Brian Yacktman, our upcoming Value Investing Live guest, is the president and chief investment officer of YCG LLC, which he founded in 2007 in Austin, Texas. YCG is an active management firm that has seen assets grow from $1 million to nearly $1.3 billion as of Sept. 30, 2021, while achieving market-beating performance since its inception. YCG offers separate account management and is the adviser to the YCG Enhanced Fund (YCGEX).

YCG seeks to invest in global champions, believing the key to successful investing is to compound capital at high rates of return for long periods of time. Based upon this strategy, the firm has five holdings that have generated a total estimated gain in excess of 100%. These holdings include The Estee Lauder Companies Inc. (EL, Financial), Nike Inc. (NKE, Financial), Equifax Inc. (EFX, Financial), Mastercard Inc. (MA, Financial) and MSCI Inc. (MSCI, Financial).

Estee Lauder

The firm’s Estee Lauder (EL, Financial) holding was first established in the first quarter of 2017 with the purchase of 43,670 shares. The holding blossomed to 121,325 shares at the beginning of 2020, but has slowly been pulled back to 93,263 shares. The firm has maintained an average price paid per share of $133.38 and the holding has secured a respectable total estimated gain of 149.38%.

Estee Lauder is the world leader in the global prestige beauty market, participating across skincare (58% of fiscal 2021 sales), makeup (26%), fragrance (12%) and haircare (4%) categories, with popular brands such as Estee Lauder, Clinique, MAC, La Mer, Jo Malone, Aveda, Bobbi Brown, Too Faced, Origins, Dr. Jart+ and The Ordinary. The company operates in 150 countries, with 23% of fiscal 2021 revenue stemming from the Americas, 43% from Europe, the Middle East and Africa and 34% from Asia-Pacific.

On Nov. 9, the stock was trading at $346.89 per share with a market cap of $124.94 billion. According to the GF Value Line, the stock is trading at a significantly overvalued rating.

GuruFocus gives the company a financial strength rating of 5 out of 10, a profitability rank of 9 out of 10 and a valuation rank of 1 out of 10. There are currently two severe warning signs issued for assets growing faster than revenue and a declining gross margin. Despite the warning signs, the company’s stellar profitability rank is supported by operating and net margins that beat at least 89% of industry competitors.

Other top guru shareholders in Estee Lauder (EL, Financial) include Baillie Gifford (Trades, Portfolio), Spiros Segalas (Trades, Portfolio), Pioneer Investments, Daniel Loeb (Trades, Portfolio) and Ray Dalio (Trades, Portfolio).

