Market Overview

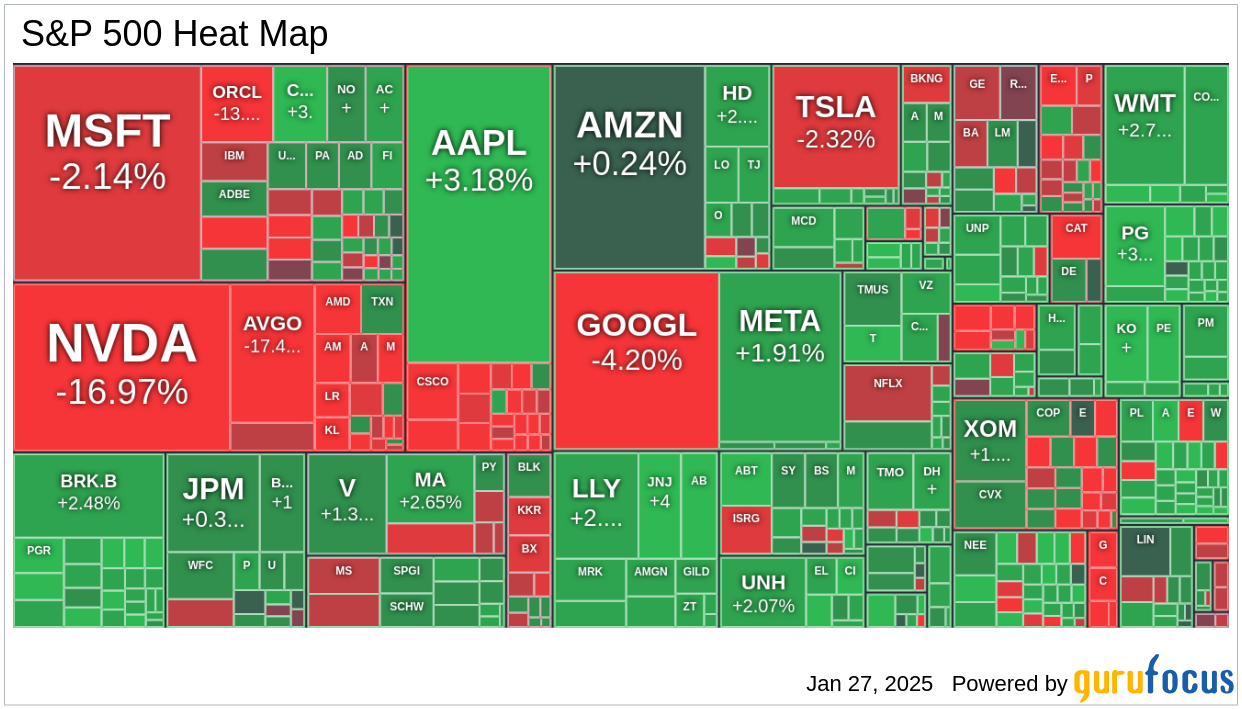

The stock market presented a mixed performance today. Notably, big tech stocks, semiconductor-related names, and utility shares with AI exposure experienced significant declines. In contrast, funds rotated into other market sectors.

Key Stock Movements

- NVIDIA (NVDA, Financial): The stock closed at 118.42, down by 24.20 points or 17.0%, marking its largest single-day loss in market capitalization. This drop was attributed to concerns over China's DeepSeek AI model, which is perceived as a cost-effective alternative to U.S. options like OpenAI's ChatGPT. The potential of DeepSeek to challenge leading U.S. AI players has raised questions about the future of the sector.- Apple (AAPL, Financial): The stock rose to 229.86, gaining 7.08 points or 3.2%.- Microsoft (MSFT, Financial): The stock fell to 434.56, down by 9.50 points or 2.1%.Sector and Index Performance

- The PHLX Semiconductor Index (SOX) fell by 9.2% as investors reconsidered capital spending. - More S&P 500 sectors ended higher (six) than lower (five). - The Dow Jones Industrial Average increased by 0.7%, with 20 out of 30 components advancing. - The equal-weighted S&P 500 recorded a modest gain of 0.1%, contrasting with the 1.5% drop in the market-cap weighted index. - NYSE market breadth was positive, with advancing issues leading decliners by a 3-to-2 ratio. However, on the Nasdaq, decliners outpaced advancers by the same margin.Fixed-Income Market

- The 10-year Treasury yield decreased by ten basis points to 4.53%. - The 2-year Treasury yield dropped by eight basis points to 4.19%. - The $69 billion 2-year note sale saw tepid demand, while a $70 billion 5-year note offering attracted stronger interest.Investor Sentiment

Investor caution was evident ahead of a busy earnings week, with approximately 40% of the S&P 500 by market capitalization set to report earnings. Among the notable companies are Apple (AAPL) and Microsoft (MSFT), two of the three $3 trillion companies.Year-to-Date Index Performance

- Dow Jones Industrial Average: +5.1% - S&P Midcap 400: +3.8% - S&P 500: +2.2% - Russell 2000: +2.4% - Nasdaq Composite: +0.2%Economic Data Review

- December New Home Sales reached 698K, beating the consensus of 680K. The prior figure was revised to 674K from 664K. The key takeaway is the growth in new home sales, although higher selling prices may pose challenges moving forward.Upcoming Economic Data

- 8:30 ET: December Durable Orders (consensus 0.4%; prior -1.1%) and Durable Orders ex-transport (consensus 0.5%; prior -0.1%) - 9:00 ET: November FHFA Housing Price Index (prior 0.4%) and November S&P Case-Shiller Home Price Index (consensus 4.2%; prior 4.2%) - 10:00 ET: January Consumer Confidence (consensus 108.1; prior 104.7)Global Markets and Commodities

- Europe: DAX -0.5%, FTSE +0.0%, CAC -0.3% - Asia: Nikkei -0.8%, Hang Seng 0.0%, Shanghai -0.1% - Commodities: Crude Oil -1.45 @ 73.15, Nat Gas -0.20 @ 3.25, Gold -39.00 @ 2739.50, Silver -0.67 @ 30.47, Copper -0.09 @ 4.32AAPL,MSFT,NVDA

Guru Stock Picks

Smead Value Fund has made the following transactions:

Eaton Vance Worldwide Health Sciences Fund has made the following transactions:

Today's News

The release of China's DeepSeek's open-source AI model, DeepSeek-R1, has sent shockwaves through the tech sector, leading to a significant sell-off. Nvidia (NVDA, Financial) shares tumbled nearly 17%, wiping out $589 billion in market cap, as investors worried about reduced AI-related spending. Despite the sell-off, Nvidia emphasized that creating such models still requires a substantial number of GPUs, highlighting the ongoing demand for their products.

Intel's (INTC, Financial) former CEO, Pat Gelsinger, criticized the market's reaction to DeepSeek's model, suggesting that the lower-cost approach could actually expand the AI market. Gelsinger noted that the affordability of DeepSeek's model challenges the existing high-cost paradigm in AI development, potentially leading to broader deployment of AI technologies.

Apple (AAPL, Financial) managed to rise nearly 1.5% despite the tech sector's downturn, as it has not heavily invested in AI, relying instead on partners like OpenAI. This strategy appears to have shielded Apple from the immediate impacts of DeepSeek's disruptive entry into the AI space.

Semiconductor stocks were among the hardest hit, with Broadcom (AVGO, Financial) falling about 19%, and Advanced Micro Devices (AMD, Financial) and Qualcomm (QCOM, Financial) also experiencing significant declines. The sell-off reflects concerns over competition from DeepSeek's cost-effective AI model, which could alter the landscape for AI hardware demand.

AGNC Investment (AGNC, Financial) reported Q4 earnings that missed Wall Street expectations, with net spread and dollar roll income per share falling short of estimates. The company's stock slipped slightly in after-hours trading, as investors weighed the impact of the Federal Reserve's easing policy on the residential mortgage REIT sector.

Estée Lauder Companies (EL, Financial) is reportedly considering selling some of its brands as part of a strategic review. The cosmetics giant is evaluating its portfolio amid a leadership transition and increased competition from rivals like L’Oréal SA. Estée Lauder's shares gained 1.8% in late trading, partially recovering from a significant 52-week loss.

DeepSeek's AI model has also raised questions about the future of data center demand, as it challenges the notion that AI will drive massive investments in data centers. This has led to declines in data center REIT stocks like Digital Realty Trust (DLR, Financial) and Equinix (EQIX, Financial), as investors reassess the growth prospects for these facilities.

GuruFocus Stock Analysis

- GuruFocus Portfolio Now Supports Brokerage Integration by Don Li

- DeepSeek's Janus-Pro-7B AI Launch Causes Nvidia Stock to Drop 17% by Faizan Farooque

- Plug Power Shares Drop as Downgrade Reflects Sector Challenges by Faizan Farooque

- Record 19 Million Americans Projected to Cruise in 2025, AAA Reports by Faizan Farooque

- Coca-Cola's Bold New Flavor Gamble Sends Stock Up 3.2%--But Will It Stick? by Khac Phu Nguyen