Quanterix (QTRX, Financial) has achieved a significant milestone as its HD-X Simoa Immunoassay Analyzer was granted Class 1 Medical Device status by South Korea's Ministry of Food and Drug Safety, facilitated by its distributor, HS Biosystems. This development is part of Quanterix's broader strategy to enhance Alzheimer's disease testing through strategic partnerships worldwide.

The company has teamed up with ARUP Laboratories, which has introduced a blood test for phosphorylated tau 217. This test is designed to help determine if symptoms of cognitive decline in individuals over 60 are due to Alzheimer's disease. The test will utilize Quanterix's SP-X platform with their Simoa assay kit, employing P-tau217 antibodies from Eli Lilly.

Additionally, Quanterix's technology plays a pivotal role in Neurogen Biomarking’s initiative, offering an at-home blood biomarker test for Alzheimer's. This innovative test identifies phosphorylated tau 217, crucial for understanding Alzheimer's pathology and mild cognitive impairment (MCI). Further, NSW Health Pathology in Australia has confirmed the use of NfL for patient assessments, showcasing Quanterix's expanding influence in Alzheimer's diagnostics.

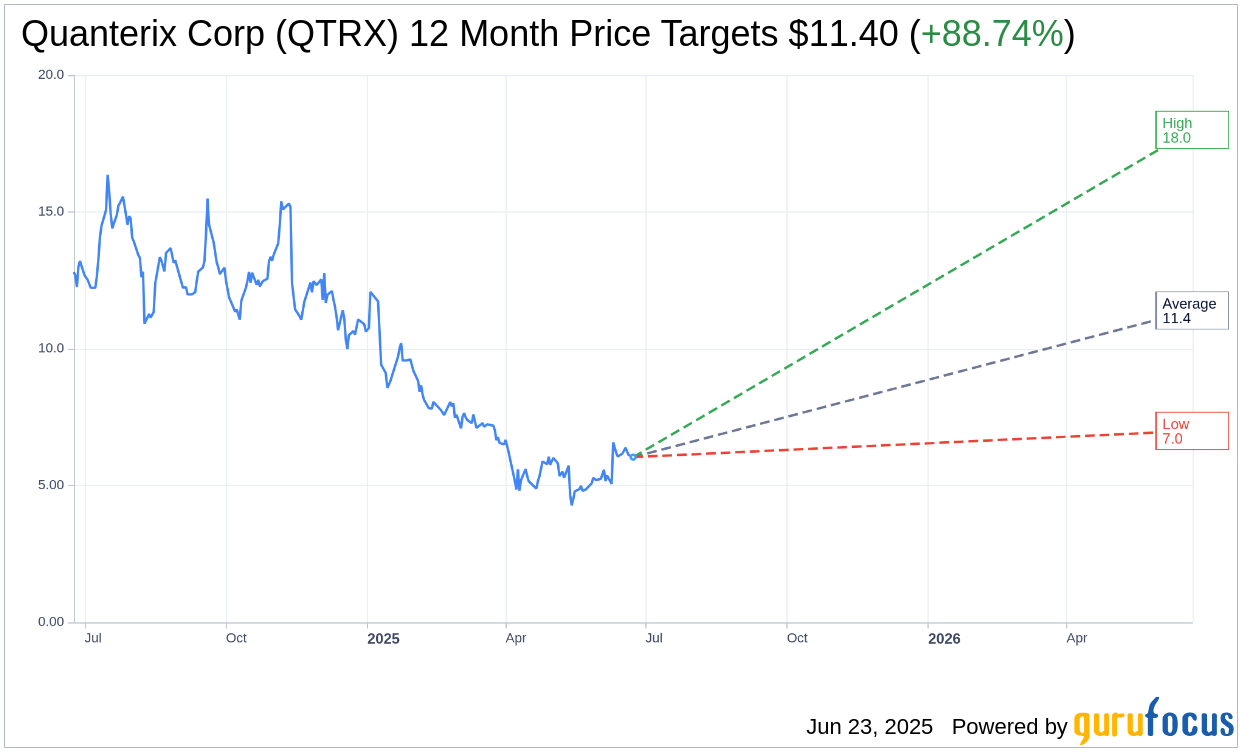

Wall Street Analysts Forecast

Based on the one-year price targets offered by 5 analysts, the average target price for Quanterix Corp (QTRX, Financial) is $11.40 with a high estimate of $18.00 and a low estimate of $7.00. The average target implies an upside of 88.74% from the current price of $6.04. More detailed estimate data can be found on the Quanterix Corp (QTRX) Forecast page.

Based on the consensus recommendation from 5 brokerage firms, Quanterix Corp's (QTRX, Financial) average brokerage recommendation is currently 2.4, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Quanterix Corp (QTRX, Financial) in one year is $15.60, suggesting a upside of 158.28% from the current price of $6.04. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Quanterix Corp (QTRX) Summary page.

QTRX Key Business Developments

Release Date: May 12, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Quanterix Corp (QTRX, Financial) exceeded expectations in Q1 2025, showcasing resilience in its instruments and consumables business.

- The company reported its highest consumables quarter, with consumables revenue up 6% year-over-year.

- Quanterix Corp (QTRX) is committed to achieving positive cash flow by 2026, supported by a strong balance sheet.

- The pending merger with EOA Biosciences is expected to enhance Quanterix Corp (QTRX)'s market position, with significant synergies anticipated.

- The launch of Samoa One platform is on track, promising to deliver up to 10x the sensitivity of existing systems, which could set a new standard in the field.

Negative Points

- Total revenue for Q1 2025 decreased by 5% compared to the prior year, indicating some challenges in revenue growth.

- Accelerator lab revenue declined by 36%, primarily due to a decrease in large multi-million dollar projects from pharma customers.

- The company revised its full-year 2025 revenue guidance downwards, citing pressures from academic funding and biopharma spending.

- There is a noted pressure on instrument sales, with expectations for them to remain flat compared to 2024.

- The market environment is challenging, with concerns around academic funding, biopharma spending, and tariffs impacting the company's outlook.