In a recent update, Karyopharm Therapeutics (KPTI, Financial) has received a downgrade from HC Wainwright & Co. The firm's analyst, Robert Burns, has adjusted the rating from a 'Buy' to a 'Neutral' as of July 16, 2025. This change reflects a shift in the assessment of the company's future performance in the market.

It is important to note that this downgrade does not come with a revised price target, as HC Wainwright & Co. did not provide any projected price points. The stock's latest rating adjustment places KPTI under a 'Neutral' status, indicating a more cautious outlook compared to the previously held 'Buy' recommendation.

Investors tracking Karyopharm Therapeutics (KPTI, Financial) should consider this update in their assessments, as analyst ratings can often influence market perceptions and stock performance. This development comes amid a dynamic period for KPTI, as the company continues to navigate the challenges and opportunities within its sector.

Wall Street Analysts Forecast

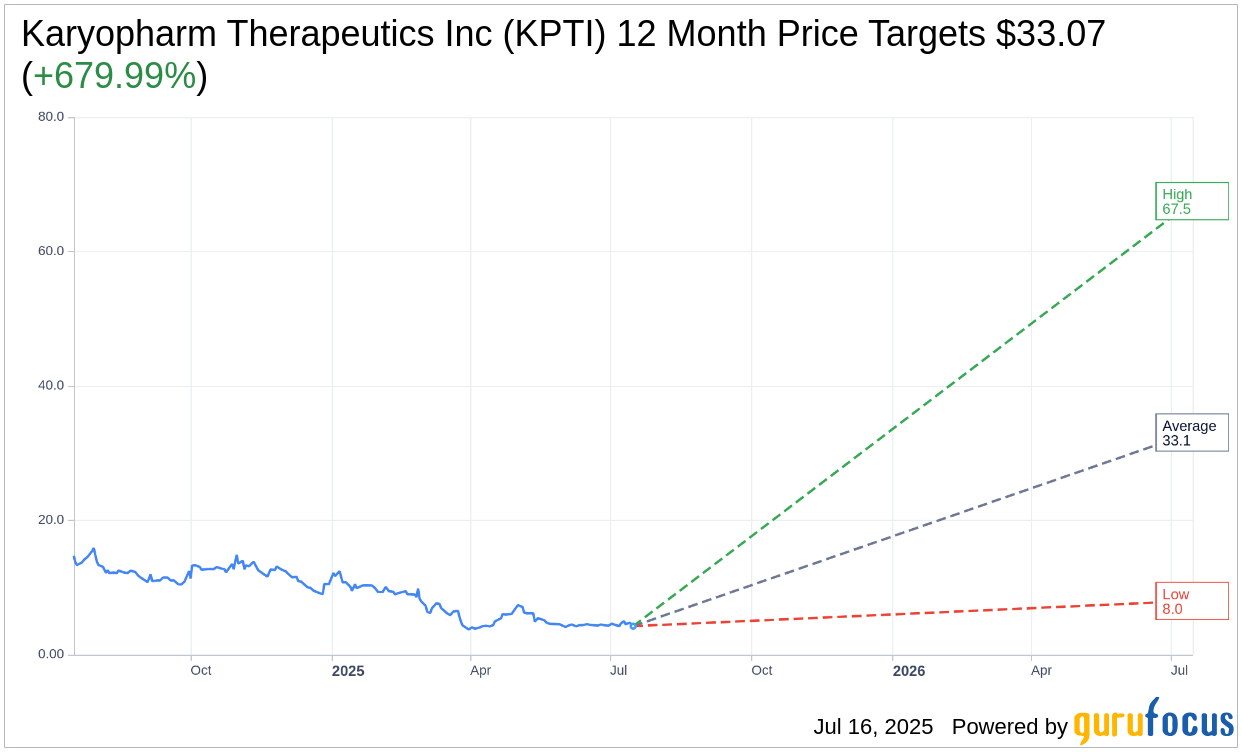

Based on the one-year price targets offered by 7 analysts, the average target price for Karyopharm Therapeutics Inc (KPTI, Financial) is $33.07 with a high estimate of $67.50 and a low estimate of $8.00. The average target implies an upside of 679.99% from the current price of $4.24. More detailed estimate data can be found on the Karyopharm Therapeutics Inc (KPTI) Forecast page.

Based on the consensus recommendation from 7 brokerage firms, Karyopharm Therapeutics Inc's (KPTI, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Karyopharm Therapeutics Inc (KPTI, Financial) in one year is $16.84, suggesting a upside of 297.17% from the current price of $4.24. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Karyopharm Therapeutics Inc (KPTI) Summary page.