Nike

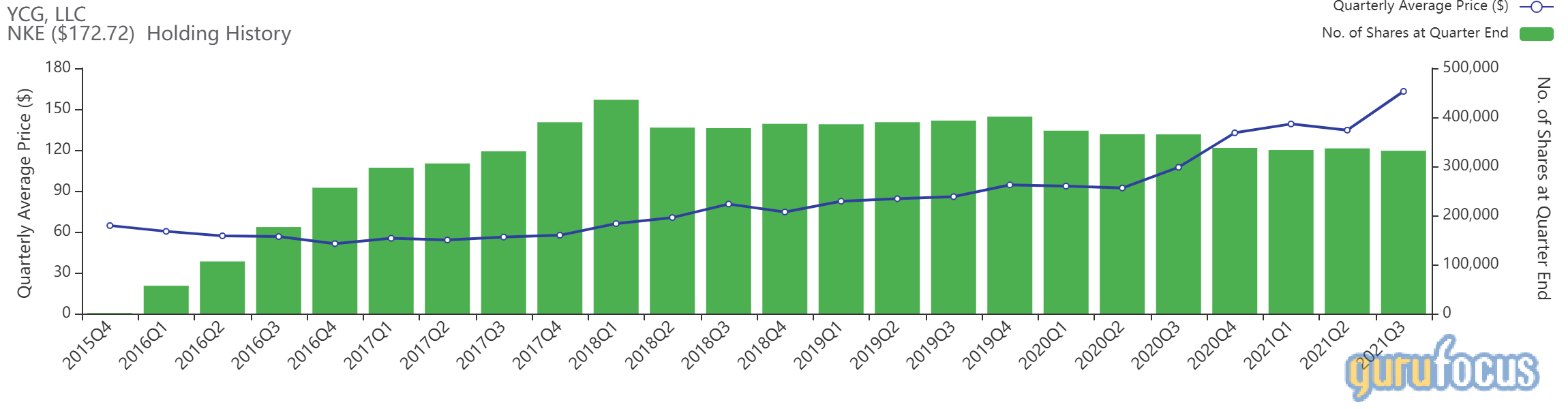

A long-term holding in Nike (NKE, Financial) has also done exceptionally well in the firm’s portfolio. The holding was established in 2015 and saw regular additions through 2018. Over the last three years, the holding has slowly been whittled down to 331,721 shares and the firm has maintained an average purchase price of $59.02 per share. Overall, the firm’s sixth-largest holding has a total estimated gain of 155.18%.

Nike is the largest athletic footwear and apparel brand in the world. It designs, develops and markets athletic apparel, footwear, equipment and accessories in six major categories: running, basketball, soccer, training, sportswear and Jordan. Footwear generates about two thirds of its sales. Nike's brands include Nike, Jordan and Converse (casual footwear). Nike sells products worldwide and outsources its production to more than 300 factories in more than 30 countries. Nike was founded in 1964 and is based in Beaverton, Oregon.

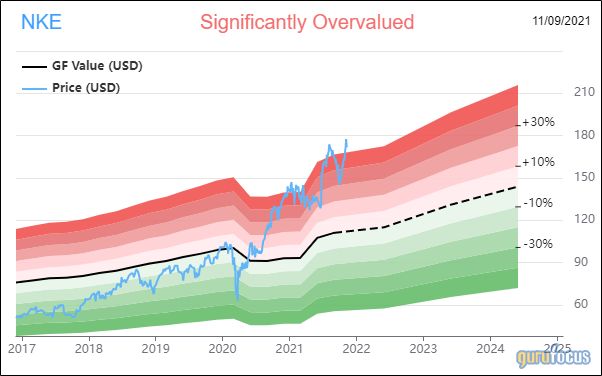

As of Nov. 9, the stock was trading at $172.94 per share with a market cap of $273.22 billion. The stock is trading at a significantly overvalued rating according to the GF Value Line.

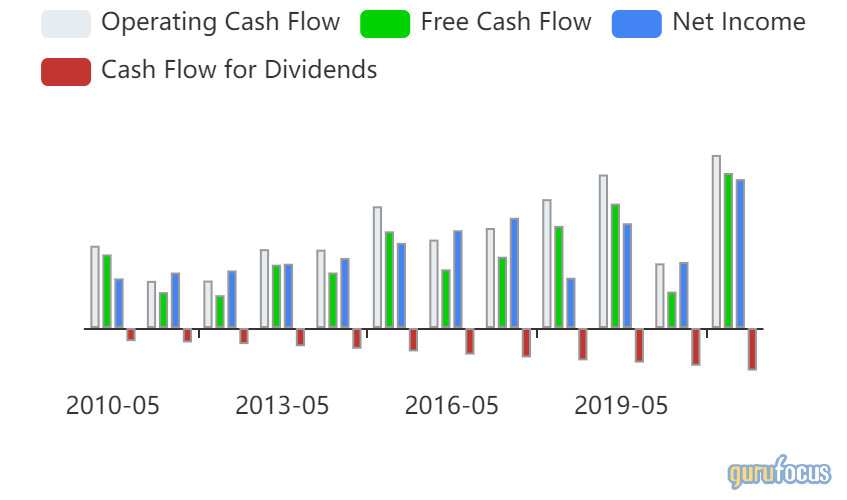

GuruFocus gives the company a financial strength rating of 6 out of 10, a profitability rank of 9 out of 10 and a valuation rank of 1 out of 10. There are currently two severe warning signs issued for assets growing faster than revenue and a declining operating margin. The company’s cash flows took a hit in 2020, but quickly recovered to a 10-year high this year.

