Market Highlights

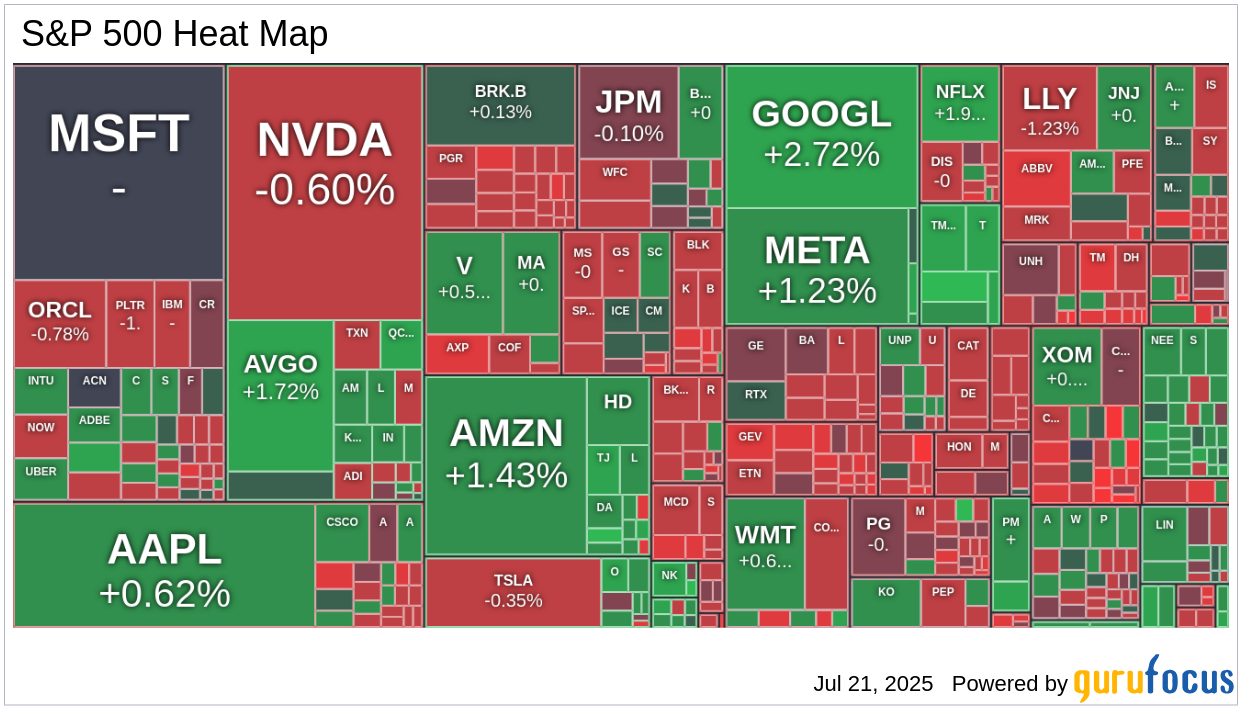

The stock market opened with strength, driven by positive earnings reports, optimism around trade deals, and lower Treasury yields, pushing the S&P 500 and Nasdaq Composite to new highs.

- Initial gains were trimmed by afternoon selling as investors took profits after a strong performance.

- Despite mixed results, the communication services sector was the top performer, rising by 1.9%.

- The consumer discretionary sector also posted a 0.6% gain.

Sector Performances

Communication services led the day, with significant contributions from key stocks.

- Verizon (VZ) gained 4.0%, exceeding EPS expectations by $0.03 and reporting a 5.2% revenue increase.

- Others like T-Mobile US (TMUS) and AT&T (T) also saw gains of 2.4% and 1.6%, respectively.

- Alphabet (GOOG) rose 2.8% ahead of its earnings report.

The market saw eight to ten sectors in the green throughout the day.

Challenges and Market Dynamics

Some sectors faced challenges due to late selling pressures.

- Energy (-0.9%) and health care (-0.6%) sectors remained mostly in the red.

- Financials (-0.3%) and industrials (-0.6%) sectors also fell late in the session.

Smaller-cap stocks, notably those in the Russell 2000, faced a pullback, finishing down 0.4%.

Broad Market Observations

Overall market performance showed a mix of gains and losses, with narrower participation.

- Only 36.4% of S&P 500 stocks advanced.

- The S&P MidCap 400 and Dow Transports displayed similar trends.

Treasury and Economic Indicators

Treasuries started the week strong, with significant moves in longer-term yields.

- The 10-year yield decreased to 4.37%, below its 50-day moving average.

- The 30-year yield settled at 4.94%, slightly above its 50-day moving average.

Leading Economic Index fell 0.3% in June, against a consensus of -0.1%.

