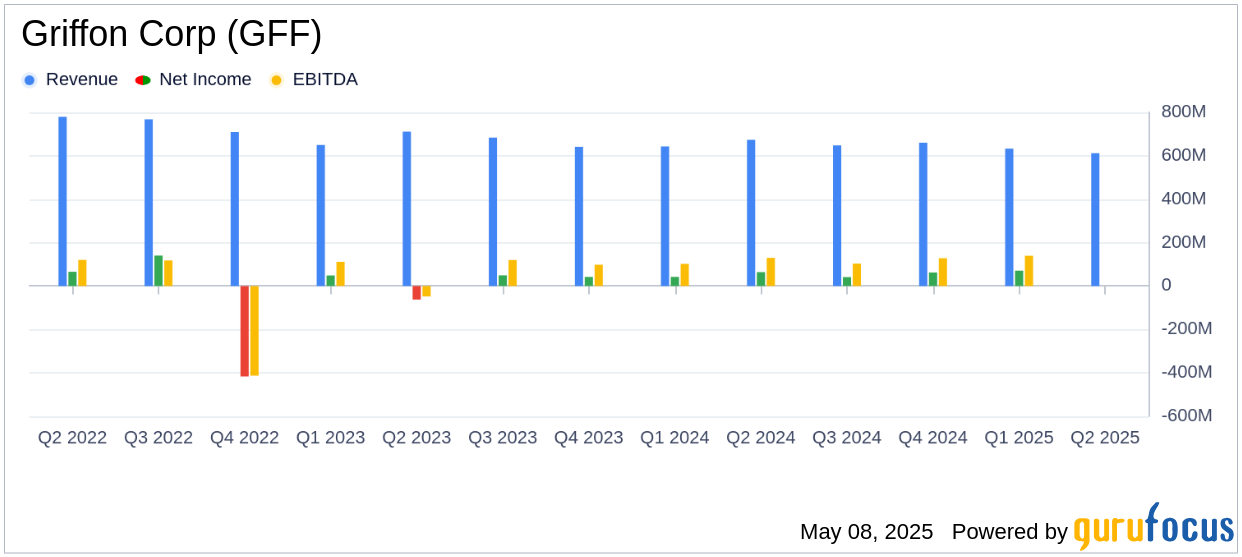

On May 8, 2025, Griffon Corp (GFF, Financial) released its 8-K filing detailing the financial results for the fiscal second quarter ending March 31, 2025. The company reported a revenue of $611.7 million, which is below the analyst estimate of $620.46 million and represents a 9% decrease from the previous year's $672.9 million. Net income was $56.8 million, or $1.21 per share, exceeding the estimated earnings per share (EPS) of $1.06. Adjusted net income was $57.6 million, or $1.23 per share, compared to $67.5 million, or $1.35 per share, in the prior year quarter.

Company Overview

Griffon Corp manufactures and markets residential, commercial, and industrial garage doors, as well as non-powered landscaping products. The company operates through two main segments: Consumer and Professional Products (CPP) and Home and Building Products (HBP). The HBP segment, which generates the majority of the company's revenue, operates through Clopay Corporation, a leading manufacturer of garage doors in North America. Griffon Corp operates in the USA, Europe, Canada, Australia, and other regions.

Performance and Challenges

The company's performance in the second quarter reflects a challenging market environment, with both revenue and net income experiencing declines. The decrease in revenue was primarily due to reduced consumer demand in North America and the UK, as well as unfavorable foreign currency impacts. These challenges highlight the importance of strategic adjustments to navigate market fluctuations and maintain profitability.

Financial Achievements

Despite the revenue decline, Griffon Corp maintained a strong EBITDA margin in its Home and Building Products segment, driven by steady residential performance and a favorable product mix. The Consumer and Professional Products segment showed an 18% increase in adjusted EBITDA, benefiting from global sourcing expansion and improved margins in Australia. These achievements underscore the company's ability to adapt and optimize operations in a competitive industry.

Key Financial Metrics

Griffon Corp's adjusted EBITDA for the second quarter was $118.5 million, a 12% decrease from the prior year. The company's leverage ratio improved to 2.6x net debt to EBITDA, compared to 2.8x in the previous year. Free cash flow for the six-month period ended March 31, 2025, was $145.8 million, reflecting strong operating results. These metrics are crucial for assessing the company's financial health and capacity to invest in growth opportunities.

| Metric | Q2 2025 | Q2 2024 |

|---|---|---|

| Revenue | $611.7 million | $672.9 million |

| Net Income | $56.8 million | $64.1 million |

| Adjusted EBITDA | $118.5 million | $134.2 million |

Analysis and Commentary

Griffon Corp's second-quarter results reflect the impact of decreased consumer demand and currency fluctuations. However, the company's strategic focus on maintaining strong margins and optimizing its global supply chain has helped mitigate some of these challenges. As Ronald J. Kramer, Chairman and CEO of Griffon, stated,

I am pleased to report that the performance of both of our segments for the first half was in-line with our expectations."

This statement highlights the company's resilience and strategic foresight in navigating a complex market environment.

Overall, while Griffon Corp faces headwinds, its strategic initiatives and financial management position it to capitalize on future opportunities in the construction industry. Investors will be keen to see how the company continues to adapt and leverage its strengths in the coming quarters.

Explore the complete 8-K earnings release (here) from Griffon Corp for further details.