Stifel analyst Nathan Jones has increased the price target for Badger Meter (BMI, Financial) from $230 to $233 while maintaining a Hold rating on the stock. This adjustment follows recent discussions with the company's management and positive channel checks, which suggest that demand remains robust and stable. Jones anticipates that this stable demand could prompt several companies to consider raising their guidance in the upcoming Q2 earnings calls. These insights are shared as part of a preview for the Diversified Industrials group.

Wall Street Analysts Forecast

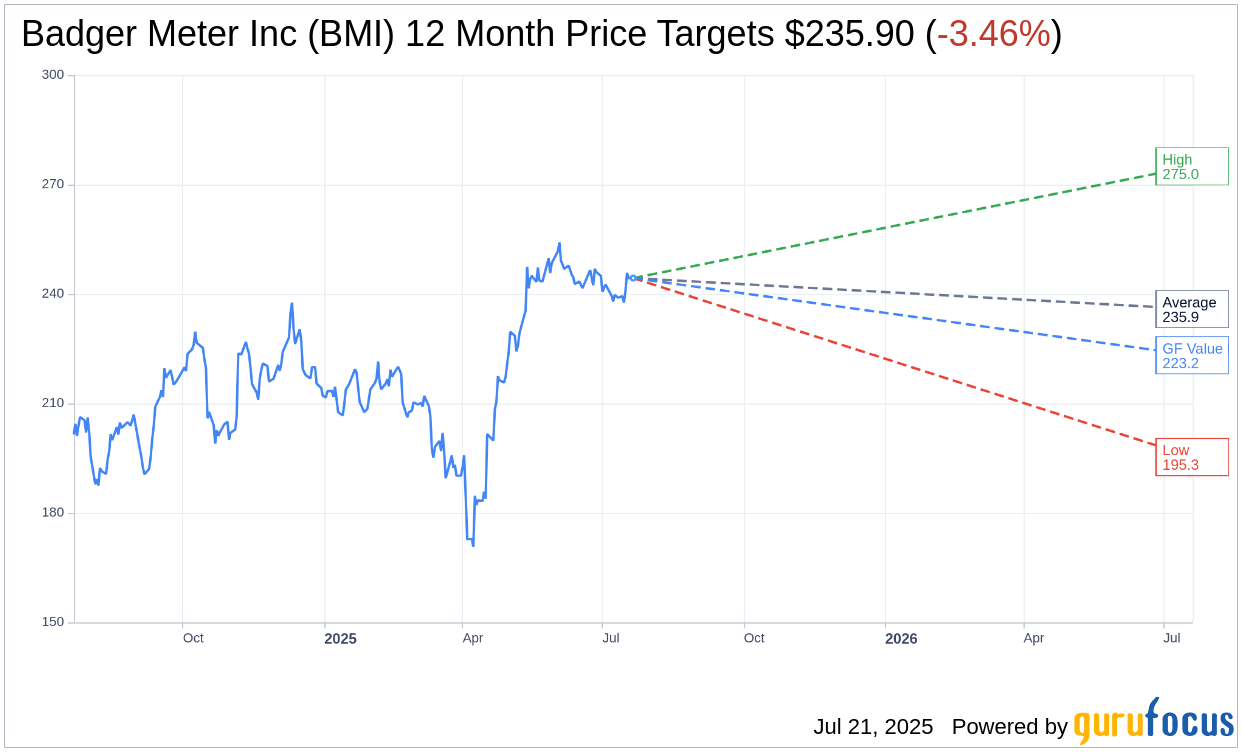

Based on the one-year price targets offered by 7 analysts, the average target price for Badger Meter Inc (BMI, Financial) is $235.90 with a high estimate of $275.00 and a low estimate of $195.32. The average target implies an downside of 3.46% from the current price of $244.37. More detailed estimate data can be found on the Badger Meter Inc (BMI) Forecast page.

Based on the consensus recommendation from 10 brokerage firms, Badger Meter Inc's (BMI, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Badger Meter Inc (BMI, Financial) in one year is $223.23, suggesting a downside of 8.65% from the current price of $244.37. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Badger Meter Inc (BMI) Summary page.