Year-to-Date Performance Overview

- Nasdaq Composite: +8.6%

- S&P 500: +7.2%

- DJIA: +4.2%

- S&P 400: +1.0%

- Russell 2000: Unchanged

Global and Commodities Update

- Europe: DAX flat, FTSE +0.2%, CAC -0.3%

- Asia: Nikkei was closed for a holiday, Hang Seng and Shanghai both up by 0.7%

- Commodities: Crude Oil at 65.97, Natural Gas at 3.36, Gold at 3406.40, Silver at 39.34, Copper at 5.64

Stock News

- Alaska Airlines (ALK, Financial) requested a ground stop for all its mainline flights nationwide, impacting all destinations. The reason for the halt was not immediately clear, causing disruptions across the network. This move comes amid ongoing challenges for the airline industry, with Alaska Airlines working to address operational issues.

- Microsoft (MSFT, Financial) is dealing with a significant cyberattack targeting its SharePoint server software. The company has issued a security patch to mitigate the attacks, which exploit a zero-day vulnerability in on-premises versions of SharePoint. Microsoft is collaborating with federal agencies to address the threat, which could affect tens of thousands of servers globally.

- Nvidia (NVDA, Financial) CEO Jensen Huang sold 75,000 shares worth $12.94 million as part of a pre-arranged plan. This follows a previous sale of 225,000 shares earlier in the month. Nvidia's market value has surged past $4 trillion, driven by strong demand for AI technology and GPUs, making it the world's most valuable firm.

- Thomson Reuters (TRI, Financial) will join the Nasdaq-100 Index, replacing ANSYS (ANSS, Financial), which was acquired by Synopsys (SNPS, Financial). This change will take effect before the market opens on July 28, 2025. The inclusion of Thomson Reuters reflects its growing influence in the technology sector.

- SS&C Technologies (SSNC, Financial) announced its acquisition of Carlyle's (CG, Financial) British fund network Calastone for approximately $1.03 billion. The deal is expected to close in the fourth quarter of 2025 and is anticipated to be accretive within 12 months. SS&C plans to fund the purchase with a mix of debt and cash.

- iTeos Therapeutics (ITOS, Financial) has agreed to be acquired by Concentra Biosciences for $10.047 per share in cash, plus a contingent value right. The acquisition follows iTeos' strategic decision to wind down operations after a Phase 2 trial setback. The transaction is expected to close in the third quarter of this year.

- ZimVie (ZIMV, Financial) will be acquired by Archimed for $19.00 per share in cash, representing a 99% premium to its 90-day volume-weighted average price. ZimVie has a 40-day period to solicit superior proposals, although no alternative offers are guaranteed.

- Biogen (BIIB, Financial) plans to invest an additional $2 billion in its North Carolina facilities, bringing its total investment in the region to $10 billion. The funds will support the advancement of its clinical pipeline and expansion of manufacturing capabilities.

- GE Vernova (GEV, Financial) announced the acquisition of French software company Alteia to enhance its AI capabilities for utility companies. The acquisition aims to improve situational intelligence and actionable insights for utilities, helping them manage grid operations more effectively.

- Sarepta Therapeutics (SRPT, Financial) shares fell after the company refused the FDA's request to halt shipments of its Elevidys gene therapy. The FDA's request followed reports linking the therapy to patient deaths. Sarepta's decision has raised concerns among investors and analysts.

- BP (BP, Financial) appointed Albert Manifold as its new Chairman, effective October 1. Manifold, previously CEO of CRH plc, will join BP's board as a non-executive director on September 1. His appointment comes as BP continues to navigate the evolving energy landscape.

- Wolters Kluwer (WTKWY, Financial) announced the sale of its Finance, Risk, and Regulatory Reporting unit to Regnology Group GmbH for €450 million. The divestment will allow Wolters Kluwer to focus on its core compliance services in the U.S. banking sector.

- Sibanye-Stillwater (SBSW, Financial) agreed to acquire U.S.-based metals recycler Metallix Refining for $82 million. The acquisition will enhance Sibanye's global recycling footprint and expand its processing capacity for recycled precious metals.

- Medtronic (MDT, Financial) received CE mark approval for its MiniMed 780G system in Europe, expanding its use to individuals aged 2 and up, including pregnant women and those with type 2 diabetes. This approval broadens the accessibility of advanced insulin delivery systems.

- West Pharmaceutical Services (WST, Financial) appointed Robert McMahon as its new CFO, effective August 4, 2025. McMahon, formerly CFO at Agilent Technologies, will succeed Bernard Birkett, who will remain as a senior advisor to ensure a smooth transition.

GuruFocus Stock Analysis

- Airbnb: A Capital-Light Compounder Hiding in Plain Sight by Khac Phu Nguyen

- Totalenergies -- Investment risk analysis by simonesossella

- Cigna's Quiet Strength: Why the Market Might Be Missing Out by juned.a0818

- Resideo Technologies: A Hidden Gem with Strong Execution Capabilities by warpanalysis

- StealthGas: Cheap Stock Despite Cash, Contracts and Modern Ships? by Nabeel Bukhari