According to the All-in-one Screener, a Premium feature of GuruFocus, five stocks that outperformed the Standard & Poor’s 500 index in 2022 yet are modestly undervalued based on GuruFocus’ GF Value measure are Vertex Pharmaceuticals Inc. (VRTX, Financial), Air Products & Chemicals Inc. (APD, Financial), Fiserv Inc. (FISV, Financial), Marathon Petroleum Corp. (MPC, Financial) and VMware Inc. (VMW, Financial).

On Friday, the final trading day of the year, the Dow Jones Industrial Average traded around 32,977.10, down approximately 243 points from the previous close of 33,220.80. For the year, the Dow tumbled approximately 8.6%.

The U.S. market indexes finished one of the worst years since the 2008 financial crisis, with the S&P 500 and the Nasdaq Composite Index sinking over 19% and 33% for the year. According to the Aggregated Statistics Chart, a Premium feature of GuruFocus, the mean 12-month return for the S&P 500 stocks is -9.85% with a median of -12.70%.

Despite the market decline, several stocks still outperformed the S&P 500 by more than 15% for the year yet are modestly undervalued based on their GF Value. Patterned after Peter Lynch’s earnings line, GuruFocus’ exclusive valuation method considers a stock’s historical price multiples and adjusts for past performance and future growth estimates.

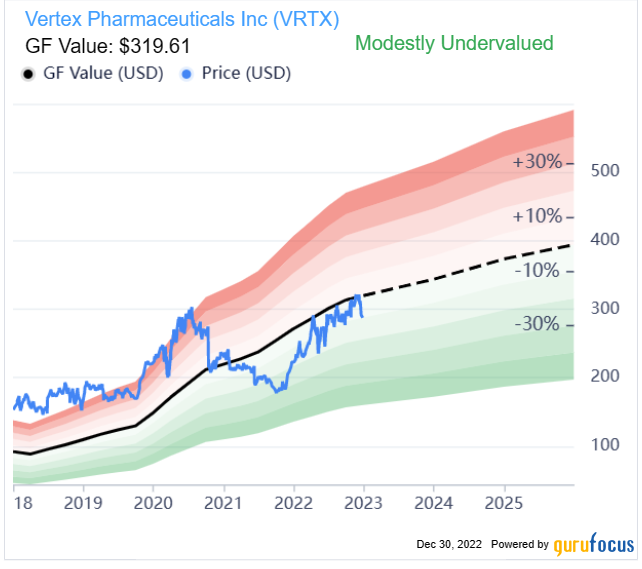

Vertex Pharmaceuticals

Shares of Vertex Pharmaceuticals traded around $285.56, showing that the stock is modestly undervalued based on its price-to-GF-Value ratio of 0.89 as of Friday. The stock outperformed the S&P 500 by approximately 47.84% for the year.

The Boston, Massachusetts-based biotech company has a GF Score of 87 out of 100 based on a growth rank of 10 out of 10, a financial strength rank of 9 out of 10, a profitability rank of 7 out of 10, a GF Value rank of 6 out of 10 and a momentum rank of 3 out of 10.

Vertex’s financial strength ranks 9 out of 10 on several positive investing signs, which include a strong Altman Z-score of 14.47, a high Piotroski F-score of 9 out of 9 and a debt-to-equity ratio that outperforms more than 67% of global competitors.

Gurus with holdings in Vertex include the Vanguard Health Care Fund (Trades, Portfolio) and Jim Simons (Trades, Portfolio)’ Renaissance Technologies.

Air Products & Chemicals

Shares of Air Products & Chemicals (APD, Financial) traded around $306.55, showing that the stock is modestly undervalued based on its price-to-GF-Value ratio of 0.87. The stock outperformed the S&P 500 by approximately 22.44% for the year.

The Allentown, Pennsylvania-based gas supplier has a GF Score of 88 out of 100 based on a rank of 8 out of 10 for profitability and growth, a financial strength rank of 7 out of 10, and a rank of 6 out of 10 for momentum and GF Value.

The company’s financial strength ranks 7 out of 10 on the heels of a high Altman Z-score of 4.85 and a high Piotroski F-score of 7 out of 9 despite cash-to-debt and interest coverage ratios underperforming over 60% of global competitors.

Fiserv

Shares of Fiserv (FISV, Financial) traded around $100.28, showing that the stock is modestly undervalued based on its price-to-GF-Value ratio of 0.79 as of Friday. The stock outperformed the S&P 500 by approximately 15.73% for the year.

