Manulife Financial Corporation (MFC, Financial) has announced a successful start to the year, achieving remarkable levels in its insurance new business results during the first quarter. The company saw double-digit increases in new business value across all segments, with a notable 43% year-over-year growth in Asia, underscoring the robust performance of its top-line results.

In addition to the strong insurance results, Global Wealth and Asset Management (Global WAM) reported a 24% rise in core earnings, along with an expanded core EBITDA margin by 290 basis points. Positive net flows further highlighted the division's success.

Moreover, MFC completed its second long-term care reinsurance transaction, demonstrating its commitment to delivering sustainable value to its shareholders. Despite challenges in the operating environment, the company's latest results showcase the strength of its franchise and effective execution strategies.

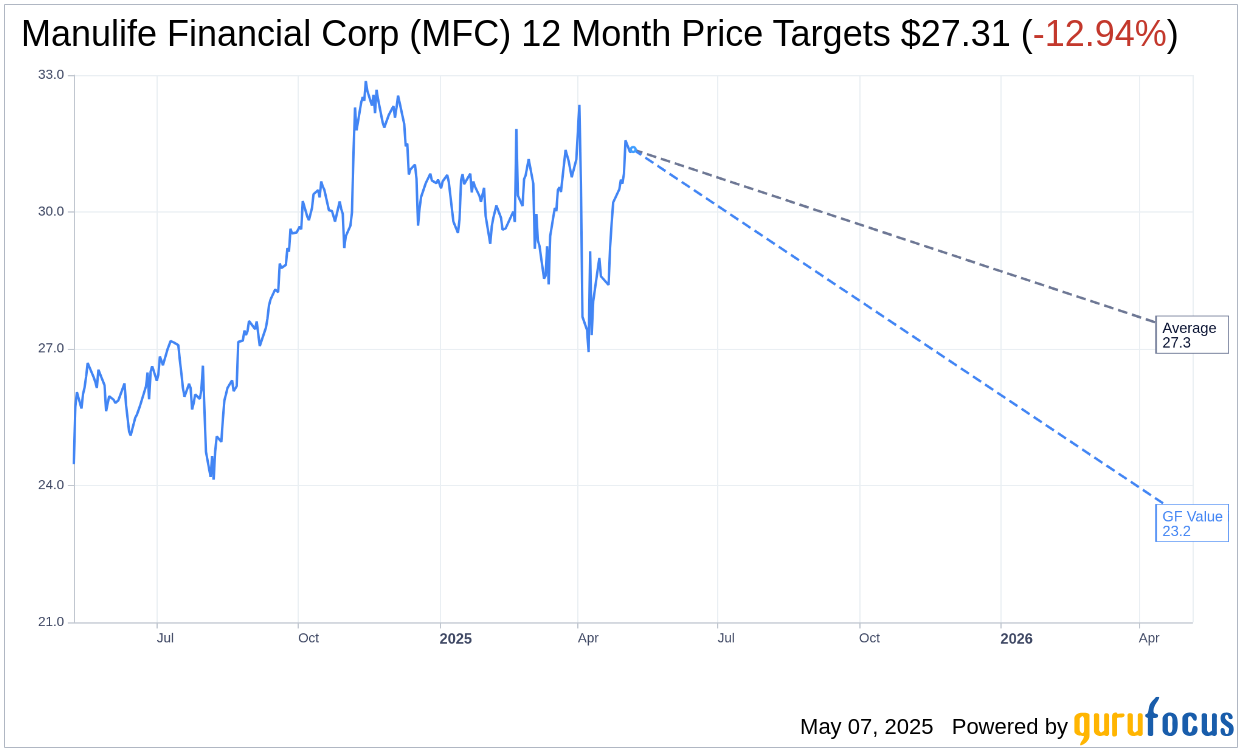

Wall Street Analysts Forecast

Based on the one-year price targets offered by 1 analysts, the average target price for Manulife Financial Corp (MFC, Financial) is $27.31 with a high estimate of $27.31 and a low estimate of $27.31. The average target implies an

downside of 12.94%

from the current price of $31.37. More detailed estimate data can be found on the Manulife Financial Corp (MFC) Forecast page.

Based on the consensus recommendation from 1 brokerage firms, Manulife Financial Corp's (MFC, Financial) average brokerage recommendation is currently 1.0, indicating "Buy" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Manulife Financial Corp (MFC, Financial) in one year is $23.18, suggesting a

downside

of 26.11% from the current price of $31.37. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Manulife Financial Corp (MFC) Summary page.

MFC Key Business Developments

Release Date: February 20, 2025

- Core Earnings: Exceeded $7 billion for the first time, a 10% increase from 2023.

- Net Inflows: $13.3 billion generated by Global WAM business.

- Capital Release: Expected $2.8 billion from reinsurance transactions.

- Efficiency Ratio: Achieved 44.8%, in line with medium-term target of below 45%.

- Core ROE: Expanded to 16.4% for the full year.

- Book Value Growth: 15% increase in both adjusted book value and book value per share.

- LICAT Ratio: Strong at 137%.

- Leverage Ratio: 23.7%, below the 25% medium-term target.

- Dividend Increase: 10% increase in common share dividend approved.

- Share Buyback Program: New program to repurchase up to 3% of outstanding common shares.

- APE Sales Growth: Increased 42% compared to 2023 Q4.

- Core EPS Growth: 11% growth, 14% excluding global minimum taxes impact.

- Cash Remittances: Record $7 billion generated in 2024.

- Core Earnings Growth in Asia: 16% increase driven by business growth momentum compared to 2023 Q4.

- Global WAM Core Earnings Growth: 34% increase supported by higher average third-party AUMA compared to 2023 Q4.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Manulife Financial Corp (MFC, Financial) achieved record core earnings exceeding $7 billion for the first time in 2024, marking a 10% increase from 2023.

- The company executed significant reinsurance transactions, including the largest ever LTC reinsurance deal with Global Atlantic and a Canadian Universal Life reinsurance transaction with RGA, unlocking $2.8 billion in capital.

- Manulife Financial Corp (MFC) reported strong growth in Asia and Global WAM, contributing to 70% of core earnings, with record APE sales and new business value.

- The company launched 27 generative AI use cases into production, generating over $600 million in benefits from digital initiatives, more than 3.5 times the level achieved in 2023.

- Manulife Financial Corp (MFC) announced a 10% increase in its common share dividend and a new buyback program to repurchase up to 3% of outstanding common shares, reflecting strong capital return to shareholders.

Negative Points

- The impact of global minimum taxes (GMT) resulted in a $57 million charge for the quarter, dampening core earnings growth by approximately 3 percentage points.

- Manulife Financial Corp (MFC) reported a $113 million charge due to lower-than-expected public equity returns and a $97 million charge from lower returns on commercial real estate investments.

- The company faced challenges in its US segment, with core earnings decreasing by 16% due to lower investment spreads and earnings foregone from reinsurance transactions.

- Manulife Financial Corp (MFC) experienced a restructuring charge of $52 million, primarily in Global WAM, related to severance costs.

- The company's LICAT ratio is expected to decrease by approximately 1 percentage point due to changes in guidelines effective January 1, 2025.