As investors continue grappling with increased interest rate hikes, four bank stocks in Bridgewater Associates’ third-quarter 13F equity portfolio with high business predictability that are trading near 52-week lows are Comerica Inc. (CMA, Financial), Capital One Financial Group (COF, Financial), East West Bancorp Inc. (EWBC, Financial) and Signature Bank (SBNY, Financial), according to current portfolio statistics, a Premium feature of GuruFocus.

Dow sinks as investors continue monitoring interest rate hikes

On Thursday, the Dow Jones Industrial Average closed at 33,202.22, down 764.13 points from Wednesday’s close of 33,966.35 as investors continue monitoring the Federal Reserve’s interest rate hikes to combat inflation. While the Fed increased its benchmark rate by 0.50% to a range between 4.25% and 4.5%, the Federal Open Market Committee set its expected terminal rate to 5.1%, suggesting that interest rate hikes may continue into 2023.

U.S. markets continued their selloff on Friday, with the Dow tumbling more than 300 points. According to the Aggregated Statistics Chart, a Premium feature of GuruFocus, the mean one-week return for the Standard & Poor’s 500 index stocks is -2.14% with a median of -2.23%.

Bridgewater's background

Ray Dalio (Trades, Portfolio) founded the Greenwich, Connecticut-based firm in 1975. Bridgewater's portfolio management team applies Dalio’s key principles, which include employing radical truth and radical transparency, encouraging open and honest dialogue and allowing the best thinking to prevail.

Dalio stepped down as co-chief investment officer of Bridgewater in October 2022 as part of his succession plan to convert the firm into an employee-owned business. The firm’s $19.75-billion third-quarter 13F equity portfolio contains 866 stocks with a quarterly turnover ratio of 9%. The top four sectors in terms of weight are consumer defensive, health care, consumer cyclical and financial services, with weights of 29.70%, 20.66%, 10.9% and 7.6%.

Investors should be aware that the 13F filings do not give a complete picture of a firm’s holdings as the reports only include its positions in U.S. stocks and American depository receipts, but the reports can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.

Comerica

Bridgewater owns 23,303 shares of Comerica (CMA, Financial) as of the quarter's end, giving the position 0.01% equity portfolio weight.

Shares of Comerica traded around $63.80, showing that the stock is modestly undervalued based on its price-to-GF-Value ratio of 0.73 as of Friday. The stock traded approximately 1.54% above its 52-week low.

The Dallas-based financial services company has a GF Score of 84 out of 100 based on a rank of 8 out of 10 for momentum and growth, a GF Value rank of 9 out of 10, a profitability rank of 6 out of 10 and a financial strength rank of 4 out of 10.

Comerica’s profitability ranks 6 out of 10. Although the company has a five-star business predictability rank, Comerica’s net margin and return on assets outperform just over 65% of global competitors.

Capital One

The firm owns 86,665 shares of Capital One (COF, Financial), giving the position 0.04% equity portfolio weight.

Shares of Capital One traded around $93.91, showing that the stock is significantly undervalued based on its price-to-GF-Value ratio of 0.60 as of Friday. The stock traded approximately 4% above its 52-week low.

The McLean, Virginia-based credit card and commercial lending company has a GF Score of 82 out of 100. Even though the company’s financial strength ranks just 3 out of 10, Capital One has a profitability rank of 6 out of 10 and a rank of 8 out of 10 for growth, GF Value and momentum.

Capital One’s profitability ranks 6 out of 10 on the heels of a five-star business predictability rank despite net margins and returns outperforming just over 62% of global competitors.

East West Bancorp

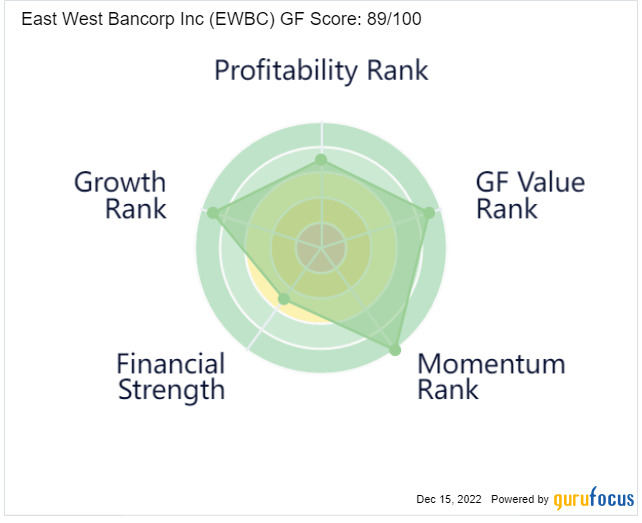

Bridgewater owns 34,367 shares of East West Bancorp (EWBC, Financial), giving the position 0.01% equity portfolio weight.

Shares of East West Bancorp traded around $63.61, showing that the stock is modestly undervalued based on its price-to-GF-Value ratio of 0.73 as of Friday. The stock traded approximately 3.18% above its 52-week low.

The Pasadena, California-based bank has a GF Score of 89 out of 100 based on a rank of 9 out of 10 for growth and GF Value, a momentum rank of 10 out of 10, a profitability rank of 7 out of 10 and a financial strength rank of 5 out of 10.

The company’s profitability ranks 7 out of 10 on the heels of a five-star business predictability rank and net profit margins and returns outperforming more than 80% of global competitors.

Signature Bank

Bridgewater owns 15,216 shares of Signature Bank (SBNY, Financial), giving the position 0.01% equity portfolio weight.

Shares of Signature Bank traded around $114.55, showing that the stock is significantly undervalued based on its price-to-GF-Value ratio of 0.49 as of Friday. The stock trades approximately 1.04% above its 52-week low.

The New York-based commercial bank has a GF Score of 81 out of 100 based on a growth rank of 10 out of 10, a profitability rank of 6 out of 10, a momentum rank of 5 out of 10 and a rank of 4 out of 10 for GF Value and financial strength.

Signature’s profitability ranks 6 out of 10 on the heels of a 4.5-star business predictability rank and a return on assets that outperforms more than 60% of global competitors.

Also check out: