Steven Scruggs (Trades, Portfolio), who manages the FPA Queens Road Small Cap Value Fund, disclosed its second-quarter portfolio earlier this week.

The guru’s Charlotte, North Carolina-based fund announced last year that First Pacific Advisors (Trades, Portfolio), which is headquartered in Los Angeles, would become its investment advisor starting in November 2020.

In pursuit of long-term capital appreciation, the fund applies a fundamental, bottom-up research process to invest in a diversified portfolio of small-cap companies. The stock picking strategy stems from Benjamin Graham’s principles of finding companies that trade at a discount to intrinsic value.

Keeping these considerations in mind, Scruggs revealed the fund established three new positions, sold out of two stocks and added to or reduced a number of other existing holdings during the three months ended May 31. The most significant trades included increases to the Servisfirst Bancshares Inc. (SFBS, Financial), CNO Financial Group Inc. (CNO, Financial), American Equity Investment Life Holding Co. (AEL, Financial) and South Jersey Industries Inc. (SJI, Financial) positions as well as a decrease in the Graphic Packaging Holding Co. (GPK, Financial) investment.

Servisfirst Bancshares

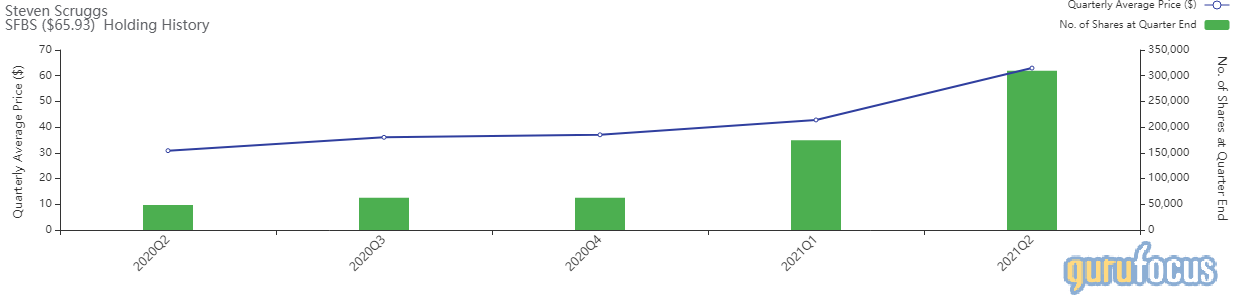

The guru boosted the Servisfirst Bancshares (SFBS, Financial) holding by 77.56%, investing in 135,343 shares. The stock traded for an average price of $62.97 per share during the quarter.

He now holds 309,845 shares total, which account for 5.19% of the equity portfolio and is his largest holding. GuruFocus estimates Scruggs has gained 33.4% on the investment since establishing it in the second quarter of 2020.

The Birmingham, Alabama-based bank holding company has a $3.6 billion market cap; its shares were trading around $66.73 on Thursday with a price-earnings ratio of 19.3, a price-book ratio of 3.49 and a price-sales ratio of 9.36.

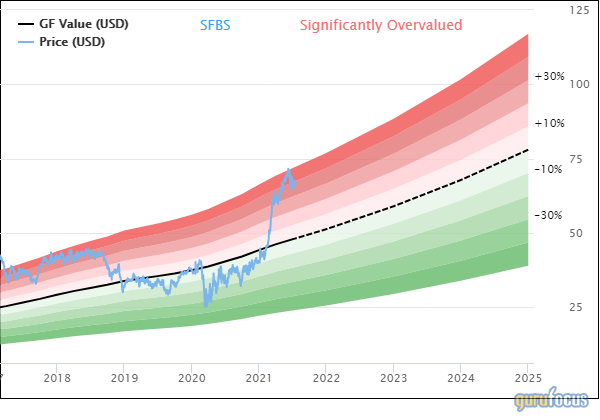

The GF Value Line suggests the stock is significantly overvalued currently based on its historical ratios, past performance and future earnings projections.

GuruFocus rated Servisfirst’s financial strength 4 out of 10 despite having a comfortable level of interest coverage and healthy debt-related ratios compared to other banks.

