Key Takeaways:

- Simulations Plus (SLP, Financial) shares decrease by over 12% due to a disappointing revenue forecast for Q3 of fiscal 2025.

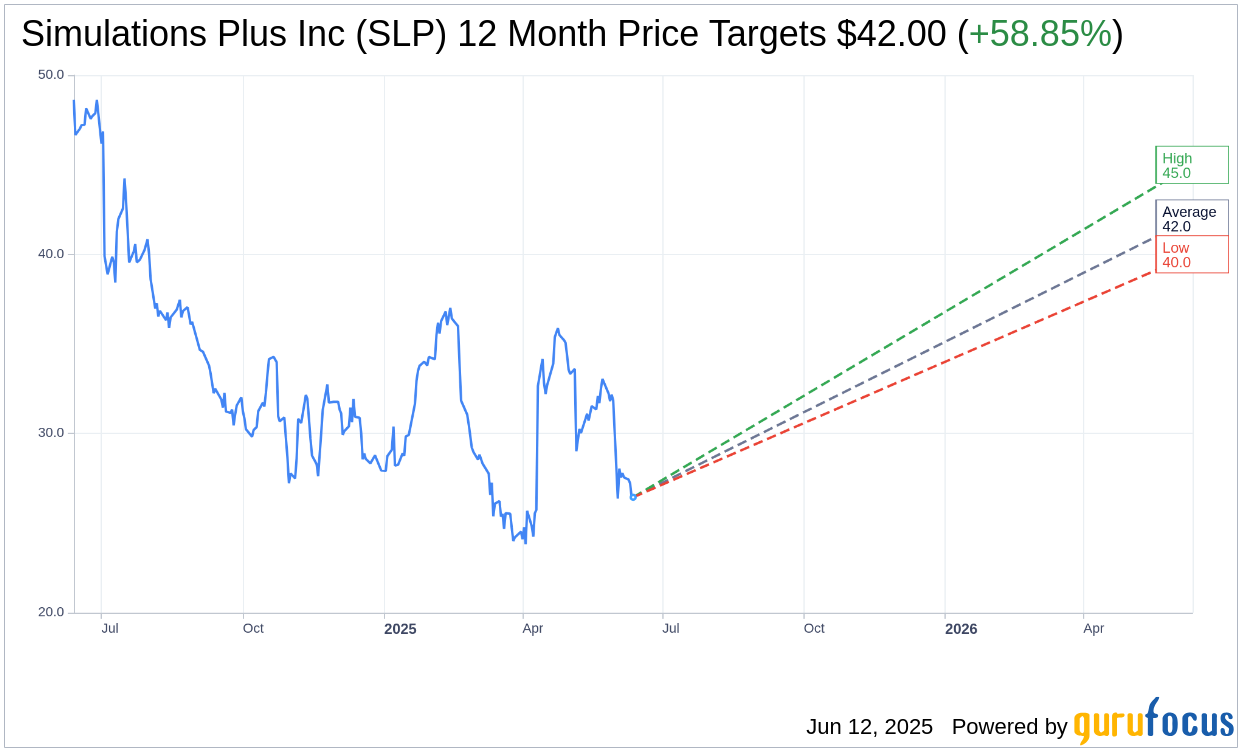

- Analysts project a potential 58.85% upside with an average price target of $42.00.

- The GF Value estimate indicates a substantial potential upside of 178.82% within a year.

Shares of Simulations Plus (SLP) experienced a significant decline of over 12% in premarket trading. This downturn followed the announcement of a lower-than-expected revenue forecast for the third quarter of fiscal 2025, projecting between $19 million and $20 million, falling short of the anticipated $22.83 million. The company's full-year outlook also did not meet expectations, primarily due to current market uncertainties.

Wall Street Analysts Forecast

According to analyses by four analysts, Simulations Plus Inc. (SLP, Financial) is projected to have an average price target of $42.00, with estimates ranging from a high of $45.00 to a low of $40.00. This average target signifies a potential upside of 58.85% from its current trading price of $26.44. For further detailed estimates, visit the Simulations Plus Inc (SLP) Forecast page.

Furthermore, the consensus recommendation from six brokerage firms rates Simulations Plus Inc. (SLP, Financial) at an average of 1.7, classifying it as "Outperform." This rating is part of a scale where 1 represents a Strong Buy and 5 denotes a Sell position.

According to GuruFocus estimates, the GF Value for Simulations Plus Inc. (SLP, Financial) one year from now stands at $73.72, indicating a remarkable upside potential of 178.82% from the current price of $26.44. The GF Value represents GuruFocus's assessment of the stock's fair trading value. This estimation is derived from the historical trading multiples, past business growth, and future performance projections. To delve deeper into the data, explore the Simulations Plus Inc (SLP) Summary page.