First BanCorp (FBP, Financial) achieved noteworthy financial results in the second quarter, reflecting solid company fundamentals and strategic management. The company reported a Common Equity Tier 1 (CET1) capital ratio of 16.61% and a tangible book value per share of $11.16. Additionally, net charge-offs for the period were at 0.60%.

Key financial metrics indicate robust performance, with earnings per share and pre-tax pre-provision income both increasing by 9% from the same quarter last year. Return on average assets stood at 1.69%, driven by record net interest income, a strong loan production pipeline, stable credit conditions, and effective expense management. The firm maintained an efficiency ratio in the top quartile at 50%, underscoring its operational efficiency and profitability.

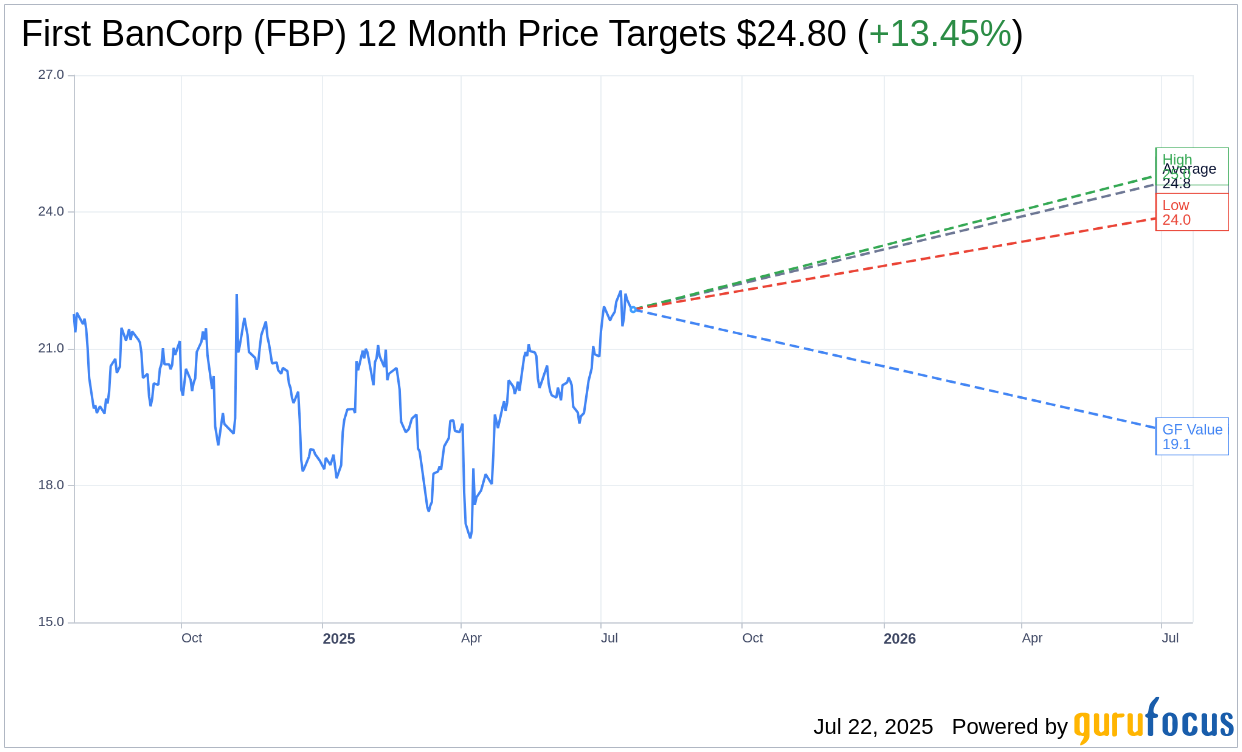

Wall Street Analysts Forecast

Based on the one-year price targets offered by 5 analysts, the average target price for First BanCorp (FBP, Financial) is $24.80 with a high estimate of $25.00 and a low estimate of $24.00. The average target implies an upside of 13.45% from the current price of $21.86. More detailed estimate data can be found on the First BanCorp (FBP) Forecast page.

Based on the consensus recommendation from 5 brokerage firms, First BanCorp's (FBP, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for First BanCorp (FBP, Financial) in one year is $19.08, suggesting a downside of 12.72% from the current price of $21.86. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the First BanCorp (FBP) Summary page.