Imperial Petroleum (IMPP, Financial) reported first-quarter revenue of $32.1 million, a decrease from the $41.2 million recorded in the same period last year. The fleet operational utilization was noted at 83.8% for Q1 2025, showing a slight decline from 86% in Q4 2024 but an improvement from 80.6% in Q1 2024. Approximately 47% of the fleet's calendar days were allocated to time charter operations, with the remaining 53% devoted to spot activity.

The company achieved a net income of $11.3 million in the first quarter of 2025, which was deemed satisfactory given the fluctuating market conditions. Imperial Petroleum is in the midst of expanding its fleet, expecting to grow from four vessels to nineteen by the second quarter of 2025. This rapid growth aligns with their strategy to transform from a small to a medium-sized company.

Imperial Petroleum highlights its zero bank debt and liquidity exceeding $220 million as of March 31, 2025, as part of its strong operational framework. The focus remains on building a diversified and high-quality fleet, anticipating long-term returns from these strategic expansions.

Wall Street Analysts Forecast

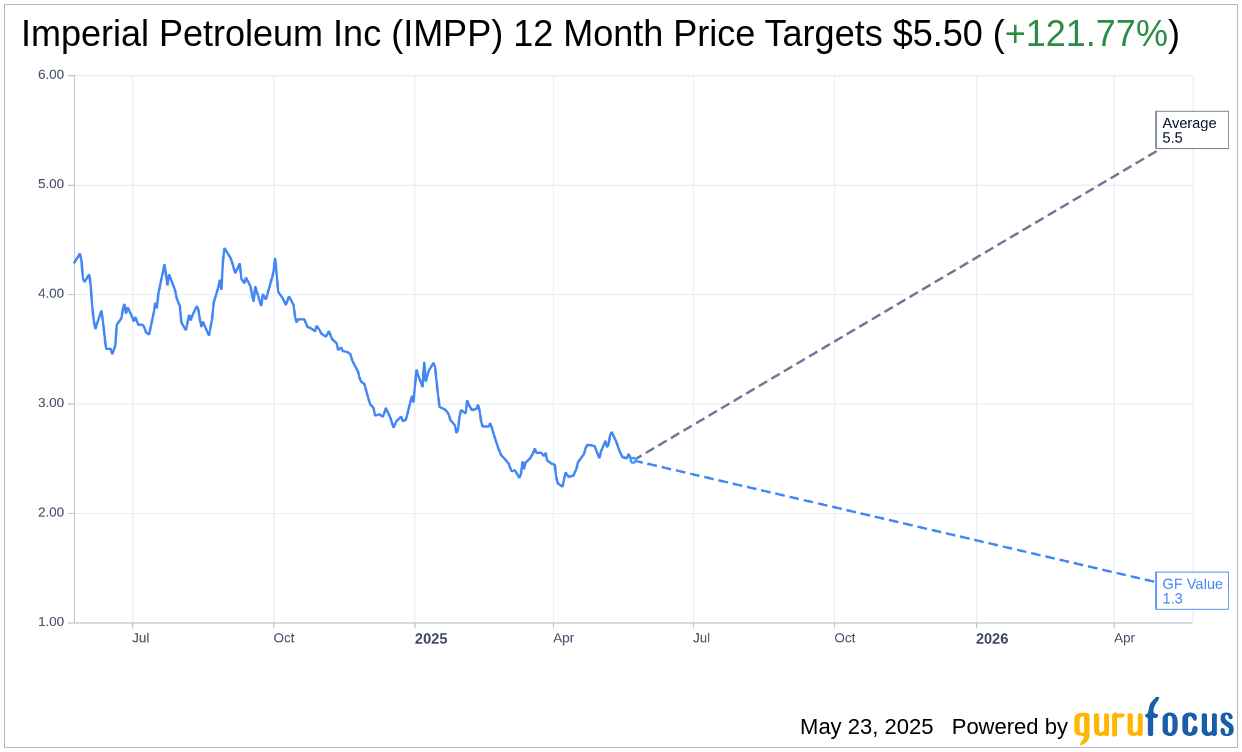

Based on the one-year price targets offered by 1 analysts, the average target price for Imperial Petroleum Inc (IMPP, Financial) is $5.50 with a high estimate of $5.50 and a low estimate of $5.50. The average target implies an upside of 121.77% from the current price of $2.48. More detailed estimate data can be found on the Imperial Petroleum Inc (IMPP) Forecast page.

Based on the consensus recommendation from 1 brokerage firms, Imperial Petroleum Inc's (IMPP, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Imperial Petroleum Inc (IMPP, Financial) in one year is $1.29, suggesting a downside of 47.98% from the current price of $2.48. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Imperial Petroleum Inc (IMPP) Summary page.