On June 30, 2025, WCM Investment Management, LLC executed a substantial reduction in its holdings of Icon PLC, a global contract research organization. The firm decreased its position by 6,189,725 shares, marking a 96.87% reduction in its stake. This transaction reflects a strategic decision by the firm, impacting both its portfolio and the market perception of Icon PLC. The shares were traded at a price of $145.45, resulting in a portfolio impact of -2.31%. Post-transaction, WCM Investment Management, LLC retains 199,946 shares, which now constitute 0.08% of its portfolio and 0.25% of Icon PLC's total shares.

WCM Investment Management, LLC: A Profile

WCM Investment Management, LLC is a prominent investment firm headquartered in Laguna Beach, California. The firm manages an equity portfolio valued at $38.91 billion, with a strategic focus on the technology and financial services sectors. Known for its disciplined investment philosophy, the firm holds top positions in companies such as ICICI Bank Ltd (IBN, Financial), Taiwan Semiconductor Manufacturing Co Ltd (TSM, Financial), Sea Ltd (SE, Financial), Spotify Technology SA (SPOT, Financial), and AppLovin Corp (APP, Financial). This diverse portfolio underscores the firm's commitment to identifying growth opportunities across various industries.

Icon PLC: An Overview

Icon PLC, headquartered in Ireland, is a leading global contract research organization specializing in drug development and clinical trial services. With a market capitalization of $12.05 billion, the company is considered significantly undervalued, boasting a GF Value of $247.67. Icon PLC provides outsourced development services to pharmaceutical, biotechnology, and medical-device firms, with the majority of its revenue derived from clinical research. The company's current stock price is $151.58, reflecting a 4.21% gain since the transaction.

Financial Metrics and Valuation of Icon PLC

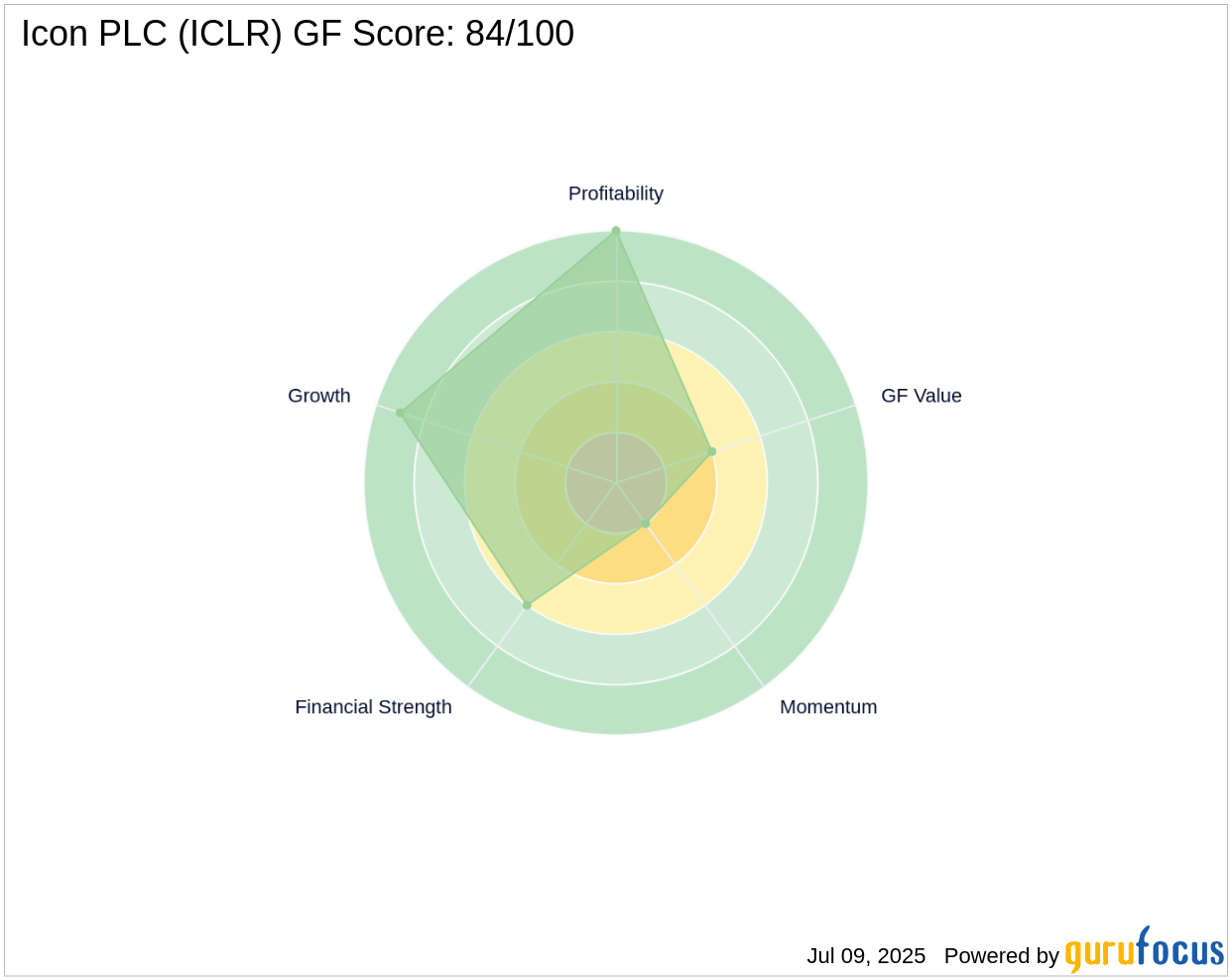

Icon PLC exhibits a price-to-earnings ratio of 16.51 and a GF Score of 84/100, indicating good outperformance potential. The stock is trading at a significant discount to its intrinsic value, with a GF Value Rank of 4/10. Despite a year-to-date price change of -28.71%, the company's strong profitability and growth metrics, including a Profitability Rank of 10/10 and a Growth Rank of 9/10, highlight its potential for future success.

Performance and Growth Indicators

Icon PLC has demonstrated robust financial performance, with an EBITDA growth of 29.30% over the past three years. The company's Operating Margin growth, however, has seen a slight decline of -1.90%. Despite this, Icon PLC maintains a strong Financial Strength with a Z Score of 1.94 and an interest coverage ratio of 5.59. The company's Piotroski F-Score of 8 further underscores its financial health and operational efficiency.

Other Notable Investors in Icon PLC

In addition to WCM Investment Management, LLC, Icon PLC has attracted investments from other prominent figures in the investment community. Notable investors include Ron Baron (Trades, Portfolio), Seth Klarman (Trades, Portfolio), and Glenn Greenberg (Trades, Portfolio). Ruane, Cunniff & Goldfarb L.P. holds the largest share percentage among the gurus invested in Icon PLC, highlighting the company's appeal to seasoned investors.

Transaction Analysis

The significant reduction in WCM Investment Management, LLC's stake in Icon PLC suggests a strategic reallocation of resources within its portfolio. This move may reflect the firm's assessment of market conditions or a shift in investment priorities. Despite the reduction, Icon PLC's strong financial metrics and growth potential continue to make it an attractive investment opportunity for other market participants. The transaction's impact on the firm's portfolio is notable, with a -2.31% change, yet the remaining shares still represent a meaningful position in Icon PLC.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

Also check out: