As we move into a high inflation environment, investors are looking for a safe haven for their investments. According to data from the Bureau of Labor Statistics, the annual inflation rate in the U.S. accelerated to a massive 7.5% in January of 2022 - this is much higher than the Federal Reserve's 2% average target rate and the highest level since February of 1982. Growth stocks in particular get slammed during periods of high inflation, as both inflation and a rise in interest rates cause large discounts in their valuations.

During high inflationary periods, many stocks suffer as companies and consumers race to adjust, but the real estate market is generally seen as a safe haven to ride the rising prices because it is a limited recource that people need. A real estate investment trust, or REIT, owns real estate which is rented out to tenants. REITs are great for cash flow, as by law they must pay out at least 90% of their taxable profits to investors as a juicy dividend payment. In this article, I reveal my top three favorite REIT stocks to navigate high inflation.

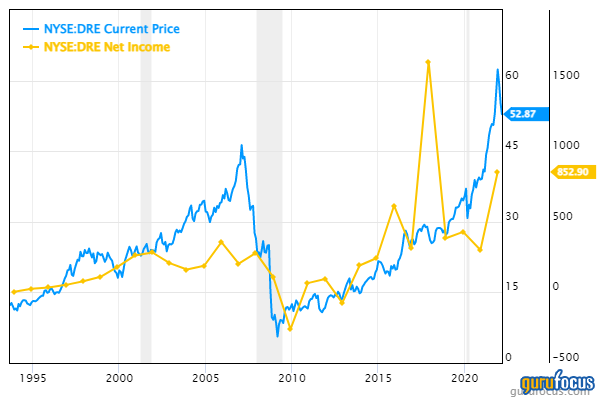

1. Duke Realty Corp

Dividend Yield: 2.1%

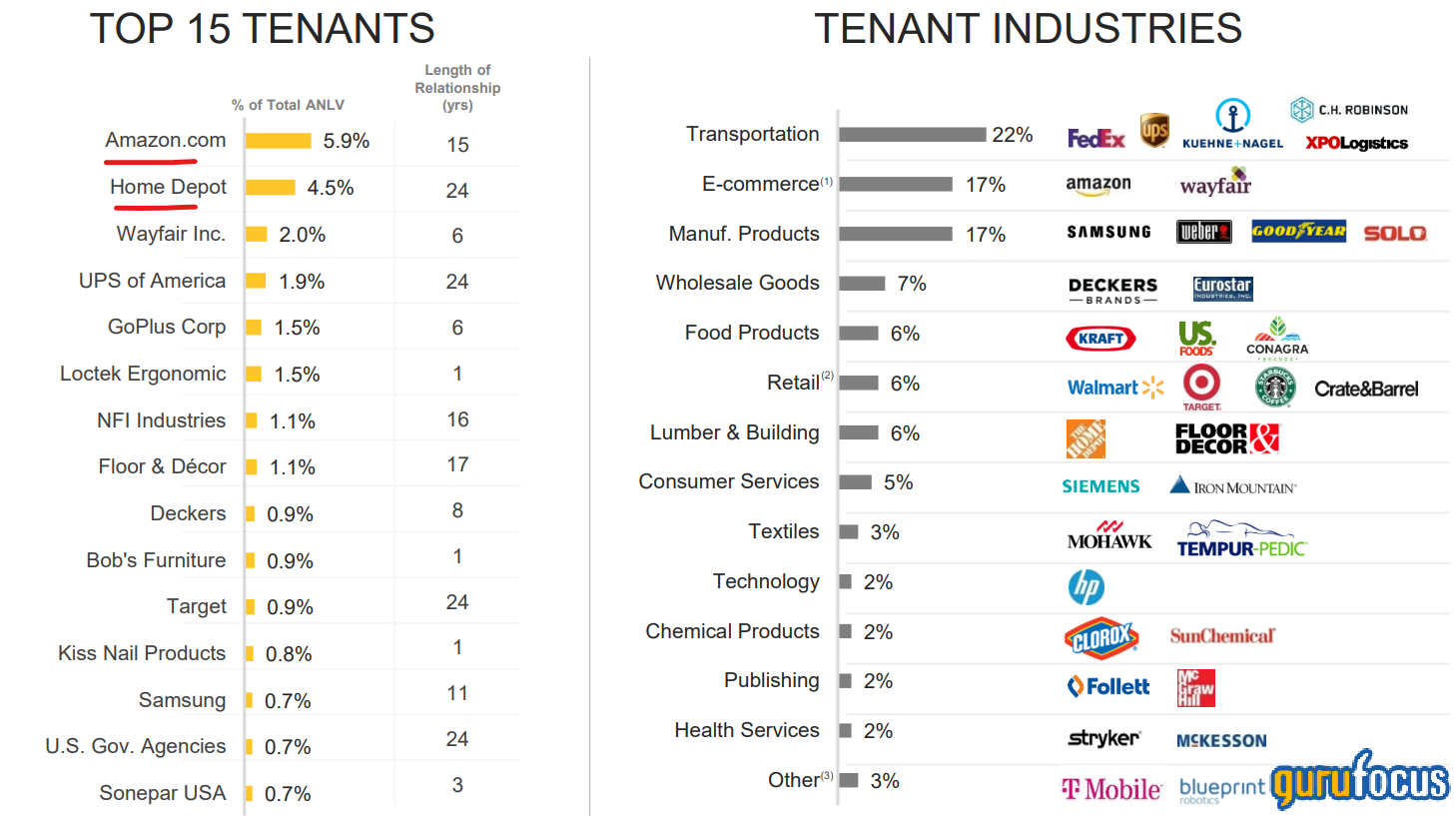

Duke Realty Corp. (DRE, Financial) is a REIT which owns approximately 160 million rentable square feet of industrial properties in 19 major U.S. logistics markets. The firm has major warehouse tenants which include their number one tenant Amazon (AMZN, Financial), accounting for 5.9% of Annualized Net Lease Value (ANLV). Other established tenants include Home Depot (HD, Financial) with 4.5% of ANLV, Target (TGT, Financial) with 0.9% and U.S. Government Agencies with 0.7%.

Source: Duke Realty investor presentation

The company's diversified and established tenant base is a great selling point and should offer stability to the revenue over the long term. It is no surprise then to see a very high 95% occupancy rate. The firm also provides leasing, property management and construction services.

Duke Realty has a $22 billion dollar market cap, a 2.1% dividend and is one of the fastest growing REITs with a three-year revenue per share growth rate of 28.5%. The company has a high valuation with a price-earnings ratio of 60, most likely due to the high growth in the sought-after logistics industry that is gaining prominence due to global supply chain shortages.

