Stanley Druckenmiller (Trades, Portfolio) is a legendary macroeconomic investor who has a net worth of $6.4 billion. He rarely does interviews, but this past October, he shared his thoughts at CNBC’s Finding Alpha conference. Here are some of my key takeaways from this rare Druckenmiller interview, in which the investing guru discussed topics such as the macroeconomic situation, inflation, recessions and even Bitcoin; let’s dive in.

Making $1 billion in a day

In 1992, Druckenmiller believed that the British Pound would break its peg against the European Exchange Rate Mechanism. Along with George Soros (Trades, Portfolio) at the Quantum fund, the two of them made $1 billion in a single day after this bet proved to be right.

In his recent interview, Druckenmiller admits that he actually wasn't completely sure that the British Pound would fall, but what he did understand was the risk/reward ratio. He knew that if he was wrong, it would cost 50 basis points, but if he was right, he would make 2,000 basis points. This was a 40:1 risk/reward bet. Druckenmiller says this is actually the opposite of the “gamble” the Federal Reserve did in 2020 with its huge stimulus injection.

What caused the inflation crisis?

In 2020, the Federal Reserve implemented what Druckenmiller believes was the most “radical policy relative to the circumstances in history,” which caused an asset bubble and the super high inflation rates we are seeing today.

Inflation as measured by the consumer price index (CPI) reached a high of 9.1% in June. It has since corrected down to 8.3% in July and 7.7% by October. However, this is still well above the Fed’s 2% target and has now forced the Fed to make interest rate hikes.

Druckenmiller's issue wasn’t the fact the Fed injected stimulus in 2020, but the fact that it continued injecting a further $2 trillion and started buying $120 billion worth of bonds per month even after the Covid vaccine rollouts and the economic reopening, which was an unprecedented amount of stimulus. He believe the Fed was taking an unnecessary amount of risk as it wanted to increase inflation above 2% out of the misguided belief that we were heading for deflation, but it's clear the central bank overshot at great cost to the economy.

According to Druckenmiller, the “worst economies happen post asset bubbles." From the Great Depression to post-1989 Japan and the dot-com bubble, the historical trend is undeniable.

Druckenmiller says the Fed took a risk/reward bet which didn’t make sense. The huge stimulus was a “radical gamble” designed to increase inflation from just above the Fed's target. Of course, this gamble didn’t pay off and thus we have seen catastrophic damage to the economy.

Druckenmiller believes that the 20 years of low inflation prior to 2020 likely influenced Fed Chairman Jerome Powell, as humans have a tendency to think the past will be like the future. The Fed had also switched from a forecast model to a data model, in that it decided to not make any changes until it saw the “whites of inflation's eyes," as Druckenmiller eloquently put it. The issue was that when inflation first started to rise, the Fed then switched back to forecasting and said it was “transitory,” which was the buzzword of the day around early 2021 and also turned out to be about as far from the truth as possible.

Russia-Ukraine war

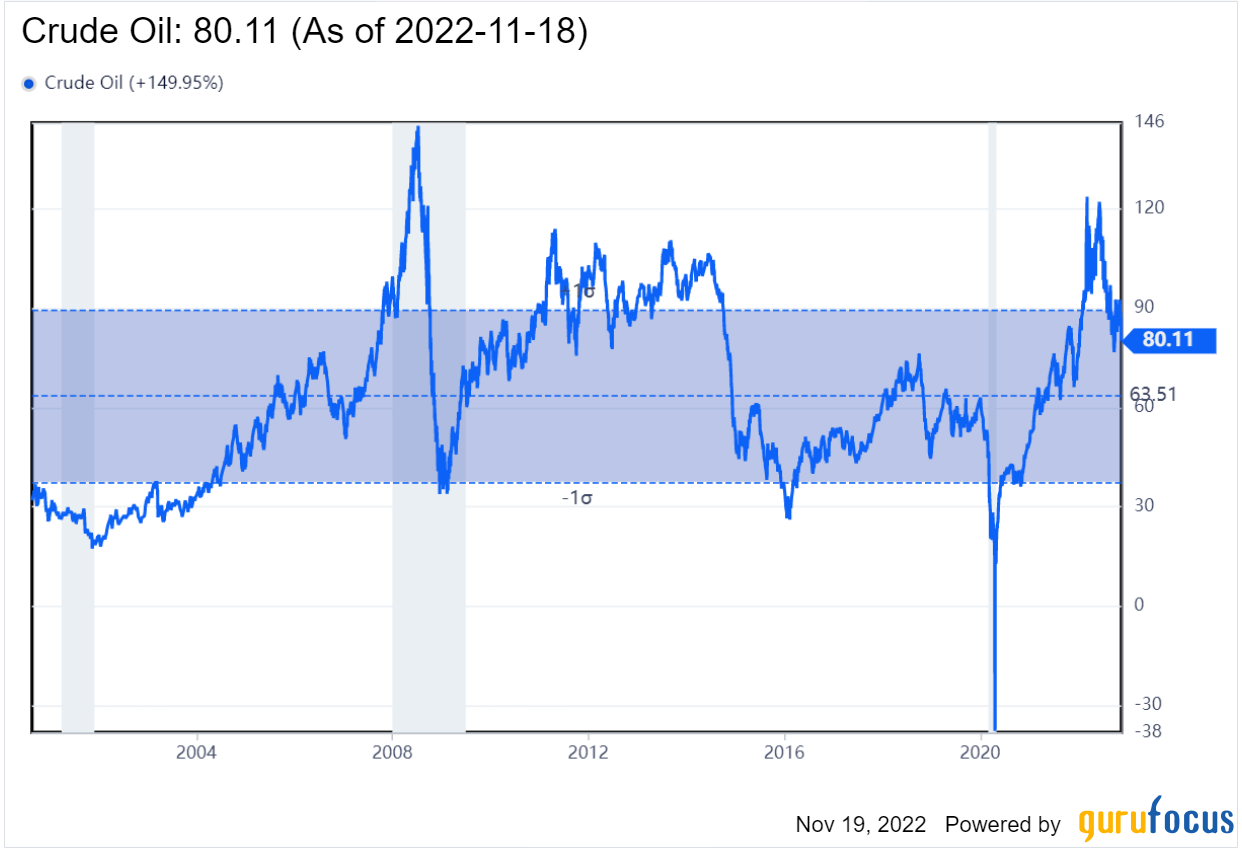

The Russia-Ukraine war has extended and increased inflationary pressures, according to Druckenmiller. However, he reiterates that the massive stimulus “lit the match” of inflation. The Russia-Ukraine war primarily caused prices in energy to rise as oil spiked to over $125 per barrel in the first quarter of 2022, according to the WTI index.

Does Druckenmiller own Bitcoin?

Druckenmiller also briefly talked about Bitcoin and said he doesn’t own the cryptocurrency at this time, though he does believe it may be a useful asset if central banks continue to utilize volatility policy regarding asset inflation. But he does caveat this with the fact that if unemployment spikes, true Bitcoin bulls would need to hold on if they wished for the asset to be successful in the long term.

UK bond crisis

In October 2022, after the former UK Finance Minister Kwasi Kwarteng announced a series of tax cuts, the UK government bond market was sent into turmoil as a sharp sell-off occurred. This forced the Bank of England to step in and buy bonds to hold up the market. Druckenmiller believes this was a “microcosm” of the free money environment which was a result of $30 trillion in quantitative easing globally over the last 10 years. He believes this environment creates “bad behavior” as pension funds leverage up, thus as interest rates change issues occur, things begin to spiral out of control.

Will we have another Lost Decade?

It's conventional wisdom stocks go up in the long term, but Druckenmiller questions the definition of “long term." In a stagflation scenario of high inflation and low growth, stock price indexes have been flat in decades that have been dubbed a "Lost Decade."

For example, if you bought the Dow Jones Industrial Average in 1929, you would have got back to even by 1954. The Dow was also the same level in 1966 as it was in 1982. Therefore it's entirely possible that we could have another Lost Decade in stock indexes. Just because they go up in the ultra-long-term doesn't mean they'll be higher in the next few years.

In fact, Druckenmiller has made a “central forecast” that the Dow Jones Industrial Average will not be much higher than it today in 10 years' time. He has forecasted a recession in 2023. Druckenmiller believes this is because “all the factors” which caused the bull market of the prior 10 years are not just stopping but reversing. We are going from a 0% interest rate, free money environment to a high interest rate, financially constrained environment.

Nevertheless, Druckenmiller still says he believes investing in individual stocks of great companies at fair valuations can bring about beneficial results. This can help mitigate issues with stock market indexes such as the S&P 500 staying relatively flat.

Deglobalization

Druckenmiller also believes we are going through a period of deglobalization, which has been driven by supply chain issues and geopolitical uncertainty. We are now seeing a return to local manufacturing hubs. For example, the Biden administration recently announced its $53 billion CHIPS Act to help the U.S. reduce reliance on China by offering subsidies to incentivize foundries to be built in the U.S. again. Companies taking advantage of these subsidies include Micron (MU, Financial) and Intel (INTC, Financial). This is great for supply chain stability, though for a variety of reasons, such as U.S. labor and property being more expensive as well as the fact that the country lacks workers skilled in this field, it will drive up semiconductor prices. For these and many other reasons, deglobalization is considered inflationary.

High debt and pensions

The U.S. has total debt which equates to an eye-watering $31 trillion. This has risen significantly over the past few years and has resulted in a debt-to-GDP ratio of 124%. It costs the government $48 billion just to maintain the debt at the current interest rates, which is ~12% of federal spending. This means that funds such as Social Security will be likely to run out for the next generation or even this generation.

Druckenmiller says this won't matter to his generation becasue “we will be dead” by the time this system collapses (he's 69 years old). Given that most of the people in charge of the country are about that age group, they don't really care about leaving money for the younger generations and seem content with carrying increasingly high debt levels.