The company’s profitability fared better with a 6 out of 10 rating, boosted by margins and returns on equity and assets that outperform a majority of competitors. Servisfirst also has a high Piotroski F-Score of 7, indicating its operations are healthy. Consistent earnings and revenue growth also contributed to a predictability rank of five out of five stars. According to GuruFocus, companies with this rank return an average of 12.1% annually over a 10-year period.

Of the gurus invested in Servisfirst, Scruggs has the largest holding with 0.57% of outstanding shares. The FPA Capital Fund (Trades, Portfolio), Ken Fisher (Trades, Portfolio) and Mario Gabelli (Trades, Portfolio) also own the stock.

CNO Financial Group

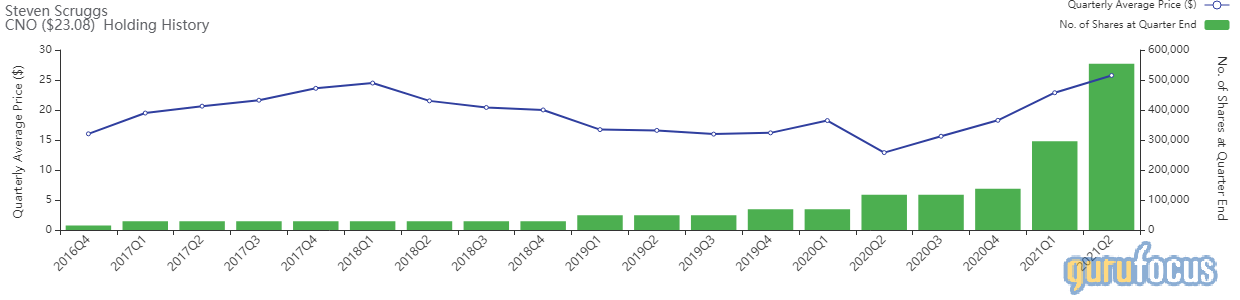

Scruggs upped the CNO Financial (CNO, Financial) position by 87.22%, buying 258,291. Shares traded for an average price of $25.76 each during the quarter.

He now holds 554,434 shares total, making up 3.55% of the equity portfolio and represent his eighth-largest holding. GuruFocus estimates the guru has gained 2.79% on the investment.

The financial services company headquartered in Carmel, Indiana that provides a variety of insurance products has a market cap of $3.04 billion; its shares were trading around $23.14 on Thursday with a price-earnings ratio of 6.88, a price-book ratio of 0.63 and a price-sales ratio of 0.79.

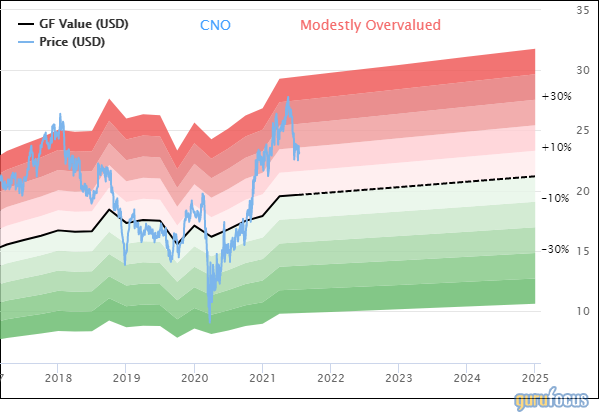

According to the GF Value Line, the stock is modestly overvalued currently.

Despite having adequate interest coverage, CNO Financial’s (CNO, Financial) financial strength was rated 3 out of 10 by GuruFocus due to weak debt-related ratios that underperform other financial companies. The return on invested capital is also being eclipsed by the weighted average cost of capital, indicating the company is struggling to create value as it grows.

The company’s profitability fared better, scoring a 6 out of 10 rating on the back of margins and returns that outperform over half of its industry peers. CNO also has a high Piotroski F-Score of 9 and a one-star predictability rank. GuruFocus says companies with this rank return an average of 1.1% annually.

