In light of single-family rent surging at record growth, six homebuilder stocks with high guru ownership as of the fourth quarter of 2021 include Lennar Corp. (LEN, Financial), D.R. Horton Inc. (DHI, Financial), Tri Pointe Homes Inc. (TPH, Financial), KB Home (KBH, Financial), Toll Brothers Inc. (TOL, Financial) and Taylor Morrison Home Corp. (TMHC, Financial) according to the Aggregated Portfolio of Gurus, a Premium feature of GuruFocus.

On Tuesday, private data and analytics company CoreLogic Inc. (CLGX, Financial) reported that single-family rents increased 12.6% year over year in January, the 10th consecutive month of record-level growth and the fastest year-over-year increase in over 16 years according to the CoreLogic Single Family Rent Index, which measures rent changes among single-family homes using repeat-rent analysis.

As investors monitor increasing rent prices, GuruFocus’ Aggregated Portfolio listed six residential construction stocks that have at least 10 gurus owning shares based on fourth-quarter 2021 13F statistics. Investors should be aware that the 13F filings do not give a complete picture of a guru’s holdings; they only consider a guru’s U.S.-based holdings and American depository receipts, yet they can still provide valuable information.

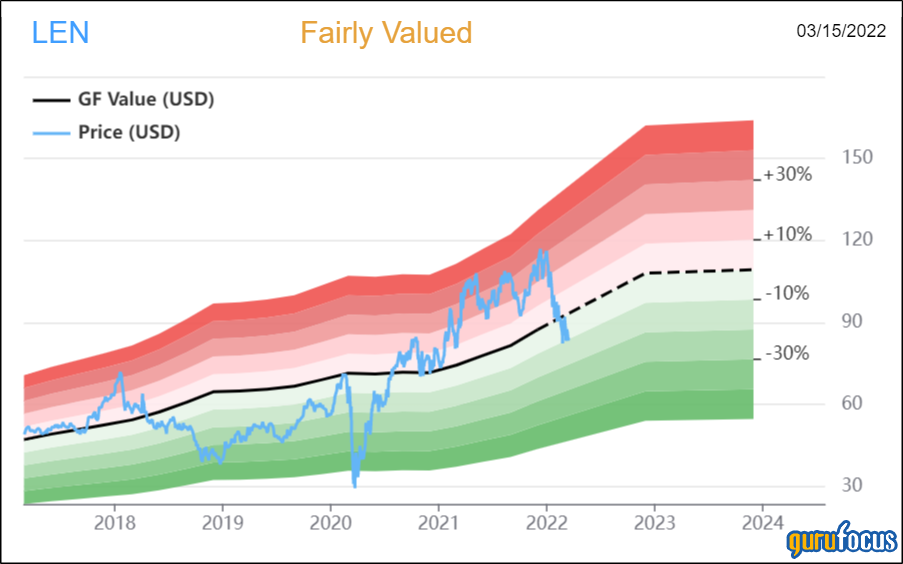

Lennar

Seventeen gurus own shares of Lennar (LEN, Financial) with a combined weighting of 13.70%. Twelve gurus purchased shares during the fourth quarter.

Shares of Lennar traded around $84.48, showing the stock is fairly valued based on Tuesday’s price-to-GF Value ratio of 0.91.

The Miami-based homebuilder has a GuruFocus profitability rank of 9 based on several positive investing signs, which include a 3.5-star business predictability rank, a high Piotroski F-score of 7 and profit margins and returns that outperform more than 83% of global competitors.

Gurus with holdings in Lennar include the Smead Value Fund (Trades, Portfolio) and Ken Fisher (Trades, Portfolio)’s Fisher Investments.

D.R. Horton

Sixteen gurus own shares of D.R. Horton (DHI, Financial) with a combined weight of 18.13%. Seven gurus purchased shares during the fourth quarter.

Shares of D.R. Horton traded around $79.19, showing the stock is modestly undervalued based on Tuesday’s price-to-GF Value ratio of 0.75.

The Arlington, Texas-based company has a GuruFocus profitability rank of 10 based on several positive investing signs, which include a four-star business predictability rank and profit margins and returns that top more than 81% of global competitors.

Gurus with holdings in D.R. Horton include George Soros (Trades, Portfolio)’ Soros Fund Management and David Tepper (Trades, Portfolio)’s Appaloosa LP.

Tri Pointe Homes

Thirteen gurus own shares of Tri Pointe Homes (TPIH) with a combined weight of 2.44%. Five gurus purchased shares during the fourth quarter.

Shares of Tri Pointe Homes traded around $22.02, showing the stock is modestly undervalued based on Tuesday’s price-to-GF Value ratio of 0.83.

The Irvine, California-based company has a GuruFocus profitability rank of 8 based on several positive investing signs, which include a high Piotroski F-score of 7 and profit margins and returns that are outperforming more than 68% of global competitors.

KB Home

Eleven gurus own shares of KB Home (KBH, Financial) with a combined weighting of 1.98%. Eight gurus purchased shares during the fourth quarter.

Shares of KB Home traded around $36.43, showing the stock is modestly undervalued based on Tuesday’s price-to-GF Value ratio of 0.73.

The Los Angeles-based homebuilder has a GuruFocus profitability rank of 8 based on several positive investing signs, which include a solid Piotroski F-score of 6 and three-year revenue and earnings growth rates that outperform more than 70% of global competitors.

Toll Brothers

Ten gurus own shares of Toll Brothers (TOL, Financial) with a combined weight of 1.08%. Six gurus purchased shares during the fourth quarter.

Shares of Toll Brothers traded around $50.02, showing the stock is modestly undervalued based on Tuesday’s price-to-GF Value ratio of 0.81.

The Horsham, Pennsylvania-based homebuilder has a GuruFocus profitability rank of 8 based on several positive investing signs, which include a high Piotroski F-score of 8 and three-year revenue and earnings growth rates that are outperforming more than 70% of global competitors.

Taylor Morrison Home

Ten gurus own shares of Taylor Morrison Home (TMHC, Financial) with a combined weight of 9.04%. Four gurus purchased shares during the fourth quarter.

Shares of Taylor Morrison Home traded around $30.52, showing the stock is slightly undervalued based on Tuesday’s price-to-GF Value ratio of 0.91.

The Scottsdale, Arizona-based company has a GuruFocus profitability rank of 8 out of 10 based on several positive investing signs, which include profit margins near a 10-year high and three-year revenue and earnings growth rates outperforming more than 80% of global competitors.