Climb Channel Solutions, part of Climb Global Solutions (CLMB, Financial), has announced an enhancement to its offerings by incorporating SiteDocs into its Bluebeam portfolio. This initiative emphasizes Climb’s dedication to providing innovative solutions that enhance productivity, safety, and efficiency for the architecture, engineering, and construction sectors. The addition of SiteDocs aims to further solidify Bluebeam’s partnership with Climb Channel Solutions, marking an important step in their ongoing mission to offer industry-leading solutions to the construction market.

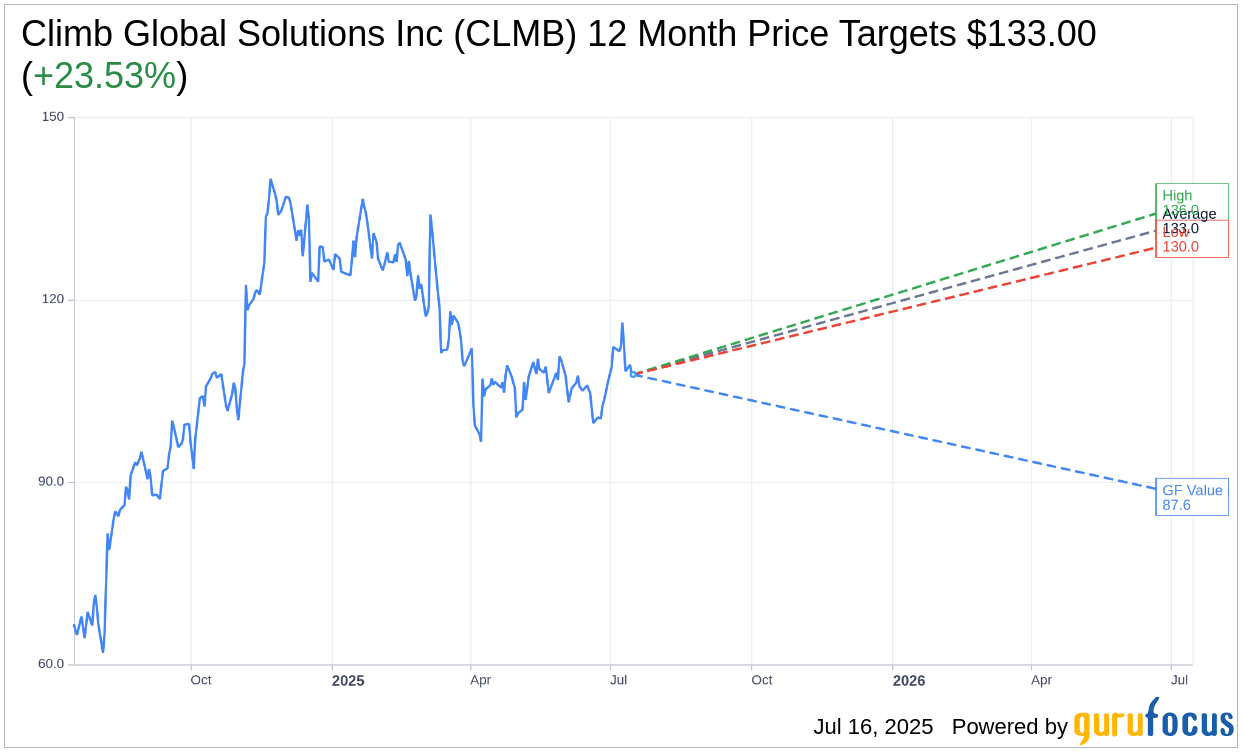

Wall Street Analysts Forecast

Based on the one-year price targets offered by 2 analysts, the average target price for Climb Global Solutions Inc (CLMB, Financial) is $133.00 with a high estimate of $136.00 and a low estimate of $130.00. The average target implies an upside of 23.53% from the current price of $107.67. More detailed estimate data can be found on the Climb Global Solutions Inc (CLMB) Forecast page.

Based on the consensus recommendation from 2 brokerage firms, Climb Global Solutions Inc's (CLMB, Financial) average brokerage recommendation is currently 1.5, indicating "Buy" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Climb Global Solutions Inc (CLMB, Financial) in one year is $87.56, suggesting a downside of 18.68% from the current price of $107.67. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Climb Global Solutions Inc (CLMB) Summary page.

CLMB Key Business Developments

Release Date: May 01, 2025

- Gross Billings: Increased 34% to $474.6 million compared to $355.3 million in the prior year quarter.

- Distribution Segment Gross Billings: Increased 36% to $453.6 million.

- Solution Segment Gross Billings: Increased 2% to $21 million.

- Net Sales: Increased 49% to $138 million compared to $92.4 million.

- Gross Profit: Increased 37% to $23.4 million compared to $17 million.

- Gross Profit Margin: Increased to 4.9% from 4.8% in the prior year quarter.

- SG&A Expenses: $16.8 million compared to $12.5 million, with DSS accounting for $1.1 million of the increase.

- Net Income: Increased 35% to $3.7 million or $0.81 per diluted share compared to $2.7 million or $0.60 per diluted share.

- Income Tax Expense: Decreased 37% to $600,000 with an effective tax rate of 13.3%.

- Adjusted Net Income: Increased 39% to $3.9 million or $0.86 per diluted share.

- Adjusted EBITDA: Increased 38% to $7.6 million compared to $5.5 million.

- Adjusted EBITDA Margin: Increased to 32.7% from 32.5%.

- Cash and Cash Equivalents: $32.5 million as of March 31, 2025.

- Outstanding Debt: $600,000 with no borrowings under the $50 million revolving credit facility.

- Quarterly Dividend: $0.17 per share declared, payable on May 16, 2025.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Climb Global Solutions Inc (CLMB, Financial) reported a 34% increase in gross billings for Q1 2025, reaching $474.6 million compared to the previous year.

- Net sales increased by 49% to $138 million, driven by organic growth and contributions from the acquisition of DSS.

- The company signed a significant contract with Darktrace, a cybersecurity firm, which has already generated a $30 million pipeline in potential gross bills.

- Climb Global Solutions Inc (CLMB) is making progress with its new ERP system, improving efficiency and transactional speed across global operations.

- The company declared a quarterly dividend of $0.17 per share, reflecting confidence in its financial health and commitment to returning value to shareholders.

Negative Points

- SG&A expenses increased to $16.8 million from $12.5 million, with DSS accounting for $1.1 million of the increase.

- The company faces challenges in filling the gap left by the loss of Citrix as a vendor, although mitigations are underway.

- Despite growth, the company acknowledges that some vendor relationships, like with Darktrace, take a long time to develop and execute.

- The economic environment remains uncertain, and while tariffs have not significantly impacted the company yet, they remain a potential risk.

- The integration of acquired companies into the ERP system has been a complex process, though it is now largely complete.