On March 31, 2025, Working Capital Advisors (UK) Ltd. made a significant move by increasing its stake in Open Lending Corp (LPRO, Financial). The firm added 619,060 shares to its portfolio at a trade price of $2.76 per share. This transaction resulted in a 0.97% increase in the firm's portfolio, bringing the total number of shares held to 9,753,997. Open Lending Corp now constitutes 15.25% of the firm's portfolio, highlighting its strategic importance to the investment strategy.

Transaction Details and Portfolio Impact

The recent acquisition of shares in Open Lending Corp by Working Capital Advisors (UK) Ltd. reflects a strategic decision to bolster its holdings in the company. The addition of 619,060 shares at $2.76 each signifies a calculated investment, increasing the firm's total shares in Open Lending Corp to 9,753,997. This move has elevated the stock's position in the firm's portfolio to 15.25%, indicating a strong belief in the company's potential despite its current challenges.

Profile of Working Capital Advisors (UK) Ltd.

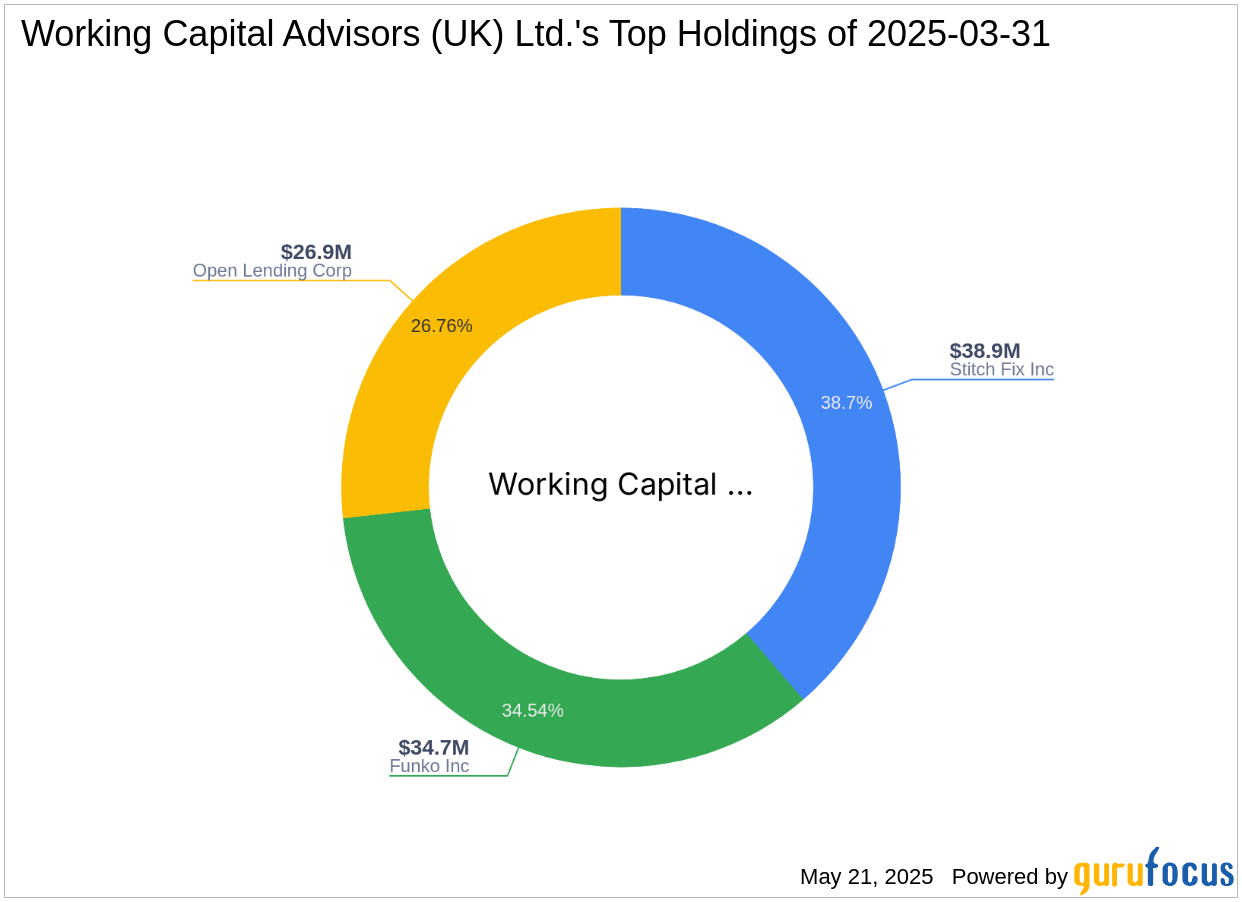

Based in London, UK, Working Capital Advisors (UK) Ltd. is a prominent investment firm with a diverse portfolio. While the firm's specific investment philosophy is not detailed, its top holdings include Funko Inc (FNKO, Financial), Stitch Fix Inc (SFIX, Financial), and Open Lending Corp (LPRO, Financial). With total equity valued at $101 million, the firm primarily focuses on the Consumer Cyclical and Financial Services sectors, showcasing a strategic approach to investment diversification.

Overview of Open Lending Corp

Open Lending Corp, headquartered in the USA, specializes in providing automated lending services to financial institutions. The company offers a range of services, including loan analytics, risk-based pricing, risk modeling, and automated decision technology. With a market capitalization of $245.562 million, Open Lending Corp plays a crucial role in the credit services industry, despite facing recent financial challenges.

Financial Performance and Valuation of Open Lending Corp

Open Lending Corp's current stock price stands at $2.05, with a GF Score of 65/100, indicating poor future performance potential. The stock is considered modestly overvalued with a Price-to-GF Value ratio of 1.18. Year-to-date, the stock has experienced a significant decline of 64.1%, reflecting the challenges the company faces in the current market environment.

Financial Metrics and Ratios

The financial metrics of Open Lending Corp reveal a challenging landscape. The company currently operates at a loss, as indicated by a PE Ratio of 0.00. The Return on Equity (ROE) is -86.45%, and the Return on Assets (ROA) is -39.63%, highlighting inefficiencies in generating returns. The Balance Sheet Rank is 3/10, while the Profitability Rank is 6/10, suggesting room for improvement in financial health and profitability.

Stock Performance and Growth Indicators

Open Lending Corp has faced significant challenges in recent years, with a 3-year revenue growth decline of 50.90% and a gross margin growth decline of 50.70%. The stock's Momentum Rank is 2/10, indicating weak momentum. The Relative Strength Index (RSI) over 14 days is 62.67, suggesting some stock momentum, but the overall growth indicators remain concerning.

Conclusion

The acquisition of additional shares in Open Lending Corp by Working Capital Advisors (UK) Ltd. underscores the firm's strategic interest in the company despite its current financial challenges. This transaction could potentially influence Open Lending Corp's future performance and valuation, as the firm continues to navigate a complex market environment. The investment reflects a calculated risk, with the potential for long-term gains if Open Lending Corp can overcome its current hurdles and improve its financial metrics.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.