With a 5.56% stake, Richard Pzena (Trades, Portfolio) is CNO’s largest guru shareholder. Other top guru investors are Hotchkis & Wiley, Richard Snow (Trades, Portfolio), Chuck Royce (Trades, Portfolio), FPA Capital and Barrow, Hanley, Mewhinney & Strauss.

American Equity Investment

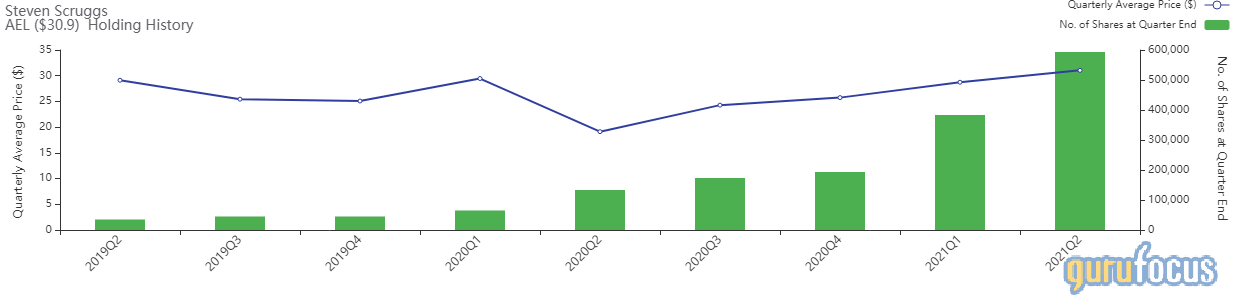

Expanding the holding by 54.74%, Scruggs invested in 210,000 shares of American Equity Investment Life (AEL, Financial). The stock traded for an average per-share price of $31.05 during the quarter.

The investor now holds 593,598 shares total, representing 4.36% of the equity portfolio. It is the fund’s fourth-largest position. GuruFocus data shows he has gained 10.19% on the investment.

The West Des Moines, Iowa-based life insurance company has a $2.99 billion market cap; its shares were trading around $31.38 on Thursday with a price-earnings ratio of 4.38, a price-book ratio of 0.49 and a price-sales ratio of 0.73.

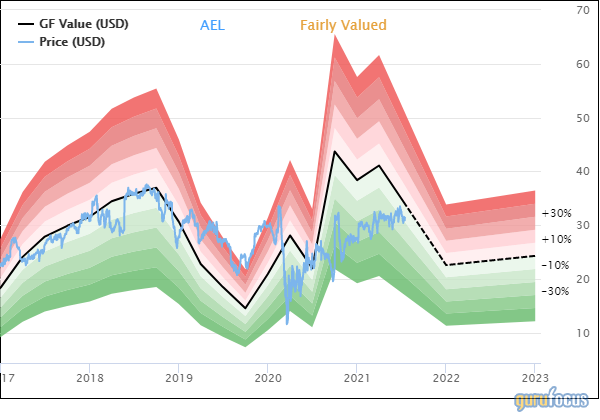

Based on the GF Value Line, the stock appears to be fairly valued currently.

GuruFocus rated American Equity Investment’s financial strength 5 out of 10. In addition to having weak interest coverage, the company appears to struggle creating value since the WACC surpasses the ROIC.

The company’s profitability scored a 6 out of 10 rating on the back of strong margins and returns that outperform a majority of competitors, a high Piotroski F-Score of 7 and a 2.5-star predictability rank. GuruFocus data shows companies with this rank return an average of 7.3% annually.

Pzena is the company’s largest guru shareholder with a 2.37% stake. Jim Simons (Trades, Portfolio)’ Renaissance Technologies, Snow, Hotchkis & Wiley, FPA Capital, Royce and azValor Managers FI (Trades, Portfolio) are also invested in American Equity Investment.

