Insights from Stanley Druckenmiller (Trades, Portfolio)'s First Quarter 2025 13F Filing

Stanley Druckenmiller (Trades, Portfolio) recently submitted the 13F filing for the first quarter of 2025, providing insights into his investment moves during this period. Stanley Druckenmiller (Trades, Portfolio), born in 1953 in Pittsburgh, Pennsylvania, is the President, CEO, and Chairman of Duquesne Capital, which he founded in 1981 and converted into a family office in 2010. He managed money for George Soros (Trades, Portfolio) from 1988 to 2000 as the lead portfolio manager for Quantum Fund. The two partners famously shorted the British Pound in 1992. Druckenmiller was highly influenced by George Soros (Trades, Portfolio)' trading style, which is quite evident in his own investing strategy. He uses a top-down approach that combines long positions and short positions in all types of assets like stocks, bonds, currencies, and futures.

Summary of New Buy

Stanley Druckenmiller (Trades, Portfolio) added a total of 12 stocks, among them:

- The most significant addition was Docusign Inc (DOCU, Financial), with 1,074,655 shares, accounting for 2.86% of the portfolio and a total value of $87.48 million.

- The second largest addition to the portfolio was CCC Intelligent Solutions Holdings Inc (CCCS, Financial), consisting of 5,595,039 shares, representing approximately 1.65% of the portfolio, with a total value of $50.52 million.

- The third largest addition was EQT Corp (EQT, Financial), with 859,345 shares, accounting for 1.5% of the portfolio and a total value of $45.92 million.

Key Position Increases

Stanley Druckenmiller (Trades, Portfolio) also increased stakes in a total of 14 stocks, among them:

- The most notable increase was Teva Pharmaceutical Industries Ltd (TEVA, Financial), with an additional 5,882,350 shares, bringing the total to 14,879,750 shares. This adjustment represents a significant 65.38% increase in share count, a 2.95% impact on the current portfolio, with a total value of $228.7 million.

- The second largest increase was Taiwan Semiconductor Manufacturing Co Ltd (TSM, Financial), with an additional 491,265 shares, bringing the total to 598,780. This adjustment represents a significant 456.93% increase in share count, with a total value of $99.4 million.

Summary of Sold Out

Stanley Druckenmiller (Trades, Portfolio) completely exited 37 holdings in the first quarter of 2025, as detailed below:

- Skechers USA Inc (SKX, Financial): Stanley Druckenmiller (Trades, Portfolio) sold all 1,074,840 shares, resulting in a -1.94% impact on the portfolio.

- SLM Corp (SLM, Financial): Stanley Druckenmiller (Trades, Portfolio) liquidated all 2,520,275 shares, causing a -1.87% impact on the portfolio.

Key Position Reduces

Stanley Druckenmiller (Trades, Portfolio) also reduced positions in 17 stocks. The most significant changes include:

- Reduced Seagate Technology Holdings PLC (STX, Financial) by 1,344,599 shares, resulting in an -85.97% decrease in shares and a -3.12% impact on the portfolio. The stock traded at an average price of $94.51 during the quarter and has returned 6.74% over the past 3 months and 25.49% year-to-date.

- Reduced United Airlines Holdings Inc (UAL, Financial) by 675,120 shares, resulting in a -64.68% reduction in shares and a -1.76% impact on the portfolio. The stock traded at an average price of $94.43 during the quarter and has returned -26.59% over the past 3 months and -21.17% year-to-date.