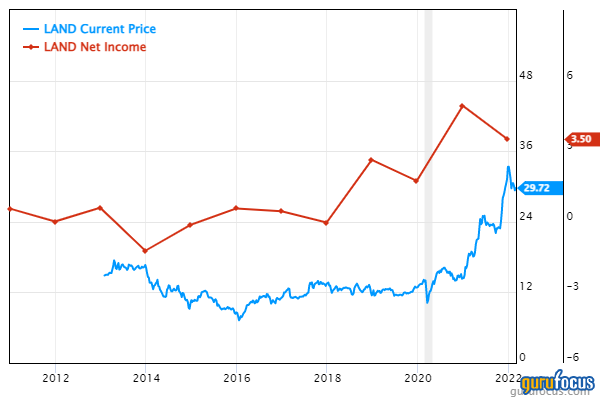

2. Gladstone Land

Dividend Yield: 2.56%

Gladstone Land (LAND, Financial) is a farmland REIT that owns 115 farms on 90,000 acres of land across the U.S. This land is diversified across 10 different states with an incredible 100% occupancy rate.

Gladstone pays out monthly dividends with a current dividend yield of 2.56%. Historically, the shares price of this REIT has also appreciated well. In addition, the REIT has recently acquired a citrus grove in South Florida. Farmland, which is traditionally not a very popular choice among retail investors, has caught investors' attention recently due to Bill Gates (Trades, Portfolio), who has now become the largest private farmland owner in the U.S.

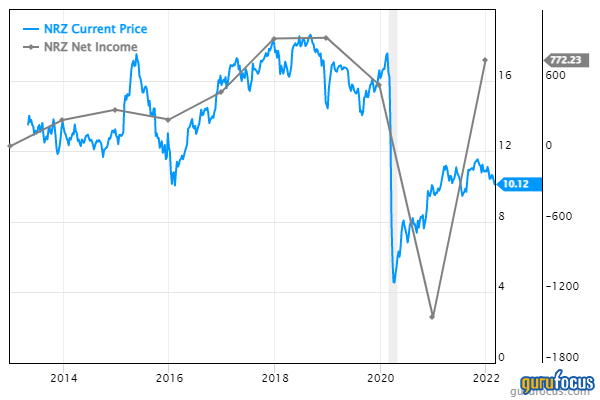

3. New Residential Investment Corp

Dividend Yield: 9.5%

New Residential Investment Corp. (NRZ, Financial) is a public REIT which invests into the residential housing sector. The firm's portfolio includes residential loans, mortgage servicing-related assets, etc. Mortgage servicing rights (MSR) are a contractual agreement in which the right to service an existing mortgage is sold by the original mortgage lender to another party.

In my opinion, this is one of the best value REITs out there right now since it has a price-earnings ratio of just 5.9. New Residential also has $3.5 billion in revenue and $960 million in operating profit in addition to approximately $40 billion in asset value. The company also has a juicy 9.3% dividend yield thanks in part to its low valuation. The company also has a strong balance sheet with $1.3 billion in cash. It has a $4.7 billion market cap.

Source: New Residential investor presentation

The company also has a series of complementary businesses such as:

- Newrez/Caliber subservicing on behalf of third parties

- Genesis Capital: leading provider of fix and flip loans

- Guardian Asset Management: nationwide provider of field services and property preservation

- Avenue365: national title insurance and settlement services provider

- eStreet: appraisal management company managing a qualified network of licensed appraisers.