Stephens analyst Kyle Joseph has commenced coverage of Upstart (UPST, Financial) with an Equal Weight rating and assigned a price target of $55. While evaluating various stocks within the FinTech sector, Joseph considered factors like limited operational histories and recent capital inflows. Specifically examining Upstart, he expressed caution regarding the company's growth potential compared to the broader market due to its financial focus.

The analyst noted that despite advancements in technology-based underwriting models and increased efficiency, significant market outperformance by Upstart has not been observed. Historically, firms that expand quickly during cycles tend to struggle during broader economic changes, suggesting a cautious outlook for future growth.

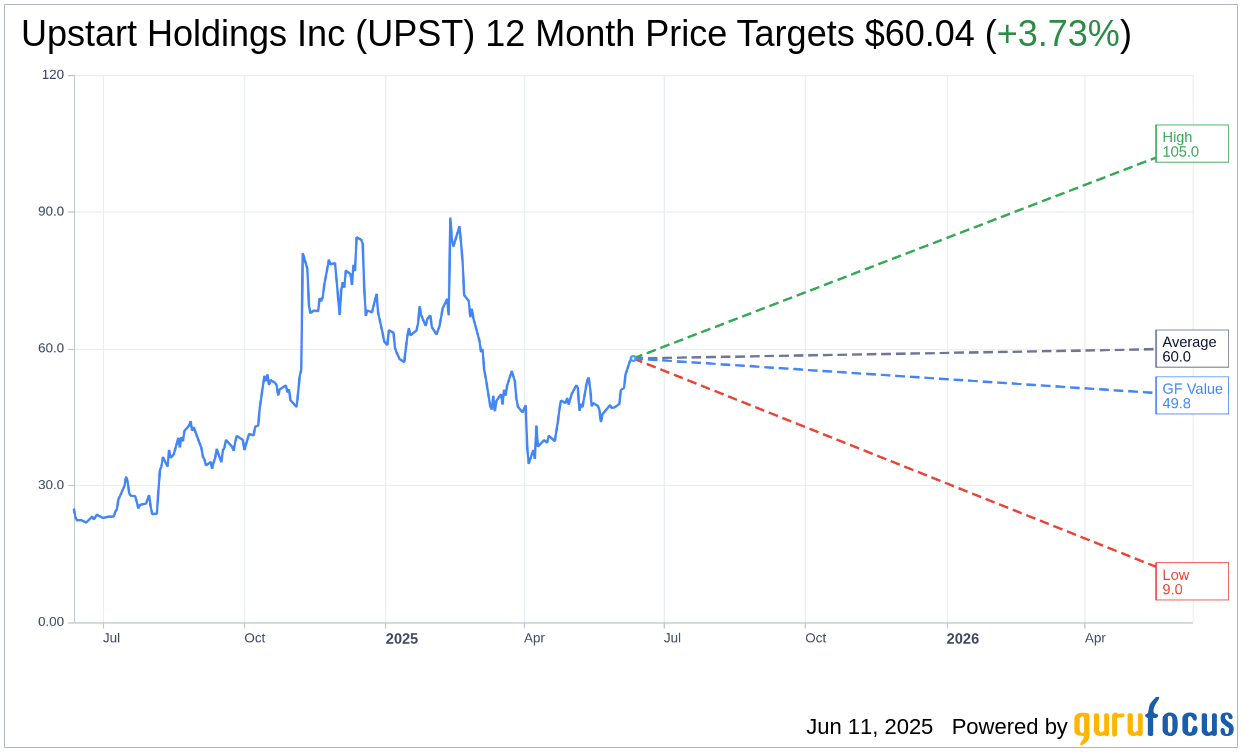

Wall Street Analysts Forecast

Based on the one-year price targets offered by 12 analysts, the average target price for Upstart Holdings Inc (UPST, Financial) is $60.04 with a high estimate of $105.00 and a low estimate of $9.00. The average target implies an upside of 3.73% from the current price of $57.88. More detailed estimate data can be found on the Upstart Holdings Inc (UPST) Forecast page.

Based on the consensus recommendation from 14 brokerage firms, Upstart Holdings Inc's (UPST, Financial) average brokerage recommendation is currently 2.6, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Upstart Holdings Inc (UPST, Financial) in one year is $49.77, suggesting a downside of 14.01% from the current price of $57.88. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Upstart Holdings Inc (UPST) Summary page.

UPST Key Business Developments

Release Date: May 06, 2025

- Revenue: $213 million, up 67% year-on-year.

- Revenue from Fees: $185 million, up 34% year-over-year.

- Net Interest Income: $28 million, exceeding outlook by $13 million.

- Platform Originations: Grew 89% year-on-year.

- Adjusted EBITDA: 20% for the first time in three years.

- GAAP Net Loss: $2 million.

- Adjusted Earnings Per Share: $0.30 based on a diluted weighted average share count of 104 million.

- Loans Held on Balance Sheet: $726 million, down 21% from the prior year.

- Unrestricted Cash: Approximately $600 million, down from $788 million in the prior quarter.

- HELOC Originations: Grew 52% quarter-on-quarter and more than 6x compared to a year ago.

- Auto Lending Originations: Grew 42% sequentially and almost 5x compared to a year ago.

- Small Dollar Product Originations: Grew 7% sequentially and almost tripled year-on-year.

- Contribution Margin: 55% in Q1, down 6 percentage points from the prior quarter.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Platform originations grew 89% year-on-year, indicating strong demand and effective model improvements.

- Revenue increased by 67% year-on-year, with adjusted EBITDA reaching 20% for the first time in three years.

- Home and auto originations showed significant growth, with home originations up 52% and auto up 42% sequentially.

- Upstart achieved a 92% automation rate for loans, enhancing efficiency and borrower experience.

- The company signed a significant partnership with Fortress for committed capital, enhancing funding stability.

Negative Points

- Contribution margin decreased to 55%, down 6 percentage points from the prior quarter, due to lower take rates in prime segments.

- GAAP net loss was reported at $2 million, despite revenue growth.

- The macroeconomic environment remains uncertain, with potential risks from reinflation and trade policies.

- Funding mix remains a challenge, with reliance on committed partnerships due to less reliable securitization markets.

- Take rates are under pressure in the super prime segment due to competitive alternatives, impacting overall margins.