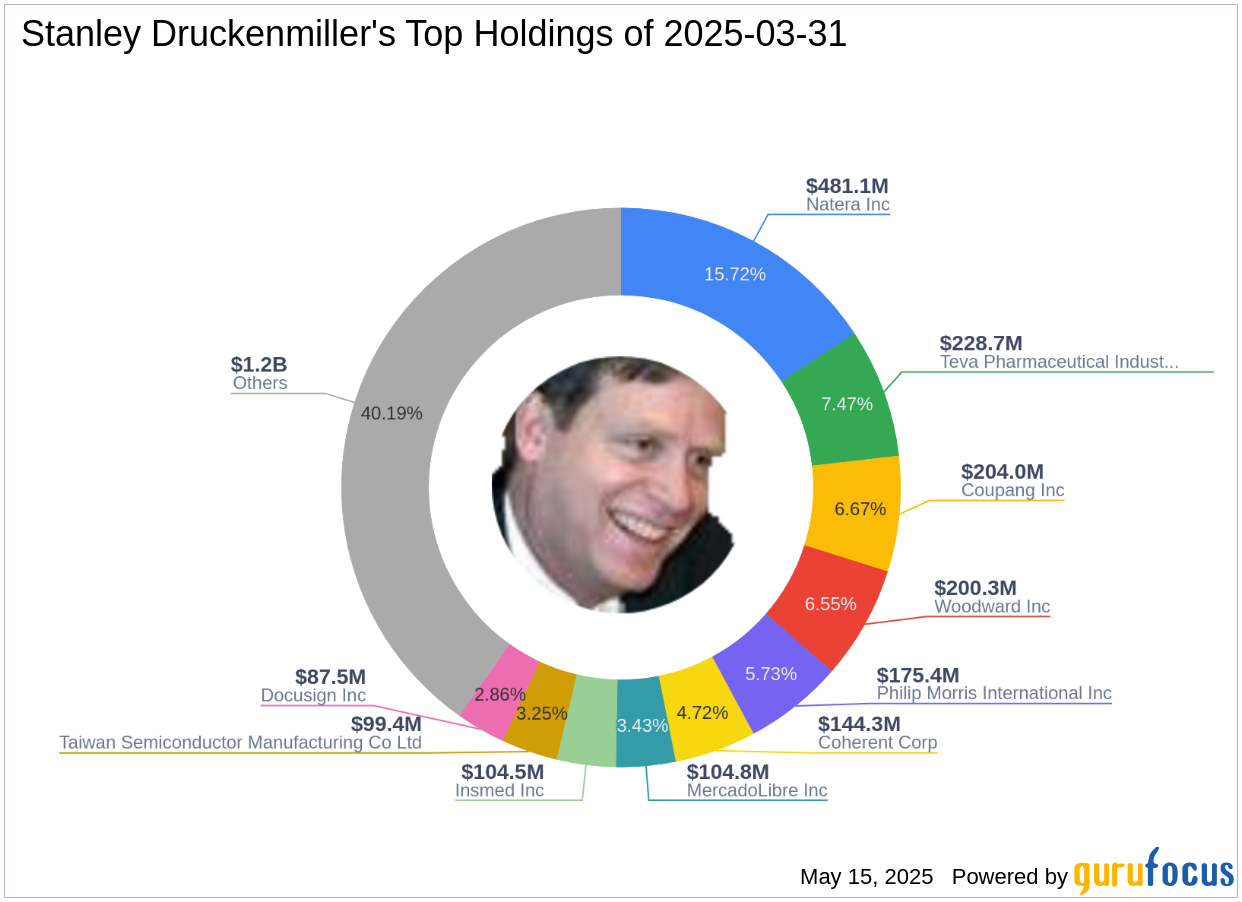

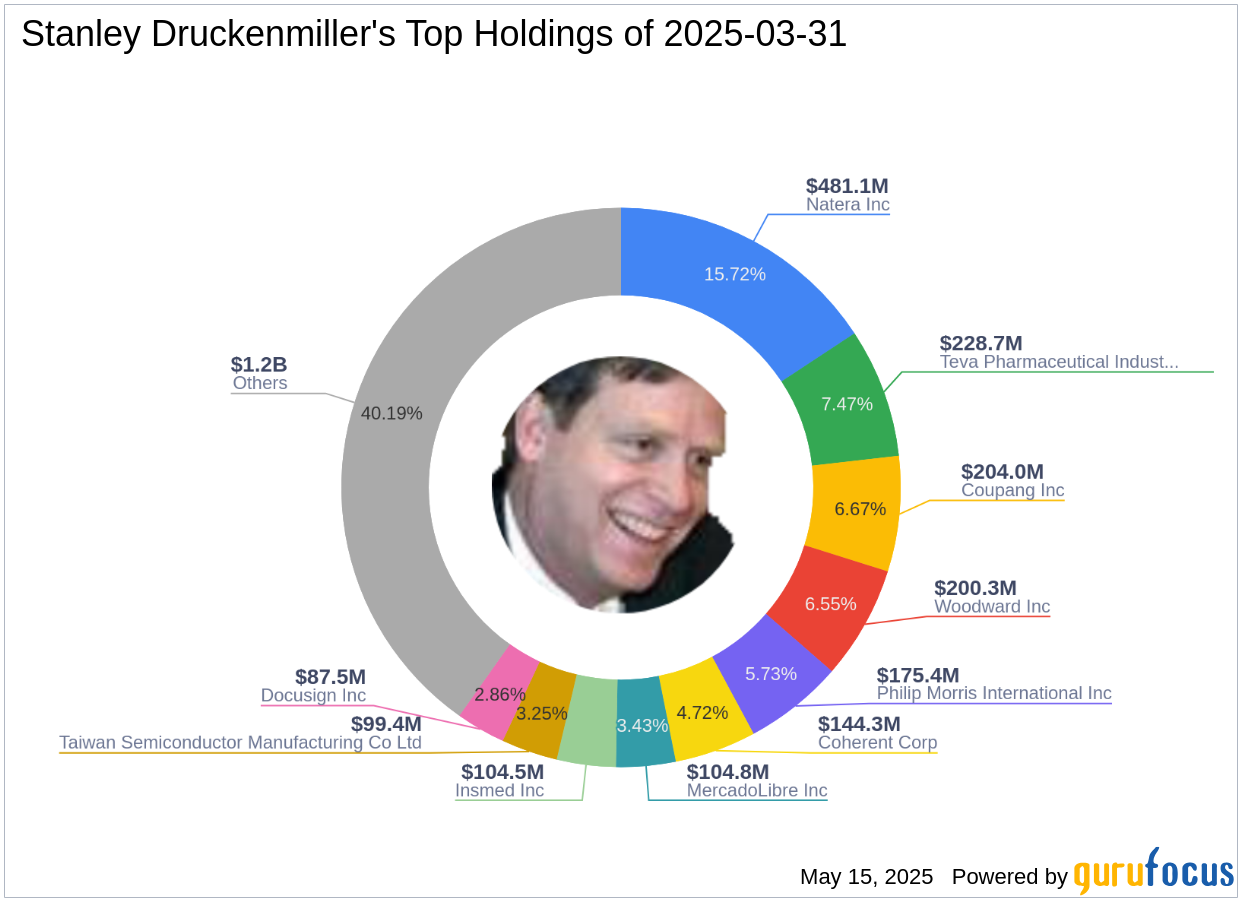

Portfolio Overview

At the first quarter of 2025, Stanley Druckenmiller (Trades, Portfolio)'s portfolio included 52 stocks. The top holdings included 15.72% in Natera Inc (NTRA, Financial), 7.47% in Teva Pharmaceutical Industries Ltd (TEVA, Financial), 6.67% in Coupang Inc (CPNG, Financial), 6.55% in Woodward Inc (WWD, Financial), and 5.73% in Philip Morris International Inc (PM, Financial).

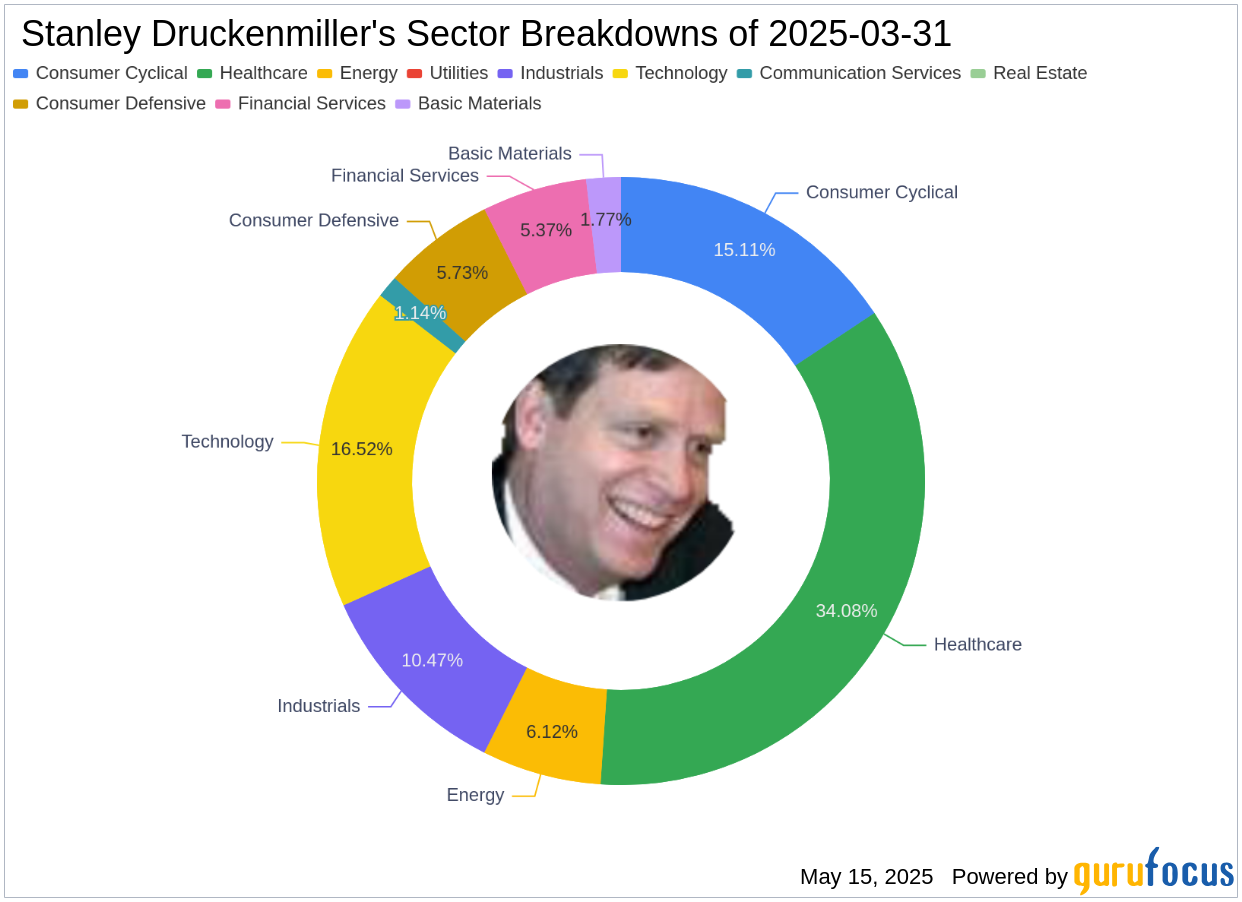

The holdings are mainly concentrated in 9 of all the 11 industries: Healthcare, Technology, Consumer Cyclical, Industrials, Energy, Consumer Defensive, Financial Services, Basic Materials, and Communication Services.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

Also check out: