In a recent meeting held in Warsaw, Poland, Internet Media Analyst Barton Crockett engaged with Vice President Grodd to discuss strategic developments at ROKU. This meeting, hosted by Rosenblatt, aimed to offer insights into the company's current and future performance. Investors are keen on understanding ROKU's market strategies and competitive positioning in the fast-evolving media landscape.

The event provided a platform for detailed discussions around ROKU's operational and financial strategies. As the company continues to innovate its offerings, market watchers are particularly interested in how ROKU plans to maintain resilience and capitalize on potential undervaluation opportunities. Such insights are invaluable for investors aiming to make informed decisions regarding their portfolios.

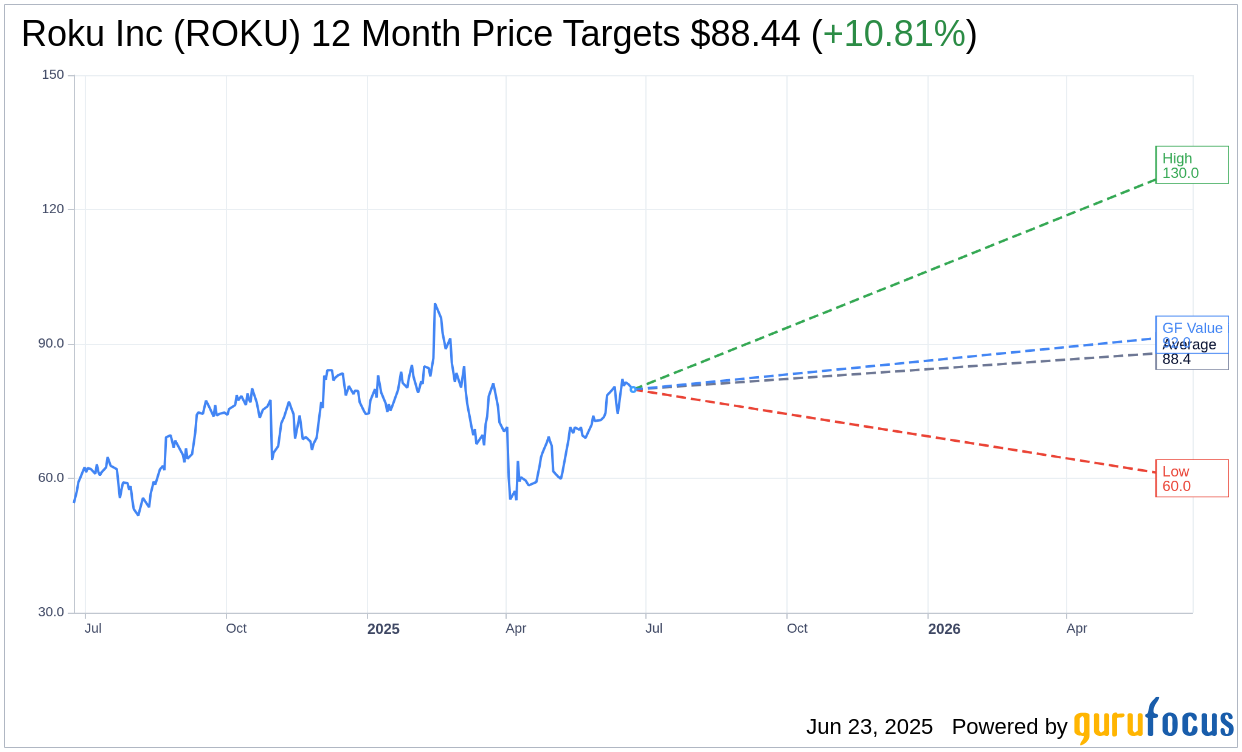

Wall Street Analysts Forecast

Based on the one-year price targets offered by 27 analysts, the average target price for Roku Inc (ROKU, Financial) is $88.44 with a high estimate of $130.00 and a low estimate of $60.00. The average target implies an upside of 10.81% from the current price of $79.81. More detailed estimate data can be found on the Roku Inc (ROKU) Forecast page.

Based on the consensus recommendation from 33 brokerage firms, Roku Inc's (ROKU, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Roku Inc (ROKU, Financial) in one year is $92.05, suggesting a upside of 15.34% from the current price of $79.81. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Roku Inc (ROKU) Summary page.

ROKU Key Business Developments

Release Date: May 01, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Roku Inc (ROKU, Financial) reaffirmed its platform revenue and adjusted EBITDA outlook for the full year 2025, showcasing confidence in its business strategy despite macroeconomic uncertainties.

- The shift to streaming continues to be a significant secular trend, positioning Roku Inc (ROKU) at the center of this transition, which is beneficial for its business growth.

- Roku Inc (ROKU) has diversified its revenue streams, reducing reliance on media and entertainment, and expanding its ad products and demand sources.

- The Roku Channel has become the number 2 app on the platform in the US, with global engagement growing 84% year-over-year, highlighting its increasing popularity and reach.

- Roku Inc (ROKU) announced the acquisition of Frndly, a subscription service, which is expected to be adjusted EBITDA margin accretive in its first full year, enhancing its subscription revenue.

Negative Points

- There is macroeconomic uncertainty, including potential impacts from tariffs, which could affect the overall market environment and Roku Inc (ROKU)'s operations.

- The shift from guaranteed to non-guaranteed advertising has a modest impact on margins within the advertising and platform segment.

- Device revenue is expected to be flat for the year, and the company is not focused on device revenue growth, which could be seen as a lack of emphasis on hardware sales.

- The transition to programmatic advertising, while beneficial, involves some cannibalization of direct sales, which could impact revenue streams.

- Roku Inc (ROKU) faces challenges in maintaining growth rates in the face of tough comparisons from previous years, particularly in the fourth quarter.