Redburn Atlantic has adjusted its perspective on Advance Auto Parts (AAP, Financial), upgrading the stock from a previous "Sell" rating to "Neutral." The firm set a new price target of $45, significantly higher than the earlier target of $28. While challenges persist, such as the company's slow turnaround progress and ongoing concerns about its investment strategy and financial structure, the analyst notes a positive outlook for the latter half of 2025. This favorable environment is expected to boost the company's comparative sales and earnings growth, echoing the performance seen in fiscal 2021. As a result, this growth might provide support to AAP's stock price in the near future, according to Redburn's analysis.

Wall Street Analysts Forecast

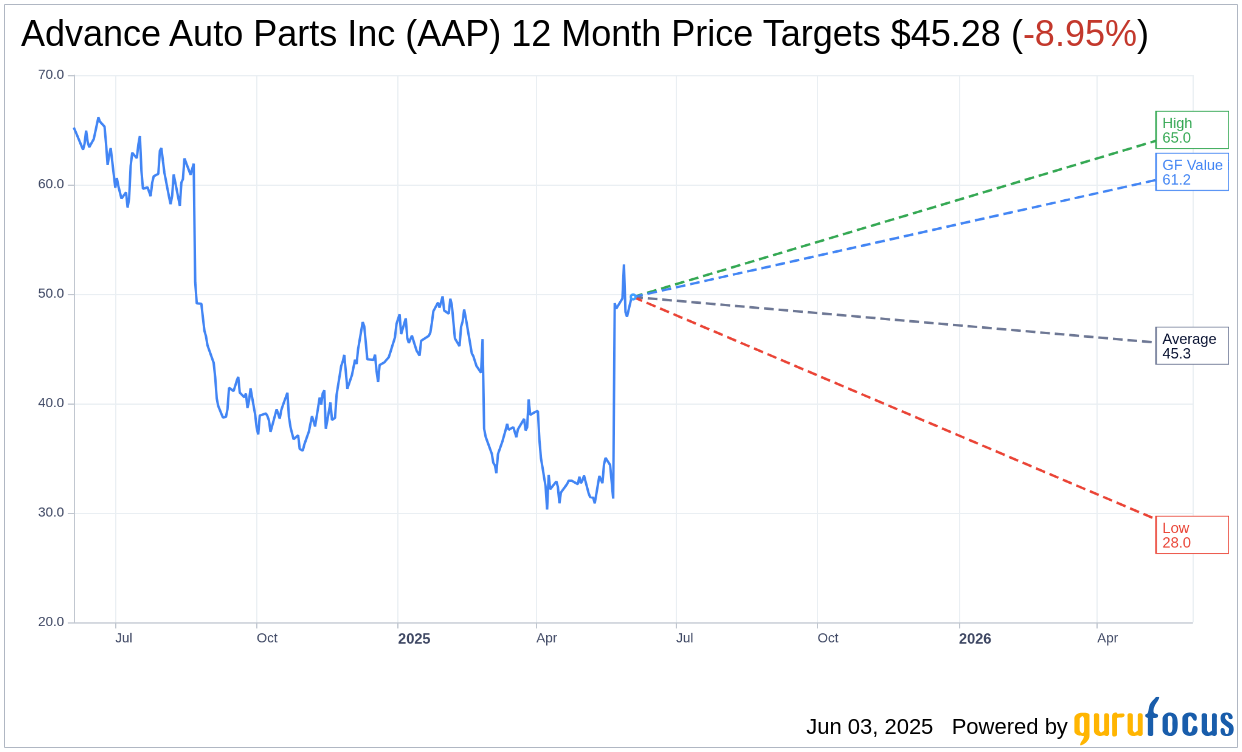

Based on the one-year price targets offered by 18 analysts, the average target price for Advance Auto Parts Inc (AAP, Financial) is $45.28 with a high estimate of $65.00 and a low estimate of $28.00. The average target implies an downside of 8.95% from the current price of $49.73. More detailed estimate data can be found on the Advance Auto Parts Inc (AAP) Forecast page.

Based on the consensus recommendation from 28 brokerage firms, Advance Auto Parts Inc's (AAP, Financial) average brokerage recommendation is currently 3.1, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Advance Auto Parts Inc (AAP, Financial) in one year is $61.17, suggesting a upside of 23% from the current price of $49.73. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Advance Auto Parts Inc (AAP) Summary page.

AAP Key Business Developments

Release Date: May 22, 2025

- Net Sales: $2.6 billion, a 7% decrease compared to last year.

- Comparable Store Sales: Declined 60 basis points during Q1.

- Gross Profit: $1.11 billion or 42.9% of net sales, with a 50 basis points contraction in gross margin.

- Adjusted Operating Loss: $8 million or negative 30 basis points of net sales.

- Adjusted Diluted Loss Per Share: $0.22 compared to earnings per share of $0.33 in the prior year.

- Free Cash Flow: Negative $198 million compared to negative $49 million in the prior year.

- Store Footprint: More than 4,000 stores, with plans to open over 100 new stores in the next three years.

- Distribution Centers: On track to close 12 DCs this year, with 6 completed to date.

- Pro Business Growth: Grew in the low single-digit range, with eight consecutive weeks of positive comparable sales growth in the US.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Advance Auto Parts Inc (AAP, Financial) reported better-than-expected first-quarter results, with a rebound in demand led by the Pro business.

- The company achieved eight consecutive weeks of positive comparable sales growth in the US Pro segment.

- AAP completed its store footprint optimization program, with 75% of its store footprint now in markets where it holds the number one or two position based on store density.

- The company plans to open more than 100 new stores over the next three years, aiming to capture a share of the $150 billion total addressable market.

- AAP is implementing a new assortment framework to improve parts coverage, which has already shown an estimated uplift of nearly 50 basis points in comparable sales growth in the initial rollout markets.

Negative Points

- Net sales from continuing operations decreased by 7% compared to last year, primarily due to store optimization activities.

- Comparable store sales declined by 60 basis points during the first quarter, excluding closed locations.

- The DIY segment remains challenged, with high weekly volatility and cautious consumer spending impacting sales.

- Gross margin contracted by 50 basis points year-over-year, largely due to liquidation sales related to store optimization.

- The company faces potential challenges from tariffs, with a blended tariff rate of about 30% affecting approximately 40% of sourced products.