Raymond James has revised its price target for Aflac (AFL, Financial), reducing it to $110 from a previous target of $115, while maintaining an Outperform rating. The firm appreciates Aflac's stable operations and its focus on a protection-oriented business model. Additionally, Aflac is commended for its robust capital reserves exceeding $40 billion and its resilience to broader economic fluctuations.

The analysis highlights Aflac's strong position in excess capital and its strategic use of Bermuda reinsurance to unlock additional capital. Raymond James continues to see Aflac as a solid investment choice due to these strengths, which offer stability and potential growth opportunities even amid challenging market conditions.

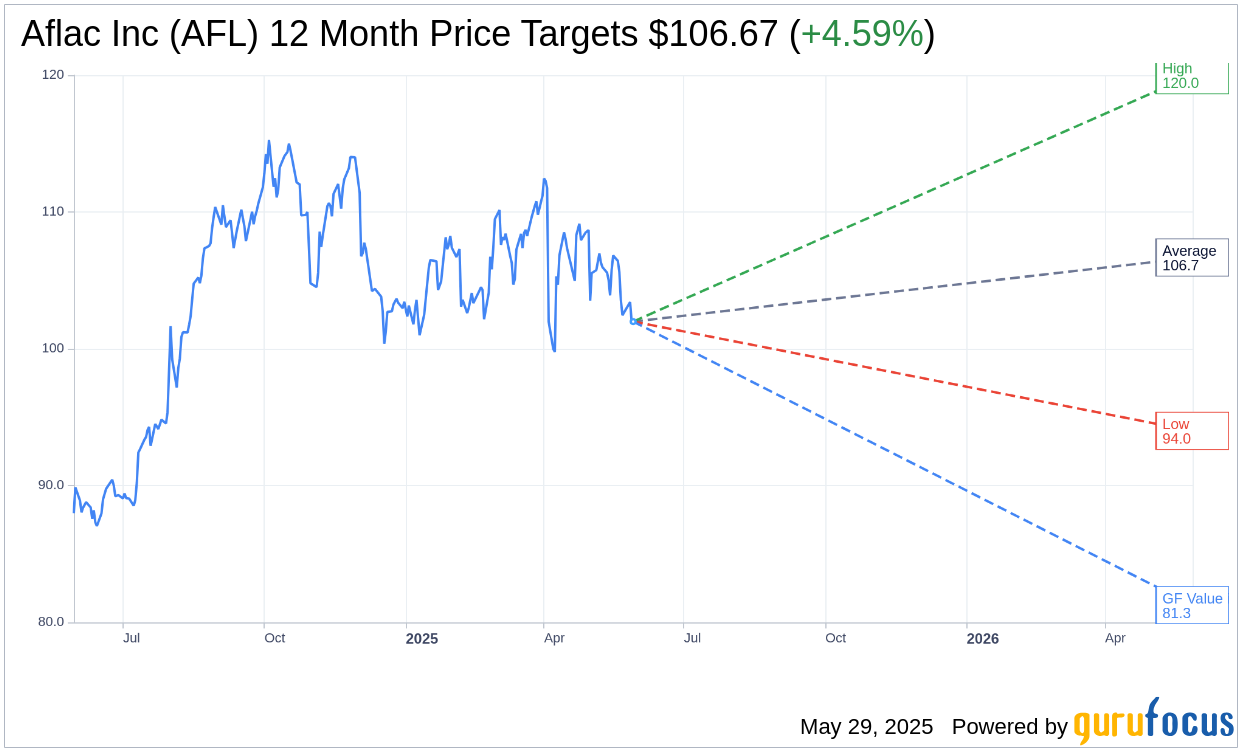

Wall Street Analysts Forecast

Based on the one-year price targets offered by 12 analysts, the average target price for Aflac Inc (AFL, Financial) is $106.67 with a high estimate of $120.00 and a low estimate of $94.00. The average target implies an upside of 4.59% from the current price of $101.99. More detailed estimate data can be found on the Aflac Inc (AFL) Forecast page.

Based on the consensus recommendation from 15 brokerage firms, Aflac Inc's (AFL, Financial) average brokerage recommendation is currently 2.9, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Aflac Inc (AFL, Financial) in one year is $81.26, suggesting a downside of 20.33% from the current price of $101.99. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Aflac Inc (AFL) Summary page.

AFL Key Business Developments

Release Date: May 01, 2025

- Net Earnings Per Diluted Share: $0.05, significantly impacted by net investment losses.

- Adjusted Earnings Per Diluted Share: $1.66, unchanged from the first quarter of 2024.

- Japan Sales Increase: 12.6% year-over-year.

- Cancer Insurance Sales Increase in Japan: 6.3%.

- US Sales Increase: 3.5% year-over-year.

- Capital Deployed for Share Repurchase: $900 million for 8.5 million shares.

- Dividends Paid: $317 million in Q1 2025.

- Total Return to Shareholders: $1.2 billion in the first quarter of 2025.

- Adjusted Book Value Per Share Increase: 2.2%, excluding foreign currency remeasurement.

- Adjusted ROE: 12.7%, 15.6% excluding foreign currency remeasurement.

- Japan Net Earned Premiums Decline: 5% for the quarter.

- Japan Total Benefit Ratio: 65.8%, down 120 basis points year-over-year.

- Japan Expense Ratio: 19.6%, up 160 basis points year-over-year.

- US Net Earned Premium Increase: 1.8%.

- US Persistency Rate: 79.3%, up 60 basis points year-over-year.

- US Total Benefit Ratio: 47.7%, up 120 basis points from Q1 2024.

- US Expense Ratio: 37.6%, down 110 basis points year-over-year.

- Unencumbered Holding Company Liquidity: $4.3 billion.

- Capital Ratios: SMR above 950%, estimated regulatory ESR above 250%, combined RBC estimated greater than 600%.

- Leverage Ratio: 20.7%, within target range of 20% to 25%.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Aflac Inc (AFL, Financial) reported a 12.6% year-over-year sales increase in Japan, driven by strong cancer insurance sales.

- The company maintained strong premium persistency in Japan at 93.8%, reflecting customer recognition of product value.

- Aflac Inc (AFL) deployed $900 million in capital to repurchase 8.5 million shares, demonstrating strong capital management.

- The company has a track record of 42 consecutive years of dividend growth, returning $1.2 billion to shareholders in Q1 2025.

- Aflac Inc (AFL) reported a 3.5% year-over-year increase in U.S. sales, with strong performance in group life and disability segments.

Negative Points

- Net earnings per diluted share were significantly impacted by net investment losses compared to gains in the previous year.

- Aflac Japan's net earned premiums declined by 5% in the quarter, with underlying earned premiums down 1.4%.

- The U.S. total benefit ratio increased by 120 basis points year-over-year, driven by business mix and lower remeasurement gains.

- Adjusted net investment income in yen terms was down 7.6% due to lower floating rate income and asset transfers.

- The expense ratio in Japan increased by 160 basis points year-over-year, primarily due to higher technology expenses.