On July 14, 2025, Simulations Plus Inc (SLP, Financial) released its 8-K filing detailing its financial performance for the third quarter of fiscal 2025, which ended on May 31, 2025. The company, a leader in the software industry, specializes in developing software for pharmaceutical research and providing consulting services to the pharmaceutical sector. Simulations Plus operates through two main segments: Software and Services, with the majority of its revenue generated from the software segment, primarily in the USA, followed by EMEA and Asia Pacific.

Performance Overview and Challenges

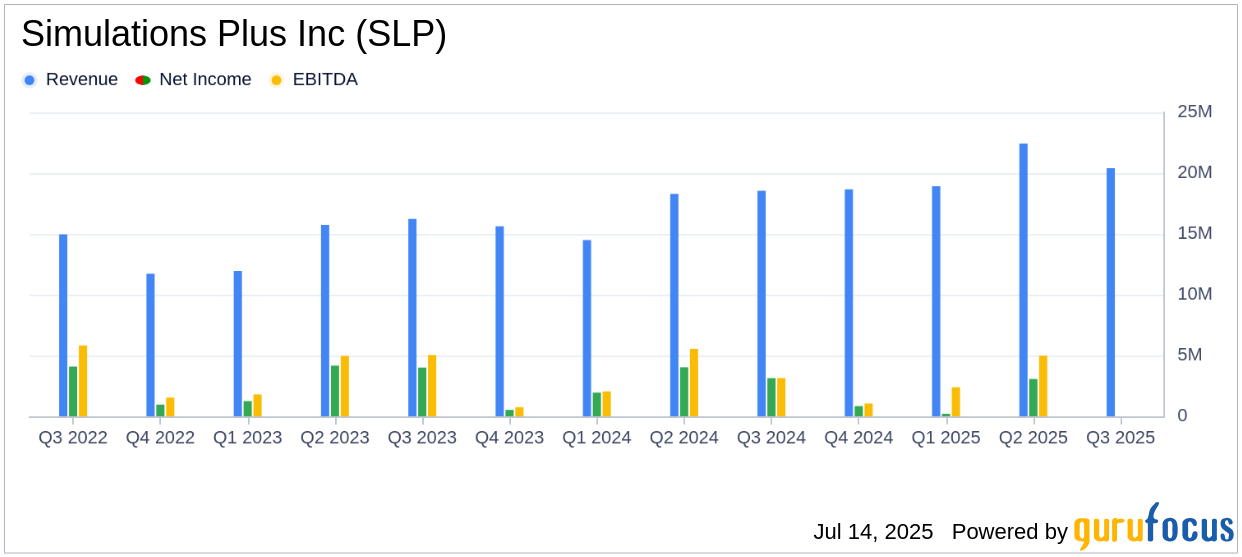

Simulations Plus Inc reported a 10% increase in total revenue to $20.4 million for the third quarter of fiscal 2025, compared to the same period in 2024. This growth was driven by a 6% increase in software revenue to $12.6 million and a 17% rise in services revenue to $7.7 million. Despite these gains, the company faced significant challenges, including a net loss of $67.3 million and a diluted loss per share of $3.35, primarily due to a non-cash impairment charge of $77.2 million. This charge was necessary to align the book value of assets with their current market value, reflecting a strategic reorganization aimed at enhancing operational efficiency.

Financial Achievements and Industry Impact

Despite the reported net loss, Simulations Plus achieved an adjusted EBITDA of $7.4 million, representing 37% of total revenue, up from $5.6 million or 30% of total revenue in the previous year. The adjusted net income was $9.0 million, with an adjusted diluted EPS of $0.45, surpassing the analyst estimate of $0.07. These achievements underscore the company's resilience and ability to generate substantial cash flow, which is crucial for sustaining growth and innovation in the competitive healthcare software industry.

Key Financial Metrics

Simulations Plus reported a gross profit of $13.0 million with a gross margin of 64%. The company's balance sheet showed total assets of $134.4 million, with cash and cash equivalents amounting to $26.95 million. The company's strategic focus on AI-driven initiatives and operational restructuring is expected to enhance its competitive edge in the biosimulation market.

“In the third quarter, our revenue grew by 10% in line with our preliminary revenue,” said Shawn O’Connor, Chief Executive Officer of Simulations Plus. “Our software revenue continued to perform well, increasing 6%, mainly driven by our ADMET Predictor® software and modest growth in our GastroPlus® and MonolixSuiteTM software, partially offset by a decline in our QSP/QST biosimulations software.”

Analysis and Future Outlook

Simulations Plus's performance in the third quarter highlights both its strengths and challenges. The company's ability to grow its software and services revenue despite macroeconomic pressures is commendable. However, the significant impairment charge and net loss indicate areas that require strategic attention. The company's updated full-year revenue guidance of $76 to $80 million and adjusted diluted EPS of $0.93 to $1.06 reflects cautious optimism. As Simulations Plus continues to innovate and streamline operations, its focus on AI-driven solutions is likely to bolster its market position and drive long-term growth.

Explore the complete 8-K earnings release (here) from Simulations Plus Inc for further details.