Nike (NKE, Financial) shares are also owned by Ken Fisher (Trades, Portfolio), Frank Sands (Trades, Portfolio), Pioneer Investments, Spiros Segalas (Trades, Portfolio) and Jim Simons (Trades, Portfolio)' Renaissance Technologies.

Equifax

One of the firm’s smaller holdings, Equifax (EFX, Financial) has also performed well in the equity portfolio. The holding has lived in the portfolio since the end of 2013 and has seen small changes sporadically throughout the years. An average price paid per share of $67.60 is well below the company’s current share price and has landed YCG at an impressive gain of 228.57%.

Along with Experian (LSE:EXPN, Financial) and TransUnion (TRU, Financial), Equifax is one of the leading credit bureaus in the United States. Equifax's credit reports provide credit histories on millions of consumers, and the company's services are critical to lenders' credit decisions. In addition, about a third of its revenue comes from workforce solutions, which provides income verification and employer human resources services. Equifax generates over 20% of its revenue from outside the United States.

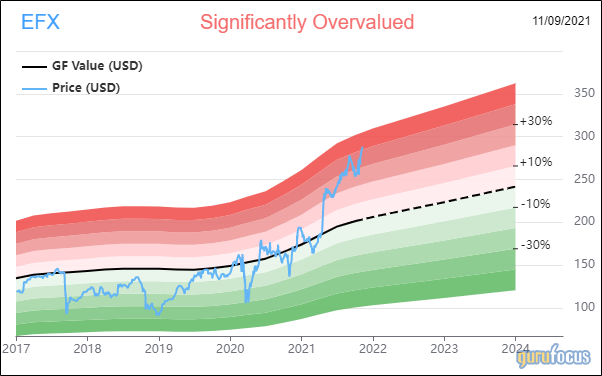

The stock was trading at $288.33 per share with a market cap of $35.23 billion on Nov. 9. A significantly overvalued rating is given to the stock by the GF Value Line.

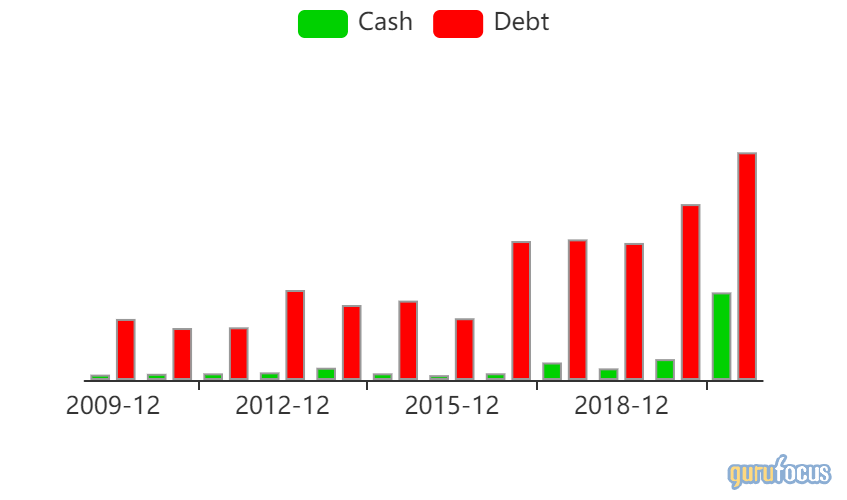

GuruFocus gives the company a financial strength rating of 4 out of 10, a profitability rank of 7 out of 10 and a valuation rank of 1 out of 10. There are currently two severe warning signs issued for assets growing faster than revenue and a declining gross margin. The company’s cash-to-debt ratio of 0.37 ranks worse than 67.97% of industry competitors thanks to increased debt in the last two years.

Al Gore (Trades, Portfolio), Simons' firm, Pioneer Investments, Tom Gayner (Trades, Portfolio) and Robert Olstein (Trades, Portfolio) also maintain positions in Equifax (EFX, Financial).

Mastercard

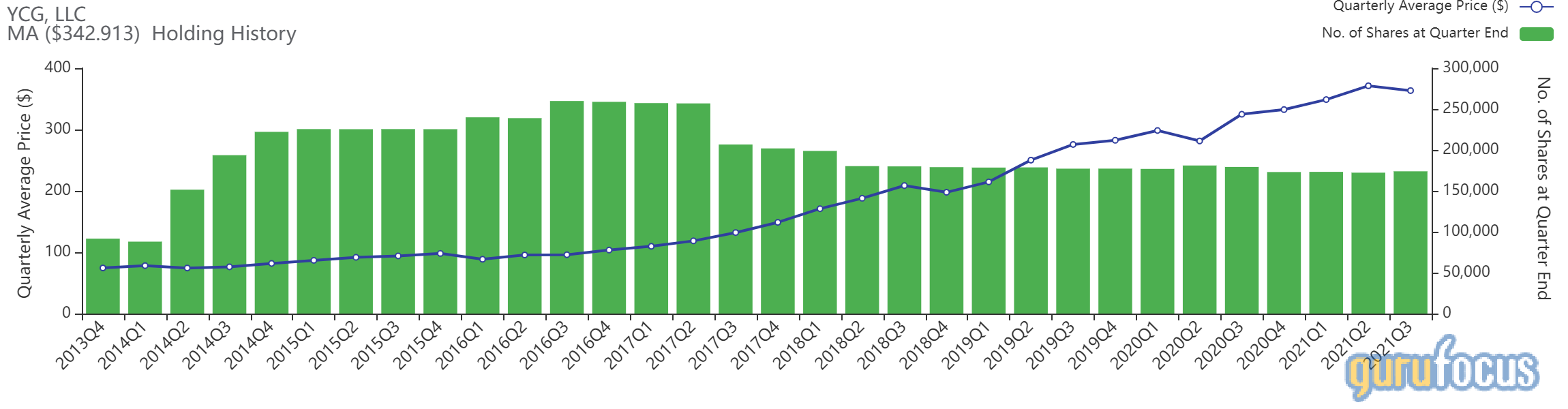

The firm’s Mastercard (MA, Financial) position, its fourth-largest holding, lands just ahead of Equifax as its second-most profitable holding. The 173,898 shares were purchased at an average price of $83.32 throughout the last eight years of ownership. Since 2016, the holding has slowly shrunk despite several small additions. At a total estimated gain of 234.78%, the holding has performed exceptionally well in YCG’s equity portfolio.

Mastercard is the second-largest payment processor in the world, having processed $4.8 trillion in purchase transactions during 2020. Mastercard operates in over 200 countries and processes transactions in over 150 currencies.

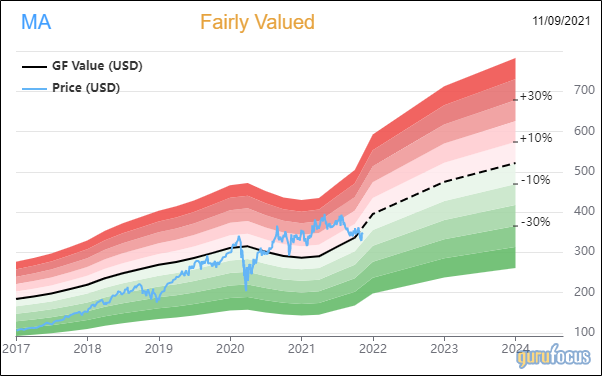

On Nov. 9, the stock was trading at $344.36 per share with a market cap of $336.87 billion. According to the GF Value Line, the stock is trading at a fair value rating.

GuruFocus gives the company a financial strength rating of 5 out of 10, a profitability rank of 9 out of 10 and a valuation rank of 1 out of 10. There is currently one severe warning sign issued for assets growing faster than revenue. The company’s revenue and net income were on a tear through 2019, but took a hit in 2020 during the pandemic.

