Griffon Corporation (GFF, Financial) announced its second-quarter revenue of $611.75 million, which fell slightly short of the market's anticipated $618.23 million. The company's performance in the first half of the year met internal forecasts, according to Chairman and CEO Ronald J. Kramer.

The Home and Building Products division maintained a robust 30% EBITDA margin, benefiting from stable residential activity and a favorable product mix. Meanwhile, the Consumer and Professional Products segment achieved year-over-year improvements in EBITDA margin. This was largely due to transitioning U.S. operations towards an asset-light model and strong performance from their Australian team.

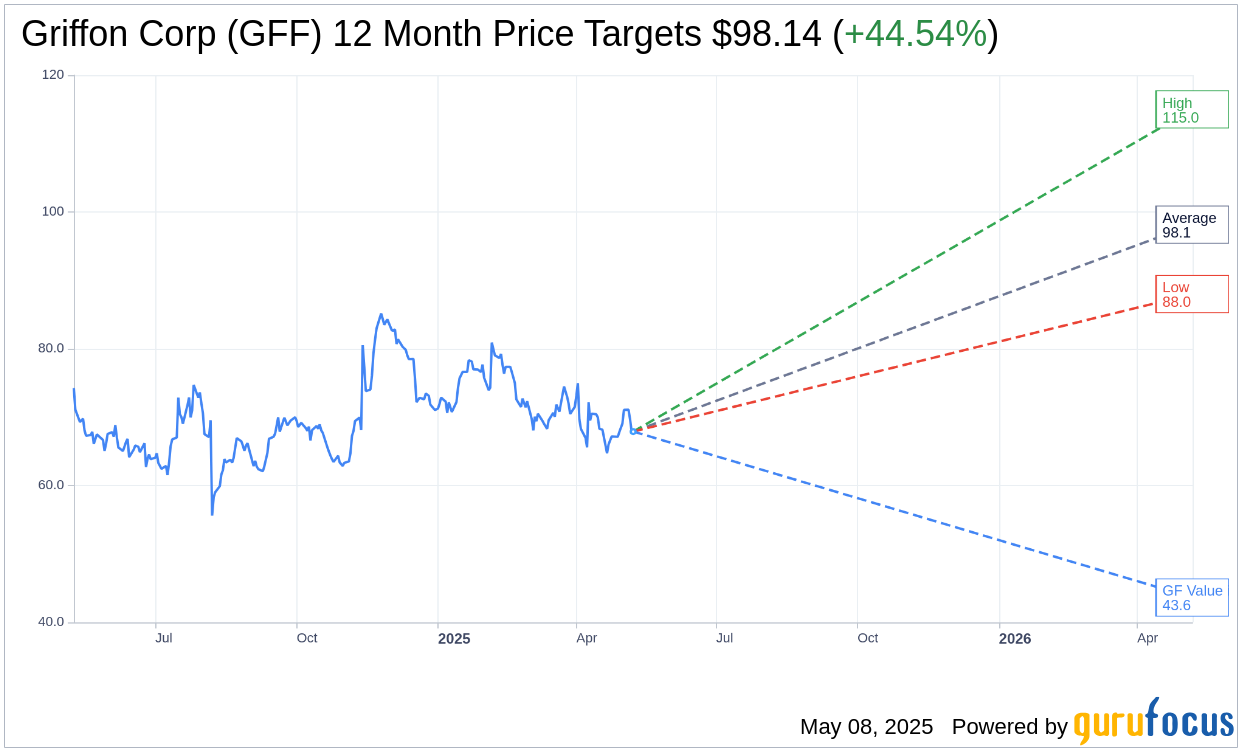

Wall Street Analysts Forecast

Based on the one-year price targets offered by 7 analysts, the average target price for Griffon Corp (GFF, Financial) is $98.14 with a high estimate of $115.00 and a low estimate of $88.00. The average target implies an upside of 44.54% from the current price of $67.90. More detailed estimate data can be found on the Griffon Corp (GFF) Forecast page.

Based on the consensus recommendation from 7 brokerage firms, Griffon Corp's (GFF, Financial) average brokerage recommendation is currently 1.4, indicating "Buy" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Griffon Corp (GFF, Financial) in one year is $43.63, suggesting a downside of 35.74% from the current price of $67.9. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Griffon Corp (GFF) Summary page.