Lantronix (LTRX, Financial) is set to showcase its cutting-edge LM4 AI-powered Out-of-Band Management platform through live demonstrations and daily giveaways at Cisco Live. The event will take place from June 9-12, 2025, in San Diego, and Lantronix will have its presence at booth 3219. As a Cisco Devnet Partner, Lantronix offers an extensive range of out-of-band management console servers aimed at minimizing unforeseen network outages. This technology facilitates both conventional out-of-band access as well as streamlined management and recovery processes.

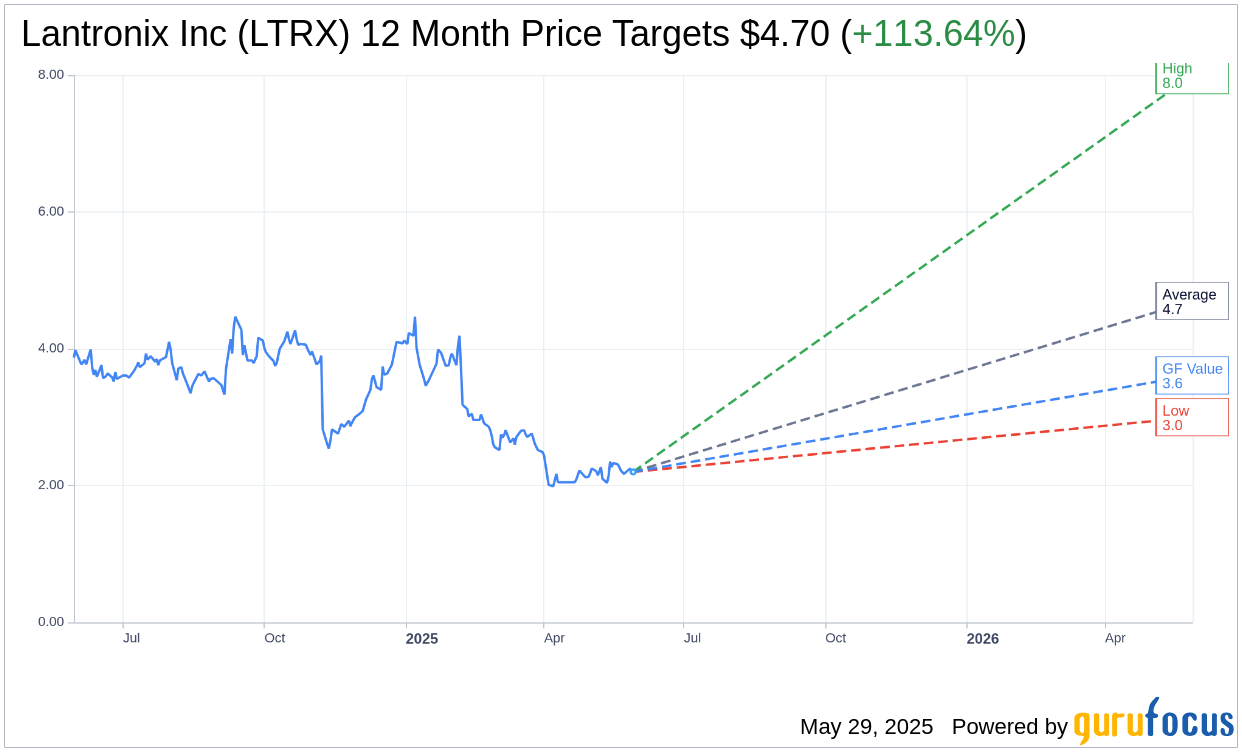

Wall Street Analysts Forecast

Based on the one-year price targets offered by 5 analysts, the average target price for Lantronix Inc (LTRX, Financial) is $4.70 with a high estimate of $8.00 and a low estimate of $3.00. The average target implies an upside of 113.64% from the current price of $2.20. More detailed estimate data can be found on the Lantronix Inc (LTRX) Forecast page.

Based on the consensus recommendation from 5 brokerage firms, Lantronix Inc's (LTRX, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Lantronix Inc (LTRX, Financial) in one year is $3.61, suggesting a upside of 64.09% from the current price of $2.2. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Lantronix Inc (LTRX) Summary page.

LTRX Key Business Developments

Release Date: May 08, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Lantronix Inc (LTRX, Financial) reported revenue of $28.5 million for Q3 2025, within their guidance range.

- The company expanded its distribution network in the European Union and Asia Pacific, enhancing customer support.

- Lantronix Inc (LTRX) launched new AI-powered camera solutions and products using Qualcomm's Dragon wing 8,550 processor.

- The company increased its cash position sequentially and reduced its debt, improving financial stability.

- Lantronix Inc (LTRX) is seeing positive customer engagement and cross-selling opportunities from the Netcom acquisition.

Negative Points

- Revenue was down both sequentially and year-over-year, with no shipments to a large smart grid customer in Europe.

- GAAP net loss was $3.9 million for Q3 2025, compared to a smaller loss in the year-ago quarter.

- The company anticipates pressure on gross margins in Q4 2025 due to the current macroeconomic environment.

- Non-GAAP net income decreased to $1.1 million in Q3 2025 from $4.2 million in the year-ago quarter.

- The company is cautious about the macroeconomic uncertainty affecting future growth and operations.