Goldman Sachs has revised its price target for Advance Auto Parts (AAP, Financial), raising it from $43 to $48, while maintaining a Neutral rating for the shares. The upward adjustment follows AAP's better-than-expected performance in the first quarter, where it exceeded both revenue and profit estimates. Analysts highlight that this improved performance suggests the company's turnaround strategies are beginning to yield positive results.

The firm also emphasized the robustness of the auto parts retail sector, noting its strong defensive characteristics and the potential for favorable pricing trends. Such factors contribute to a positive outlook for the industry in the near term.

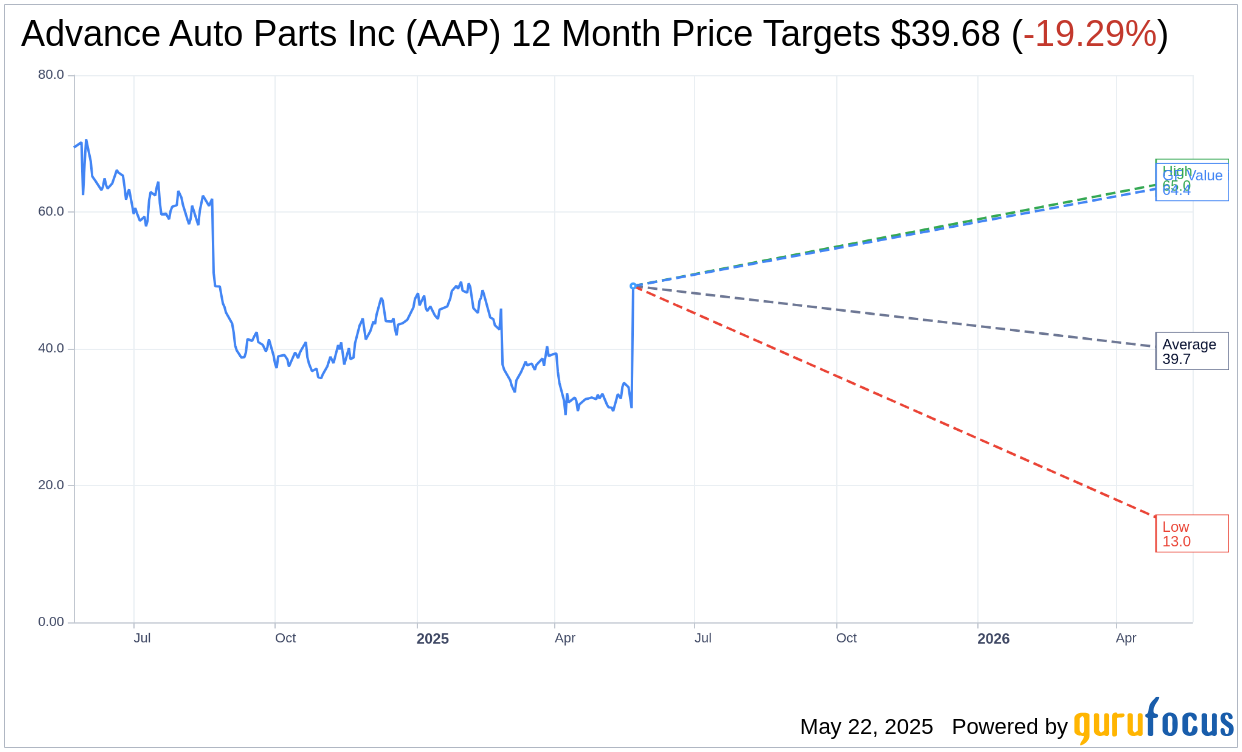

Wall Street Analysts Forecast

Based on the one-year price targets offered by 19 analysts, the average target price for Advance Auto Parts Inc (AAP, Financial) is $39.68 with a high estimate of $65.00 and a low estimate of $13.00. The average target implies an downside of 19.29% from the current price of $49.17. More detailed estimate data can be found on the Advance Auto Parts Inc (AAP) Forecast page.

Based on the consensus recommendation from 28 brokerage firms, Advance Auto Parts Inc's (AAP, Financial) average brokerage recommendation is currently 3.1, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Advance Auto Parts Inc (AAP, Financial) in one year is $64.37, suggesting a upside of 30.91% from the current price of $49.17. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Advance Auto Parts Inc (AAP) Summary page.

AAP Key Business Developments

Release Date: February 26, 2025

- Fourth-Quarter Net Sales: $2 billion, a 1% decrease compared with Q4 last year.

- Comparable Store Sales: Declined 1% in Q4, excluding closing store locations.

- Adjusted Gross Profit: $779 million or 39% of net sales, with a gross margin contraction of 170 basis points.

- Adjusted SG&A: $878 million or 44% of net sales, resulting in deleverage of 175 basis points.

- Adjusted Operating Loss: $99 million or negative 5% of net sales.

- Adjusted Diluted Loss Per Share: $1.18 compared with a loss of $0.45 per share in the prior year.

- Free Cash Flow: Negative $40 million, includes approximately $90 million of cash expenses associated with store closures.

- Full-Year Net Sales: $9.1 billion, a 1% decrease compared to last year.

- Full-Year Comparable Store Sales: Declined 70 basis points.

- Adjusted Gross Profit for Full Year: $3.8 billion or 42.2% of net sales, an expansion of approximately 30 basis points.

- Adjusted SG&A for Full Year: $3.8 billion or 41.8% of net sales, driving a deleverage of approximately 50 basis points.

- Adjusted Operating Income for Full Year: $35 million and 40 basis points as a percent of net sales.

- Adjusted Diluted Loss Per Share for Full Year: $0.29 compared with a loss of $0.28 last year.

- Cash Position: Approximately $1.9 billion at the end of the fourth quarter.

- 2025 Guidance - Net Sales: Expected in the range of $8.4 billion to $8.6 billion.

- 2025 Guidance - Comparable Sales Growth: 50 to 150 basis points on a 52-week basis.

- 2025 Guidance - Adjusted Operating Income Margin: Expected in the range of 2% to 3%.

- 2025 Guidance - Adjusted Diluted EPS: Expected in the range of $1.50 to $2.50.

- 2025 Guidance - Free Cash Flow: Expected in the range of negative $25 million to $85 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Advance Auto Parts Inc (AAP, Financial) has introduced a three-year strategic plan aimed at improving operating margins to approximately 7% by 2027.

- The company reported an improvement in comparable sales during Q4, indicating a positive trend in sales performance.

- AAP has made significant progress in transforming its supply chain, including the consolidation of distribution centers, which is expected to improve labor productivity and reduce costs.

- The company is rolling out a new assortment framework across its top 50 DMAs, covering more than 70% of sales, which has shown positive results in pilot tests.

- AAP has successfully negotiated favorable lease terminations for store closures, reducing expected closure costs and strengthening its cash position.

Negative Points

- Fourth-quarter net sales from continuing operations decreased by 1% compared to the previous year, indicating challenges in maintaining sales growth.

- The company reported an adjusted operating loss from continuing operations of $99 million, reflecting ongoing financial challenges.

- AAP's gross margin contracted by 170 basis points in Q4 due to transitory costs and liquidation sales, impacting profitability.

- The company is experiencing volatility in sales performance in Q1, attributed to weather conditions and delayed tax refunds.

- AAP's guidance for 2025 includes a reduction in net sales by 5% to 8% year over year due to store closures, indicating potential revenue challenges.