Mastercard (MA, Financial) shares are also owned by Chuck Akre (Trades, Portfolio), Warren Buffett (Trades, Portfolio), Ken Fisher (Trades, Portfolio), Pioneer Investments and Tom Russo (Trades, Portfolio).

MSCI

Landing solidly in first place, with a staggering total estimated gain of 620.58%, is the firm’s MSCI (MSCI, Financial) holding. Throughout the last eight years of ownership, the firm has consistently sold shares alongside rising share prices. The holding currently consists of 108,259 shares that were purchased at an average price of $49.68.

MSCI describes its mission as enabling investors to build better portfolios for a better world. MSCI's largest and most profitable segment is its index segment, where it provides benchmarking to asset managers and asset owners. In addition, it boasts over $1 trillion in exchange-traded fund assets linked to MSCI indexes. The MSCI analytics segment provides portfolio management and risk management analytics software to asset managers and asset owners.

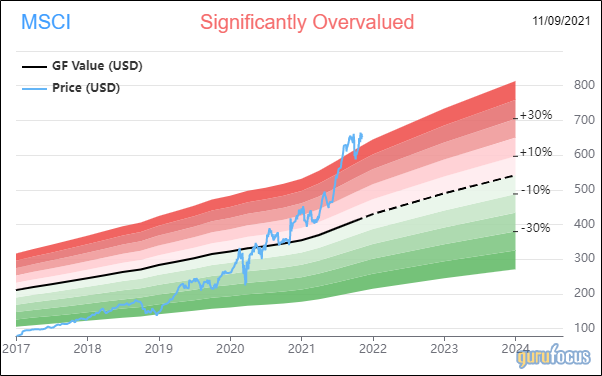

As of Nov. 9, the stock was trading at $651.30 per share with a market cap of $53.79 billion. According to the GF Value Line, the stock is trading at a significantly overvalued rating.

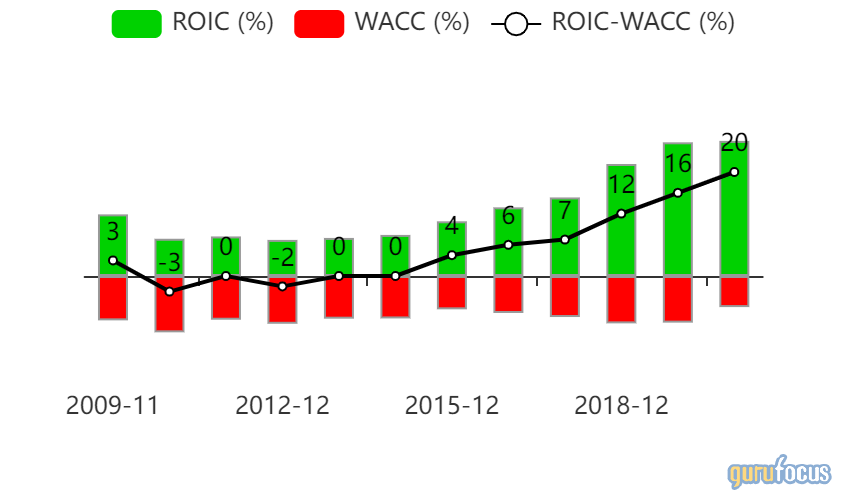

GuruFocus gives the company a financial strength rating of 4 out of 10, a profitability rank of 9 out of 10 and a valuation rank of 1 out of 10. There are currently no severe warning signs issued for the company. The return on invested capital has increased consistently in the last six years and is easily able to support the weighted average cost of capital.

Top guru shareholders in MSCI (MSCI, Financial) include Ron Baron (Trades, Portfolio), Ken Fisher (Trades, Portfolio), Pioneer Investments, Tom Gayner (Trades, Portfolio) and Mario Gabelli (Trades, Portfolio).

Join GuruFocus for Value Investing Live featuring Brian Yacktman and Elliott Savage.