South Jersey Industries

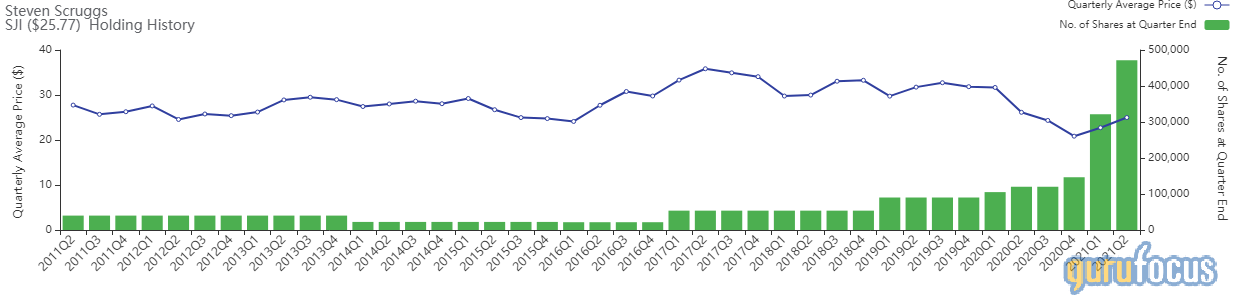

Increasing the South Jersey Industries (SJI, Financial) position by 46.61%, the guru purchased 150,000 shares. During the quarter, the stock traded for an average price of $24.99 per share.

Scruggs now holds 471,853 shares total, giving it 3.03 space in the equity portfolio. According to GuruFocus data, he has gained 1.98% on the investment so far.

The utility company, which is headquartered in Folsom, New Jersey, has a market cap of $2.89 billion; its shares were trading around $25.74 on Thursday with a price-earnings ratio of 14.07, a price-book ratio of 1.51 and a price-sales ratio of 1.52.

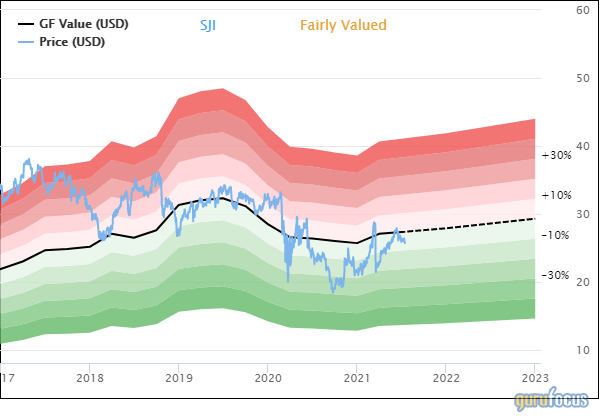

The GF Value Line shows the stock is considered to be fairly valued currently.

South Jersey Industries’ financial strength was rated 3 out of 10 by GuruFocus. As a result of the company issuing approximately $1.9 billion in new long-term debt over the past three years, it has poor interest coverage. The low Altman Z-Score of 0.81 also warns the company could be in danger of going bankrupt since assets are building up at a faster rate than revenue is growing. The ROIC also falls below the WACC, indicating value creation is a struggle.

The company’s profitability fared better with a 6 out of 10 rating. In addition to margins and returns that outperform over half of industry peers, South Jersey Industries is supported by a high Piotroski F-Score of 7. Despite recording losses in operating income and slowing revenue per share growth, it also has a one-star predictability rank.

Of the gurus invested in South Jersey Industries, Diamond Hill Capital (Trades, Portfolio) has the largest stake with 3.16% of outstanding shares. Steven Cohen (Trades, Portfolio), Hotchkis & Wiley, George Soros (Trades, Portfolio), FPA Capital, Paul Tudor Jones (Trades, Portfolio), Joel Greenblatt (Trades, Portfolio) and Barrow, Hanley, Mewhinney & Strauss also own the stock.

