An analyst from Barclays, Terry Ma, has adjusted the price target for Synchrony (SYF, Financial) stock down to $80 from the previous $81, while maintaining an Overweight rating. This update comes after the company released its second-quarter earnings report. Despite the slight target reduction, optimism remains concerning Synchrony's future, especially with its renewed partnership with Amazon, including the addition of "buy now, pay later" options, and the upcoming launch of services with Walmart later this year.

The analyst anticipates that these strategic moves will drive loan growth for Synchrony in the years 2026 and 2027. Additionally, the firm expects the company to maintain its positive credit trends, highlighting a promising outlook for the financial services provider.

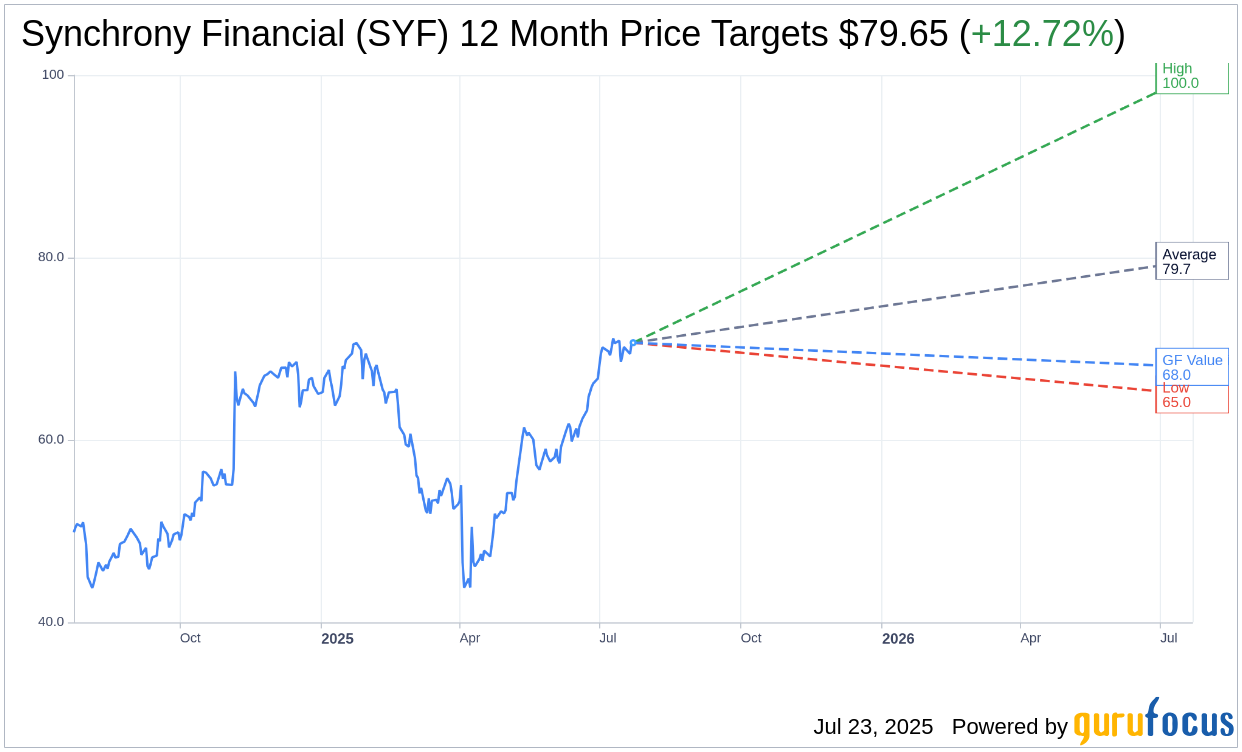

Wall Street Analysts Forecast

Based on the one-year price targets offered by 20 analysts, the average target price for Synchrony Financial (SYF, Financial) is $79.65 with a high estimate of $100.00 and a low estimate of $65.00. The average target implies an upside of 12.72% from the current price of $70.66. More detailed estimate data can be found on the Synchrony Financial (SYF) Forecast page.

Based on the consensus recommendation from 22 brokerage firms, Synchrony Financial's (SYF, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Synchrony Financial (SYF, Financial) in one year is $68.02, suggesting a downside of 3.74% from the current price of $70.66. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Synchrony Financial (SYF) Summary page.

SYF Key Business Developments

Release Date: July 22, 2025

- Net Earnings: $967 million or $2.50 per diluted share.

- Return on Average Assets: 3.2%.

- Return on Tangible Common Equity: 28.3%.

- Purchase Volume: $46 billion, with dual and co-branded cards accounting for 45%.

- Net Revenue: Decreased 2% to $3.6 billion.

- Net Interest Income: Increased 3% to $4.5 million.

- Net Interest Margin: Increased 32 basis points to 14.78%.

- Provision for Credit Losses: Decreased $545 million to $1.1 billion.

- 30-plus Delinquency Rate: 4.18%, a decrease of 29 basis points from the prior year.

- Net Charge-off Rate: 5.70%, a decrease of 72 basis points from the prior year.

- Allowance for Credit Losses: 10.59% of loan receivables.

- Deposits: Decreased by approximately $310 million.

- CET1 Ratio: 13.6%, 100 basis points higher than last year.

- Shareholder Returns: $614 million, including $500 million in share repurchases and $114 million in dividends.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Synchrony Financial (SYF, Financial) reported strong financial performance with net earnings of $967 million or $2.50 per diluted share.

- The company achieved a return on average assets of 3.2% and a return on tangible common equity of 28.3%.

- Synchrony Financial (SYF) added or renewed more than 15 partners, including Walmart and Amazon, enhancing its strategic partnerships.

- The company launched new products with two of its top 5 partners and announced a new partnership with a previous top 5 partner.

- Synchrony Financial (SYF) is investing in technology and innovation, including a new partnership with OnePay to launch a credit card program with Walmart.

Negative Points

- Purchase volume decreased by 2% year-over-year, reflecting the impact of previous credit actions and selective consumer spending behavior.

- Ending loan receivables decreased by 2% to $100 billion due to lower purchase volume and higher payment rates.

- Net revenue decreased by 2% to $3.6 billion, primarily due to higher RSAs driven by program performance.

- The payment rate increased, impacting the mix of promotional financing loan receivables, which generally carry a lower payment rate.

- Synchrony Financial (SYF) faces an uncertain macroeconomic environment, which could impact future growth and performance.