According to current portfolio statistics, a Premium feature of GuruFocus, five stocks in Paul Tudor Jones (Trades, Portfolio)’ second-quarter 13F equity portfolio that have high business predictability and are trading near 52-week lows are IQVIA Holdings Inc. (IQV, Financial), Monolithic Power Systems Inc. (MPWR, Financial), Lam Research Corp. (LRCX, Financial), Zoetis Inc. (ZTS, Financial) and MKS Instruments Inc. (MKSI, Financial).

Guru prepares his firm’s "recession playbook"

The founder and chief investment officer of Tudor Investment said in a CNBC interview that his firm is “getting ready” to deploy its recession playbook, citing the U.S. economy may soon fall into a recession. Jones warned that while he does not know whether the recession has already started yet, most recessions usually begin with short-rates starting to go down before the stock market bottoms.

Portfolio overview

The Boston-based firm seeks to generate consistent returns for both client and proprietary capital through the use of best-in-class research, trading and investment techniques. Tudor Investment’s second-quarter 13F equity portfolio contains 2,043 stocks with a quarterly turnover ratio of 47%.

The top four sectors in terms of weight are technology, financial services, health care and consumer cyclical, representing 17.12%, 14.94%, 12.41% and 11.46% of the equity portfolio.

The stocks mentioned are based on Tudor Investment’s second-quarter 13F equity portfolio filing. Investors should be aware that the 13F filings do not give a complete picture of a firm’s holdings as the reports only include its positions in U.S. stocks and American depository receipts, but they can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.

IQVIA Holdings

Tudor Investment owns 1,263 shares of IQVIA Holdings (IQV, Financial), giving the position 0.01% equity portfolio weight.

Shares of IQVIA Holdings traded around $176.51, showing the stock is modestly undervalued based on its price-to-GF Value ratio of 0.78 as of Monday. The stock trades approximately 0.77% above its 52-week low of $175.15.

The Durham, North Carolina-based medical research company has a GF Score of 93 out of 100, driven by a rank of 10 out of 10 for growth and momentum, a profitability rank of 9 out of 10 and a GF Value rank of 7 out of 10 despite financial strength ranking just 4 out of 10.

GuruFocus ranks the company’s business predictability 4.5 stars out of five.

Other gurus with positions in IQVIA Holdings include the Vanguard Health Care Fund (Trades, Portfolio) and PRIMECAP Management (Trades, Portfolio).

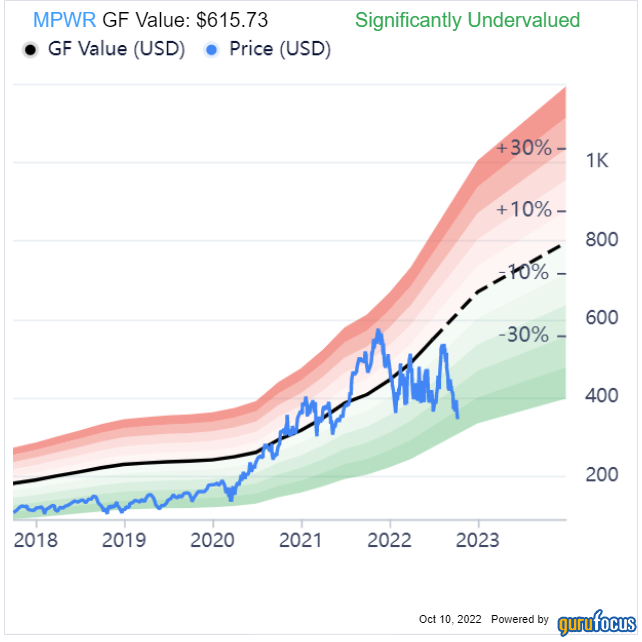

Monolithic Power Systems

The firm owns 19,391 shares of Monolithic Power Systems (MPWR, Financial), giving the position 0.20% equity portfolio weight.

Shares of Monolithic Power Systems traded around $345.56, showing the stock is significantly undervalued based on its price-to-GF Value ratio of 0.56 as of Monday. The stock trades approximately 1.51% above its 52-week low of $339.21.

The Kirkland, Washington-based semiconductor company has a GF Score of 100 out of 100, driven by a rank of 10 out of 10 for profitability, growth, financial strength and momentum as well as a GF Value rank of 8 out of 10.

Monolithic Power Systems’ profitability ranks 10 out of 10 on several positive investing signs, which include a 4.5-star business predictability rank, a high Piotroski F-score of 8 out of 9 and an operating margin that has increased approximately 7.9% per year on average over the past five years and outperforms more than 83% of global competitors.

Lam Research

Tudor Investment owns 5,594 shares of Lam Research (LRCX, Financial), giving the position 0.06% equity portfolio weight.

Shares of Lam Research traded around $350.72, approximately 3.02% above its 52-week low of $340.42. Despite this, GuruFocus’ GF Value Line labeled the stock a possible value trap due to its low price-to-GF Value ratio of 0.54.

The Fremont, California-based semiconductor equipment company has a GF Score of 98 out of 100 based on a rank of 10 out of 10 for profitability and growth, a financial strength rank of 7 out of 10 and a rank of 8 out of 10 for momentum and GF Value.

GuruFocus ranks Lam Research’s business predictability 4.5 stars out of five.

Zoetis

Tudor Investment owns 1,496 shares of Zoetis (ZTS, Financial), giving the position 0.01% equity portfolio weight.

Shares of Zoetis traded around $145.78, showing the stock is modestly undervalued based on its price-to-GF Value ratio of 0.73 as of Monday. The stock trades approximately 0.93% above its 52-week low of $144.44.

The Parsippany, New Jersey-based veterinary company has a GF Score of 95 out of 100, driven on a rank of 10 out of 10 for profitability and growth and a GF Value rank of 9 out of 10 despite financial strength and momentum ranking just between 5 and 6 out of 10.

GuruFocus ranks Zoetis’ business predictability four stars out of five.

MKS Instruments

The firm owns 24,782 shares of MKS Instruments (MKSI, Financial), giving the position 0.07% equity portfolio weight.

Shares of MKS Instruments traded around $81.41, showing the stock is significantly undervalued based on its price-to-GF Value ratio of 0.48 as of Monday. The stock trades approximately 1.6% above its 52-week low of $80.13.

The Andover, Massachusetts-based manufacturing equipment company has a GF Score of 93 out of 100 based on a growth rank of 10 out of 10, a profitability rank of 9 out of 10, a financial strength rank of 8 out of 10, a momentum rank of 7 out of 10 and a GF Value rank of 4 out of 10.

GuruFocus ranks MKS Instruments’ business predictability four stars out of five.