On March 31, 2025, FIL Ltd (Trades, Portfolio), a prominent asset management firm, made a significant move by acquiring an additional 560,000 shares of LeddarTech Holdings Inc at a price of $0.46 per share. This transaction increased FIL Ltd (Trades, Portfolio)'s total holdings in LeddarTech to 2,611,871 shares, marking a substantial investment in the company. Despite the challenging financial metrics of LeddarTech, this strategic acquisition reflects FIL Ltd (Trades, Portfolio)'s confidence in the potential of the company's technology and market position.

FIL Ltd (Trades, Portfolio): A Global Investment Powerhouse

FIL Ltd (Trades, Portfolio), also known as Fidelity Worldwide Investments, was established in 1969 as an international investment division under Fidelity Investments. The firm has grown to become one of the world's largest providers of investment strategies, with a presence in 24 countries and a diverse client base that includes over 450 institutions. FIL Ltd (Trades, Portfolio) employs an active bottom-up investment approach, focusing heavily on research to navigate semi-efficient markets. The firm is renowned for its comprehensive coverage of global market capitalization and investment-grade credit universe.

LeddarTech Holdings Inc: Innovating in Autonomous Driving

LeddarTech Holdings Inc specializes in developing perception software solutions for Advanced Driver Assistance Systems (ADAS) and autonomous driving applications. The company's software leverages AI and computer vision algorithms to create accurate 3D models of the environment, enhancing decision-making and navigation safety. LeddarTech primarily generates revenue from markets in France, Canada, and the United States, positioning itself as a key player in the autonomous driving sector.

Financial Analysis of LeddarTech Holdings Inc

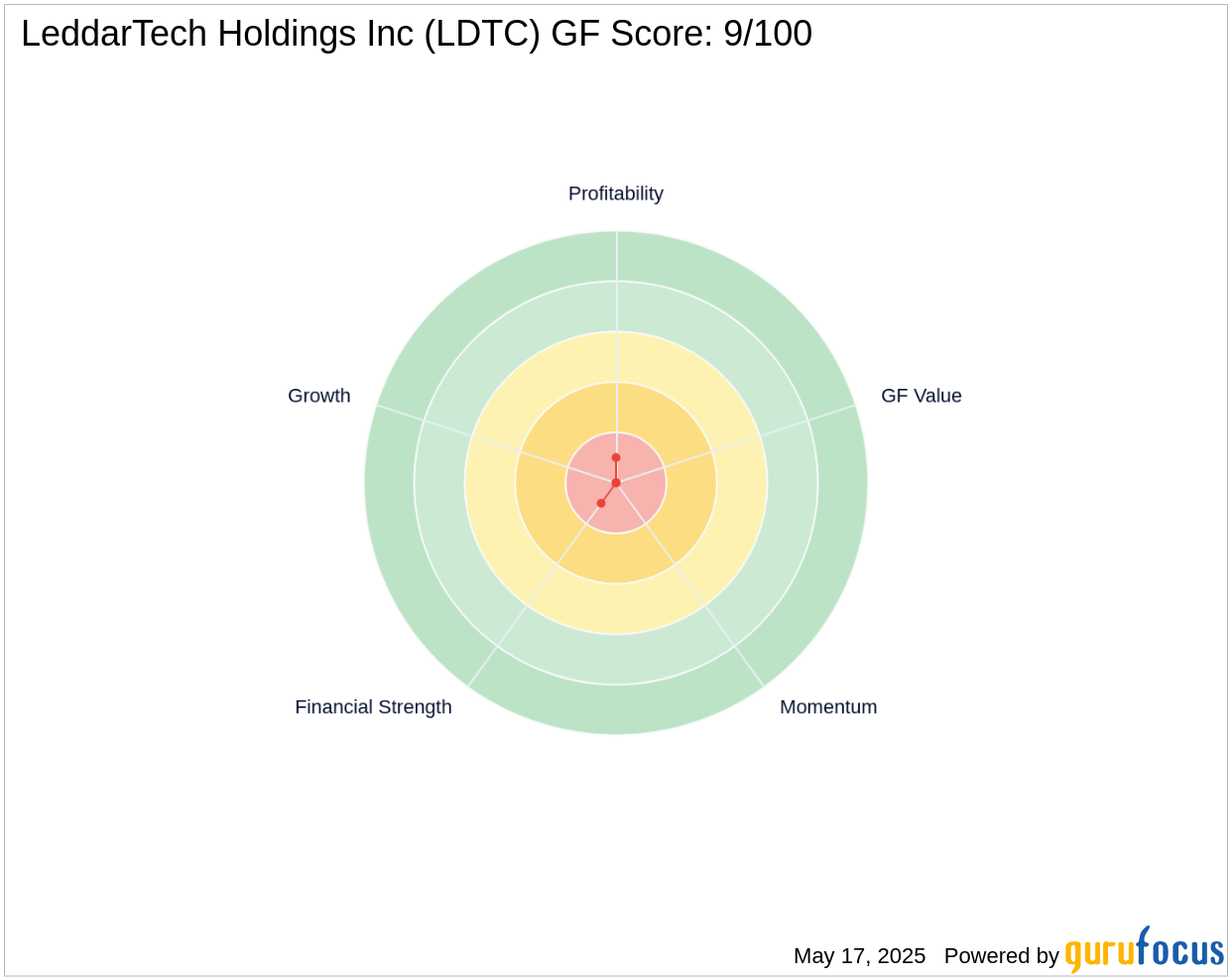

As of May 17, 2025, LeddarTech Holdings Inc has a market capitalization of $19.888 million. The company's financial performance indicators reveal challenges, with a negative Return on Assets (ROA) of -70.01% and a GF Score of 9/100, suggesting poor future performance potential. These metrics highlight the financial hurdles LeddarTech faces, yet FIL Ltd (Trades, Portfolio)'s investment indicates a belief in the company's long-term prospects.

Impact of FIL Ltd (Trades, Portfolio)'s Investment

FIL Ltd (Trades, Portfolio)'s increased stake in LeddarTech Holdings Inc, now holding 2,611,871 shares, underscores a strategic decision to invest in the company's future. Despite LeddarTech's challenging financial metrics, FIL Ltd (Trades, Portfolio)'s investment may be driven by the potential growth in the autonomous driving market and the innovative capabilities of LeddarTech's software solutions. This move could also reflect FIL Ltd (Trades, Portfolio)'s confidence in the company's ability to overcome its current financial difficulties.

Market Performance and Valuation

Since the transaction, LeddarTech's stock price has risen by 15%, currently trading at $0.529. However, the stock has experienced a significant decline of 80.41% since its Initial Public Offering (IPO) in December 2023. The lack of GF Valuation data and the stock's poor performance metrics suggest a cautious approach to its valuation. Despite these challenges, the recent price gain indicates some market optimism.

Conclusion: A Strategic Bet on Future Potential

FIL Ltd (Trades, Portfolio)'s decision to increase its position in LeddarTech Holdings Inc reflects a strategic bet on the company's potential in the autonomous driving sector. While LeddarTech faces significant financial challenges, the investment by a firm of FIL Ltd (Trades, Portfolio)'s stature suggests confidence in the company's innovative technology and market opportunities. The long-term outlook for LeddarTech will depend on its ability to improve financial performance and capitalize on growth opportunities in the evolving autonomous driving landscape.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.