The Brookfield, Wisconsin-based payment processing company has a GF Score of 92 out of 100: Even though the company’s financial strength ranks just 4 out of 10, Fiserv has a rank of 9 out of 10 for profitability, growth, GF Value and momentum.

Fiserv’s financial strength ranks 4 out of 10 on several warning signs, which include a low Altman Z-score of 1.54 and an interest coverage ratio that underperforms more than 80% of global competitors.

Despite low financial strength, Fiserv’s profitability ranks 9 out of 10 on the heels of a high Piotroski F-score of 9 out of 10 and 10 years of positive operating income over the past 10 years.

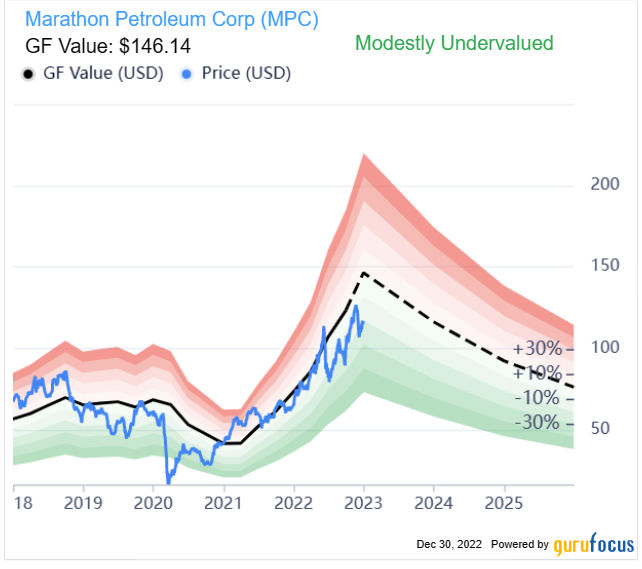

Marathon Petroleum Corp

Shares of Marathon Petroleum Corp (MPC, Financial) traded around $116.13, showing that the stock is modestly undervalued based on its price-to-GF-Value ratio of 0.79 as of Friday. The stock outperformed the S&P 500 by approximately 103.96% for the year.

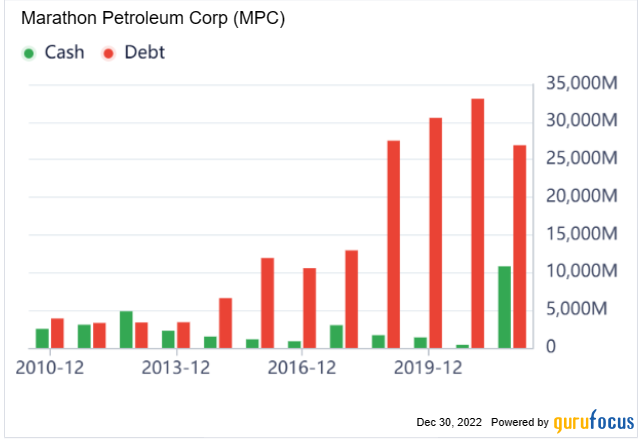

The Findlay, Ohio-based energy refining company has a GF Score of 72 out of 100 based on a rank of 7 out of 10 for profitability and GF Value, a financial strength rank of 6 out of 10, and a rank of 3 out of 10 for growth and momentum.

Marathon Petroleum’s financial strength ranks 6 out of 10 on the back of cash-to-debt and interest coverage ratios underperforming more than 60% of global competitors despite having a strong Altman Z-score of 3.73 and a high Piotroski F-score of 8 out of 9.

VMWare

Shares of VMWare traded around $121.75, showing that the stock is modestly undervalued based on its price-to-GF-Value ratio of 0.74 as of Friday. The stock outperformed the S&P 500 by approximately 21.89% for the year.

The Palo Alto, California-based information technology infrastructure company has a GF Score of 94 out of 100 driven on a rank of 10 out of 10 for growth and momentum and a rank of 9 out of 10 for profitability and GF Value despite financial strength ranking just 4 out of 10.

GuruFocus ranks VMWare’s business predictability five stars out of five.

Also check out:- Vanguard Health Care Fund Undervalued Stocks

- Vanguard Health Care Fund Top Growth Companies

- Vanguard Health Care Fund High Yield stocks, and

- Stocks that Vanguard Health Care Fund keeps buying

- Jim Simons Undervalued Stocks

- Jim Simons Top Growth Companies

- Jim Simons High Yield stocks, and

- Stocks that Jim Simons keeps buying