieved significant growth in Q1 2025, with originations up by 89% and revenue increased by 67%.

- Wall Street projects an average price target of $68.08, implying a 32.45% upside potential.

- Current brokerage recommendation for Upstart is a "Hold" with an average rating of 2.6 from 14 firms.

Upstart Holdings (UPST) has delivered an impressive performance in the first quarter of 2025, marking substantial growth. The company's platform originations soared by an impressive 89% compared to the previous year, while revenue surged by 67%, reaching a total of $213 million. These results are primarily driven by AI enhancements that have notably improved loan automation and decision accuracy. Looking ahead, Upstart anticipates Q2 revenues to be around $225 million, with an ambitious goal of achieving GAAP profitability by late 2025.

Wall Street Analysts Forecast

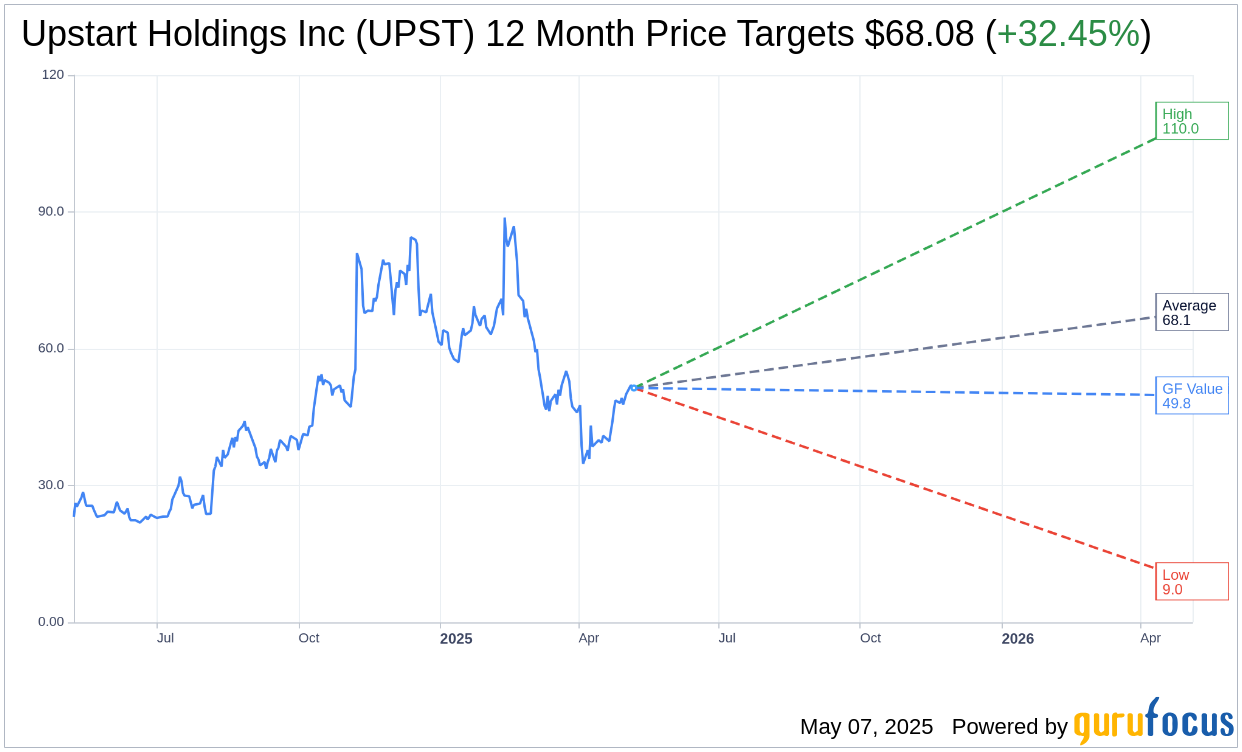

Insight from 13 analysts provides a one-year price target outlook for Upstart Holdings Inc (UPST, Financial), with an average target price set at $68.08. This includes a high estimate of $110.00 and a low estimate of $9.00, suggesting a potential upside of 32.45% from the current stock price of $51.40. For more comprehensive details, visit the Upstart Holdings Inc (UPST) Forecast page.

The consensus recommendation from 14 brokerage firms currently positions Upstart Holdings Inc (UPST, Financial) at an average recommendation rating of 2.6, which signifies a "Hold" status on a scale where 1 indicates a Strong Buy and 5 represents a Sell rating.

According to GuruFocus estimates, the projected GF Value for Upstart Holdings Inc (UPST, Financial) in the upcoming year is $49.77, indicating a potential downside of 3.17% from its present price of $51.40. The GF Value is GuruFocus' assessment of the fair trading value of the stock, calculated based on historical trading multiples, past business growth, and future performance projections. To explore more detailed data, please refer to the Upstart Holdings Inc (UPST) Summary page.