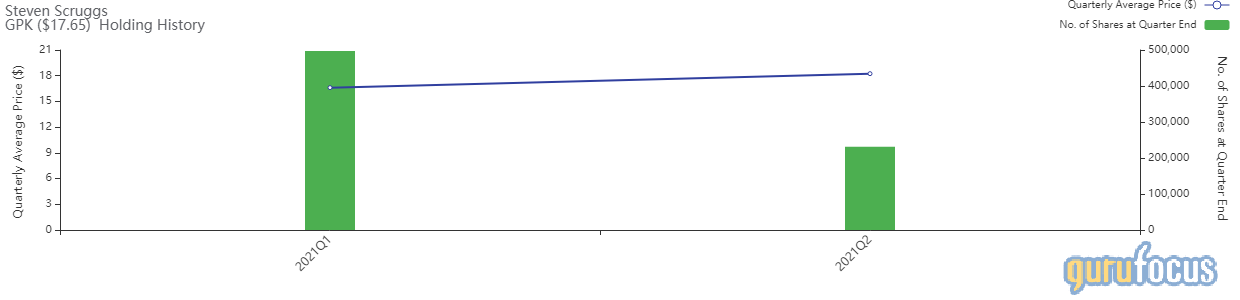

Graphic Packaging

More than halving the position in Graphic Packaging (GPK, Financial), the investor sold 266,140 shares. During the quarter, shares traded for an average price of $18.24 each.

Scruggs now holds a total of 231,077 shares, making up 0.98% of the equity portfolio. GuruFocus estimates he has gained 8.16% on the investment so far.

The Atlanta-based company, which manufactures coated and laminated paper, has a $5.41 billion market cap; its shares were trading around $17.60 on Thursday with a price-earnings ratio of 20.7, a price-book ratio of 3.25 and a price-sales ratio of 0.74.

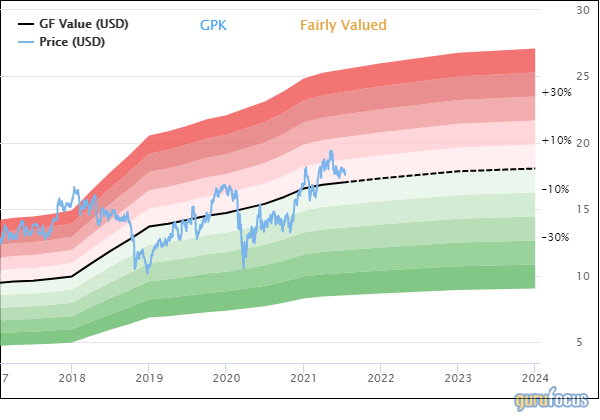

According to the GF Value Line, the stock is fairly valued currently.

GuruFocus rated Graphic Packaging’s financial strength 4 out of 10. Due to issuing approximately $653.7 million in new long-term debt over the past three years, the company has poor interest coverage. The Altman Z-Score of 1.69 also warns of potential bankruptcy risk.

The company’s profitability scored an 8 out of 10 rating. Despite seeing a decline in its operating margin, however, the company is supported by returns that outperform over half of its competitors. Graphic Packaging also has a moderate Piotroski F-Score of 6, indicating business conditions are stable, and steady earnings and revenue growth contributed to a three-star predictability rank. GuruFocus says companies with this rank return, on average, 8.2% annually.

Pioneer Investments (Trades, Portfolio) is the company’s largest guru shareholder with a 0.87% stake. Other gurus invested in Graphic Packaging are Royce, Simons’ firm and FPA Capital.

Additional trades and portfolio composition

During the quarter, Scruggs also established new positions in Merchants Bancorp (MBIN, Financial), Sprouts Farmers Market Inc. (SFM, Financial) and MGIC Investment Corp. (MTG, Financial).

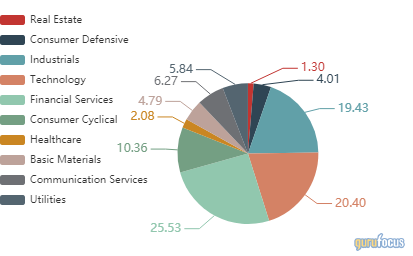

Nearly 45% of the guru’s $415 million equity portfolio, which is composed of 54 stocks, is invested in the financial services and technology sectors, followed by smaller holdings in the industrials space.

The FPA Queens Road Small Cap Value Fund returned 13.62% in 2020, beating the Russell 2000 index’s 9.23% return.

Also check out: